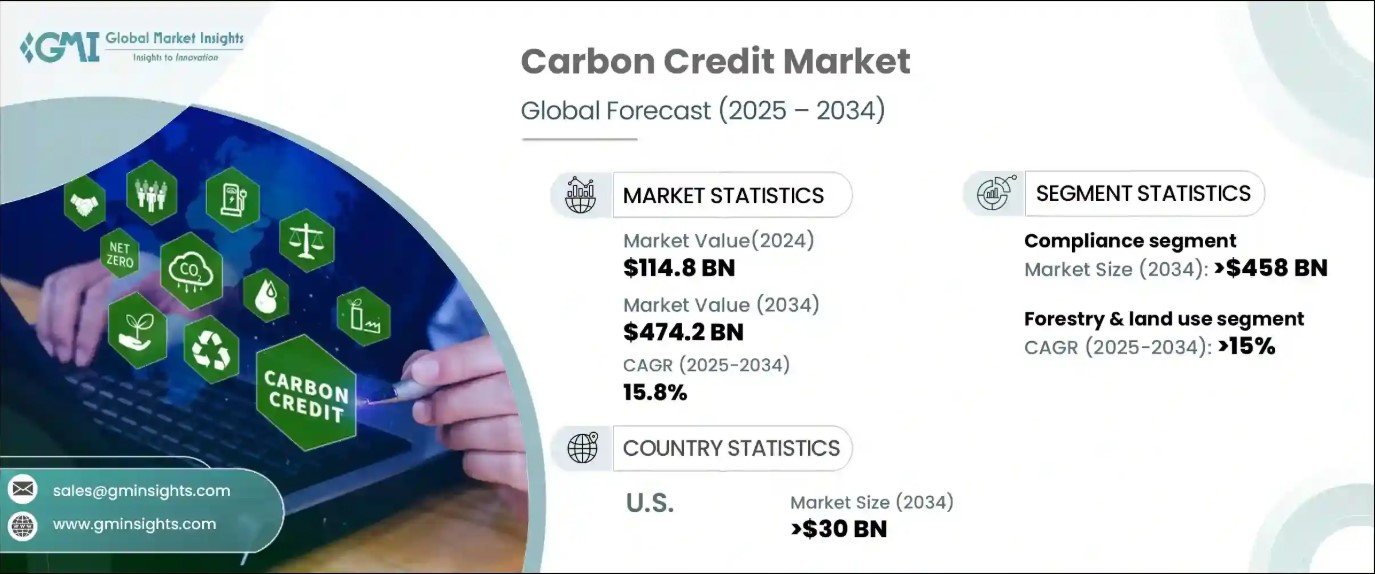

The global carbon credit market, valued at USD 114.8 billion in 2024, is projected to expand at a remarkable CAGR of 15.8% between 2025 and 2034. Carbon credits have become a cornerstone in tackling climate challenges, offering businesses and governments a mechanism to offset emissions while advancing sustainability. This dynamic market is driven by the growing importance of meeting Environmental, Social, and Governance (ESG) goals, alongside stricter regulations and corporate commitments to carbon neutrality.

As industries increasingly prioritize environmental accountability, demand for carbon credits has surged, catalyzing innovation in trading platforms and carbon offset initiatives. The integration of carbon credits with renewable energy certificates and biodiversity credits underscores a shift toward holistic environmental solutions, further fueling market growth.

Several key growth drivers are accelerating the expansion of the carbon credit market globally. These drivers are shaped by regulatory, corporate, technological, and societal trends. Here’s a breakdown of the main factors:

1. Regulatory Pressure and Government Policies

Carbon pricing mechanisms: Implementation of cap-and-trade systems and carbon taxes in many countries is pushing companies to buy carbon credits to comply with emission limits.

National and international commitments: Countries under the Paris Agreement and other climate pacts have set emission reduction targets, which often include market-based mechanisms like carbon credits.

Increased compliance markets: Emerging compliance markets in regions such as China, South Korea, and parts of Latin America are expanding demand.

2. Corporate Net-Zero Commitments

Thousands of companies are adopting net-zero or carbon-neutral goals, increasing demand for verified carbon offsets.

ESG (Environmental, Social, Governance) pressures from investors, stakeholders, and consumers are motivating companies to compensate for emissions they cannot eliminate.

3. Voluntary Carbon Market (VCM) Expansion

The voluntary carbon market is growing rapidly as businesses offset emissions beyond regulatory requirements.

Platforms like Verra and Gold Standard are certifying more projects to meet rising demand.

4. Technological Innovation

Advanced monitoring and verification (e.g., satellite imagery, AI) enhance trust and transparency in credit issuance.

Development of blockchain-based registries for trading carbon credits securely and transparently.

New carbon capture technologies and nature-based solutions (e.g., reforestation, soil carbon sequestration) are expanding the types of projects generating credits.

5. Increased Public Awareness and Climate Risk Perception

Rising concern about climate change is encouraging organizations and individuals to take climate action, including offsetting carbon footprints.

Media coverage and education are driving consumer and shareholder expectations for responsible climate behavior.

6. Financial Innovation and Investment

Carbon credits are increasingly seen as an asset class, attracting institutional investment.

Development of carbon futures and derivatives markets adds liquidity and hedging opportunities.

Carbon funds and ETFs are being created to give broader market exposure.

7. Global Carbon Market Integration

Efforts to link different regional carbon markets (e.g., EU ETS, UK ETS, and others) could create larger, more efficient markets.

Article 6 of the Paris Agreement (especially 6.2 and 6.4 mechanisms) aims to facilitate international credit trading, boosting cross-border activity.

The compliance carbon credit segment is expected to generate USD 458 billion by 2034, reflecting the expanding global commitment to regulated carbon markets. Enhanced by science-based initiatives and global collaboration, over a hundred projects are underway to establish uniform standards and methodologies. These initiatives are driving market expansion and facilitating the alignment of compliance markets with broader environmental strategies. As carbon credit exchanges link with other environmental markets, the path to comprehensive sustainability solutions is becoming more defined, offering opportunities for businesses to reduce their carbon footprints effectively.

Forestry and land-use initiatives are gaining prominence in the carbon credit market, with this segment projected to grow at a CAGR of 15% through 2034. Reforestation and afforestation efforts are pivotal in generating carbon credits while addressing climate change. These projects, often referred to as "natural climate solutions," deliver critical environmental benefits, such as carbon sequestration, ecosystem restoration, and biodiversity preservation. Additionally, they foster community engagement, making them a vital part of climate mitigation strategies. As corporations and governments increasingly adopt these nature-based solutions, their role in offsetting emissions and achieving global sustainability goals continues to grow.

The US carbon credit market is forecasted to generate USD 30 billion by 2034, bolstered by corporations' focus on sustainability and voluntary carbon offset programs. Companies are leveraging high-quality, verified carbon credits to meet ambitious net-zero emission targets. Technological advancements, including artificial intelligence and blockchain, are enhancing transparency and efficiency in carbon credit trading, making the process more accessible and trustworthy. The rising emphasis on co-benefits, such as community development and biodiversity conservation, is also driving demand. As businesses incorporate these additional benefits into their sustainability plans, the US market is becoming a hub for innovation and growth in the global carbon credit landscape.

Source: https://www.gminsights.com/industry-analysis/carbon-credit-market