Bangladesh is mostly dependent on natural gas for power generation, accounting for 56% of its energy demand. The country has been facing declining gas production since 2016, and known reserves are feared to be depleted by 2030 if there is no substantial discovery of gas fields to add to the reserves. To meet the gas demand, Petrobangla has been importing LNG since August 2018. Bangladesh is going to introduce nuclear power by 2025. Already, diversifying its energy sources by importing LNG, fuel, coal, oil, and cross-border electricity and also trying to import hydroelectricity from Nepal to meet up power demand. However, a gradual shift towards renewable energy is also essential despite the current dependence on fossil fuels and to align with global energy trends considering climate changes.

As we know, Russia invaded Ukraine in early 2022. Later, the gas supply to Europe has been cut off from Russia. Then, Europe entered the Asian market to buy fuel to meet their day-to-day demand. As a result, fuel prices go beyond our affordability. This was the situation till the middle of 2023. We had hoped that our economy would improve within a short period. But it was a major collapse, and we are experiencing an acute dollar crisis. It is one of the reasons for our energy crisis today. Apart from this, the government planned to become import-dependent to meet our energy demand and to avoid exploring oil and gas as well as extracting of own coal. The price of fuel in the world market has come down and now it is at the pre-war levels.

Energy import is needed now and later also, but own sourced energy must be required also to get electricity at an affordable price and to face the energy crisis. I am not against importing LNG, coal, and electricity as an alternative source. But the question is why the government didn’t give proper attention to exploring hydrocarbon and augmentation of gas production in parallel? Is there any initiative for offshore exploration even after resolving the maritime boundary disputes with Myanmar and India? If not, one may wonder whether it was deliberate or a mistake.

While global LNG prices have declined, the prevailing dollar crisis remains a significant challenge for Bangladesh. In the last two years, the combined import cost of oil, gas, and coal has ranged from $13 billion to $15 billion, with a projection for a requirement of $18 billion for the current year.

At present, the power sector is mostly dependent on imported electricity, fuel, LNG, and coal. The foreign currency reserves are under pressure due to increased imports. There was pressure to increase the price of gas, electricity, and fuels which would increase the cost of living and would continue to grow in the upcoming days. Meanwhile, the government has substantially increased electricity prices and suddenly increased substantially gas prices in one go. Assuming that it may increase again within a short period to pay the capacity charge to the private power producer companies. The people live in uncertainty due to an import-dependent economy, especially for importing energy a lot. This situation did not happen suddenly. The government has reached this stage due to more reliance on energy imports.

Gas Augmentation Plan

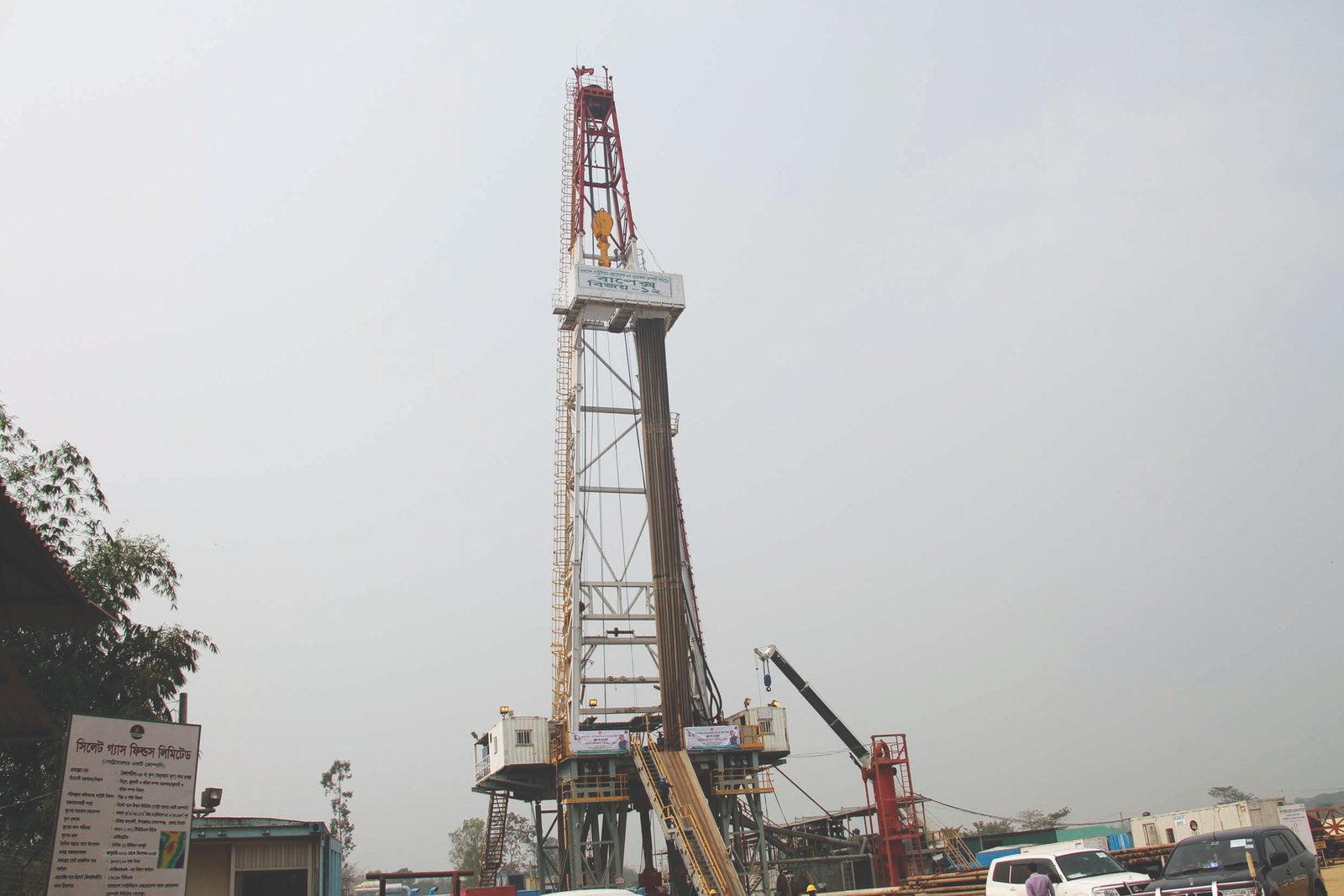

To address rising gas demand, especially for the power and industrial sectors, Petrobangla has taken a very ambitious plan to boost gas production within 2025. To augment daily gas production of 618 MMcf, they are currently implementing a project for drilling and workovers of 48 wells, out of which 17 will be exploratory wells, 15 development wells, and 16 work-over wells. This plan is very optimistic and couldn’t be achievable. It is beyond their capacity. Of these wells, the drilling of 20 wells will be carried out by BAPEX while work on the remaining 28 wells is to be outsourced including 16 workover wells by BGFCL and SGFL. The ongoing project for drilling 48 wells is progressing but will not be completed by 2025. Maybe 30% to 35% could be achievable.

In addition, Petrobangla has a plan to drill and work over 100 wells during 2025-28, which includes 54 exploration, 15 appraisal cum development, and 31 workover wells. Is it a realistic plan? Of course not. However, Petrobangla/Ministry will prepare a detailed action plan for monitoring regular works and drilling progress. However, it is not achievable even 30% of their target due to a lack of adequate technical and experienced manpower of BAPEX, BGFCL & SGFL, and other issues related to procurement rules and regulations.

|

Drilling & Workovers of 48 Wells by 2025 |

||||

|

Type of Well |

BAPEX |

BGFCL |

SGFL |

Total |

|

Exploration Well |

10 |

1 |

6 |

17 |

|

Development/Appraisal well |

10 |

4 |

1 |

15 |

|

Work Over |

- |

8 |

8 |

16 |

|

Total: |

20 |

13 |

15 |

48 |

|

Production Augmentation

(MMcfd) |

281 |

152 |

185 |

618 |

|

Drilling & Workovers of 100 Wells (2025-28) |

||||

|

Exploration Well |

44 |

4 |

6 |

54 |

|

Appraisal/Development well |

8 |

5 |

2 |

15 |

|

Work Over |

16 |

12 |

3 |

31 |

|

Total: |

68 |

21 |

11 |

100 |

|

Source : Petrobangla |

||||

The gas production could not be increased substantially within a few years to feed power plants. Indeed, the government didn`t give proper attention to exploring oil and gas in the offshore and onshore. Only, BAPEX has been carrying out this work alone with a lot of constraints and limitations. However, the possibility of increasing gas production from our gas fields will not be enough compared to the growing demand. The capacity of one of the two existing FSRUs has recently been increased by 100 MMcf per day, bringing the current total LNG supply capacity to 1100 MMcf. Two new FSRUs will come into operation in 2026 & 2027 with a capacity of 1000 MMcf per day. In any case, we must expedite hydrocarbon exploration and development activities in the onshore and offshore.

Exploration in the Chittagong Hill Tracts

Carrying out exploration activities in the hill tracts is very difficult due to complex geological structures and drilling within overpressure zones is risky. The drilling company needs to take a lot of precautions and safety measures as well as engage appropriate experts to carry out the job. Apart from this, drilling time will take much longer due to complex lithology i.e. quite long sections need to be drilled within continuous soft & sticky shale and sometimes very hard shales which will take more time compared to other areas of Bangladesh. BAPEX should avoid carrying out exploration works in the Chittagong Hill Tracts by them alone.

Drilling at Bhola Island

Gazprom will be awarded well-drilling work at Shahbazpur- 5 & 7, North-East-1, Bhola North-3 & 4 wells in Bhola Island. Shahbazpur North-East is the exploration well. Sinopec will drill wells at Rashidpur-11 & 13, Sylhet-11, Kailastila-9 and Dhupitila-1 wells. These include 4 exploration wells and one development well. But the concern here is that can we use this gas after the completion of drilling and setting up process plants. There is no scope due to the lack of a gas market there and the lack of a gas transmission pipeline to Barisal from Bhola. We need to wait till the construction of the Bhola Bridge and to construct a pipeline. However, it is worth shifting this drilling program and doing it in parallel during the construction of Bhola Bridge.

Exploration under PSC

Exploration offshore under PSC would not require any investment from the government. The government did not go that way. It did not search for its gas and extraction of coal from the discovered deposit but opted for an easy way to import it. There is a huge potential to find oil and gas in the Bay of Bengal as well as extraction of own discovered coal deposits which were found in the north-western part of the country. The government could have given proper attention to exploring hydrocarbon, but it did not happen. Only BAPEX has been engaged in the exploration and its development. In addition to drilling, they have been making relentless efforts towards necessary workovers of different sick and problematic wells of BAPEX, BGFCL, and SGFL since 2010 for augmentation of gas production.

Bangladesh's offshore area remains unexplored despite the settlement of disputes with neighboring Myanmar and India over the maritime boundary almost 10 years ago. There is a plan to invite international bidding in March 2024 for exploration in the offshore areas to make Bangladesh more attractive to international oil companies and attract investment in hydrocarbon exploration in the Bay of Bengal. The country has a total of 48 blocks, including 26 located offshore. Of the offshore blocks, 11 are located in lyshallow water while 15 are in deep sea water areas. Of the offshore blocks, 24 remain open for IOCs while two blocks SS-04 and SS-09 are under contract with ONGC Videsh Ltd, India.

Policy Issues

The government should understand the main obstacle to achieving the drilling target which is PPR and needs to follow existing PPR mandatory for oil and gas exploration by the national companies for engaging service companies, procurement of drilling equipment and materials, procurement, and commissioning of process plants, construction of a necessary gas pipeline and hookup line, preparation of drilling sites, construction of rig pad, necessary roads, bridges, culverts, etc. Apart from this, constraints of adequate experienced technical manpower of BAPEX and other national gas production companies are also big hindrances. If the government wants to expedite hydrocarbon exploration by BAPEX, they should waive or suspend the mandatory provision to follow PPR for oil and gas exploration at least for 10 years.

The government should try to understand the utmost capability of BAPEX considering their existing technically skilled manpower which includes geologists, geophysicists, drilling engineers and drilling personnel, mud engineers (chemists), electrical & mechanical engineers, etc. Apart from that, there is a shortage of chemical engineers and technical operators to run the necessary process plants. The government should think about keeping off BAPEX for doing exploration works alone in the Chittagong Hill Tracts.

Other issues include carrying out exploration activities in the Chittagong Hill Tracts where reputed and experienced international oil companies should be engaged under PSC or JV between BAPEX & reputed IOCs following reasonably soft terms and conditions. However, the government and BAPEX tried several times earlier to make JV with reputed IOCs but the initiatives were not yet successful.

Now, the government is emphasizing gas exploration and enhancing production to reduce pressure on LNG imports. They have decided to award some of the wells for drilling to the international drilling contractor. Five wells of SGFL are to be awarded to China's Sinopec drilling company and five wells of BAPEX at Bhola will be given to Gazprom of Russia. The plan has already been taken by the government to enhance gas production is not possible only with BAPEX. So, the process of giving work to Sinopec and Gazprom under the special act is underway. Both are eligible companies and they worked in Bangladesh before.

Gas Shortage

The daily gas shortage in the country is about 1,000 million cubic feet a day against the demand. Currently, about 2,050 MMcf of gas is being produced daily in the country. At present, the daily demand for gas is about 4,000 MMcf. About 800 to 900 MMcf of imported LNG is being supplied daily to the national grid. Even if we can substantially increase our gas production, we need to import LNG to meet our growing demand.

Gas Reserves

Currently, gas is being produced by three national companies, viz. BGFCL, SGFL, and BAPEX as well as two international companies, namely Chevron and Kris Energy. As of today, 29 gas fields have been discovered in the country. The total Gas Initial in Place (GIIP) was 38.2 Tcf, out of which 29.7 Tcf was recoverable (proven and probable). From 1960 to Dec 2023, a total of 20.7 Tcf gas was produced leaving only 9.0 Tcf recoverable.

Power Scenario

The power generation capacity in the country is more than 26,500 MW. However, the power generation and supply is on an average of 12,000 to 13,000 MW throughout the year. So, there is no problem in power generation capacity. The biggest challenge is the supply of energy for power generation and industrial uses. The estimated highest electricity demand during the upcoming Ramadan month, summer, and irrigation season is about 17,800 MW. However, due to the commissioning of several large coal-based power plants last year, the power generation capacity has increased substantially. But the concern is to ensure the supply of fuel to the power plants.

Despite the installed capacity of power plants, almost half of the gas-based power plants remain suspended throughout the year due to a shortage of gas. The gas-based power plants have a demand of about 2000 MMcf of gas per day, but 900 to 1200 MMcf are being supplied.

There are 29 power plants, having a combined capacity of more than 10,000 MW are now under construction out of which, BPDB is directly implementing 5 plants, and others by IPPs. The country struggles to manage the cost of overcapacity to the tune of 40% in the power sector. After the completion of the construction of these plants and its commissioning within 3 years, it will further increase the amount of capacity payments. The capacity payment into the private, rental, and quick rental power plants has already increased from Tk 5,376 crore in 2017 to Tk 18,000 crore in 2023.

In 2024, surplus electricity generation capacity will rise to 50% from the existing 40%. The sectors’ cumulative outstanding bills have now jumped to about $5 billion of which the backlog amount is about $4 billion, and the remaining $1 billion is in the energy sector. The demand for energy in the country is increasing day by day due to feeding energy to the power plants.

Meanwhile, the government has substantially increased electricity prices and huge gas prices in one run. Assuming that it may increase again within a short period to pay capacity charges to the private power producer companies. To facilitate power generation from different plants and companies, the energy sector has to import fuel, coal, and LNG. Only 40% of own electricity is utilized considering installed capacity. Why do we need to construct more and more power plants than required?

Production capacity from fuel sources

Now, the total generation capacity of electricity is about 25,480 MW out of which 10710 MW gas based, 6190 MW using furnace oil, 4410 MW from imported and local coal, 2655 MW through import of electricity from India, 820 MW from diesel and 690 MW from renewables – mostly solar. The power generation capacity of coal-based power plants is about 5987 MW, which is about 23% of the total capacity.

Recently, the state minister for Power, Energy & Mineral Resources criticized BAPEX and Petrobangla for the slow progress of gas exploration and not being able to move in synchronization with the power sector. He was not happy with their performance and gave strict instructions to increase gas production in line with the power demand. However, it is not possible within a few years. If we find a big discovery offshore or maybe in the onshore blocks 8 & 11 or the deeper prospects, then the scenario would change a lot.

Mortuza Ahmad Faruque, Energy Expert and Former Managing Director of BAPEX

Special Article As PDF/userfiles/21_18_Special Article.pdf