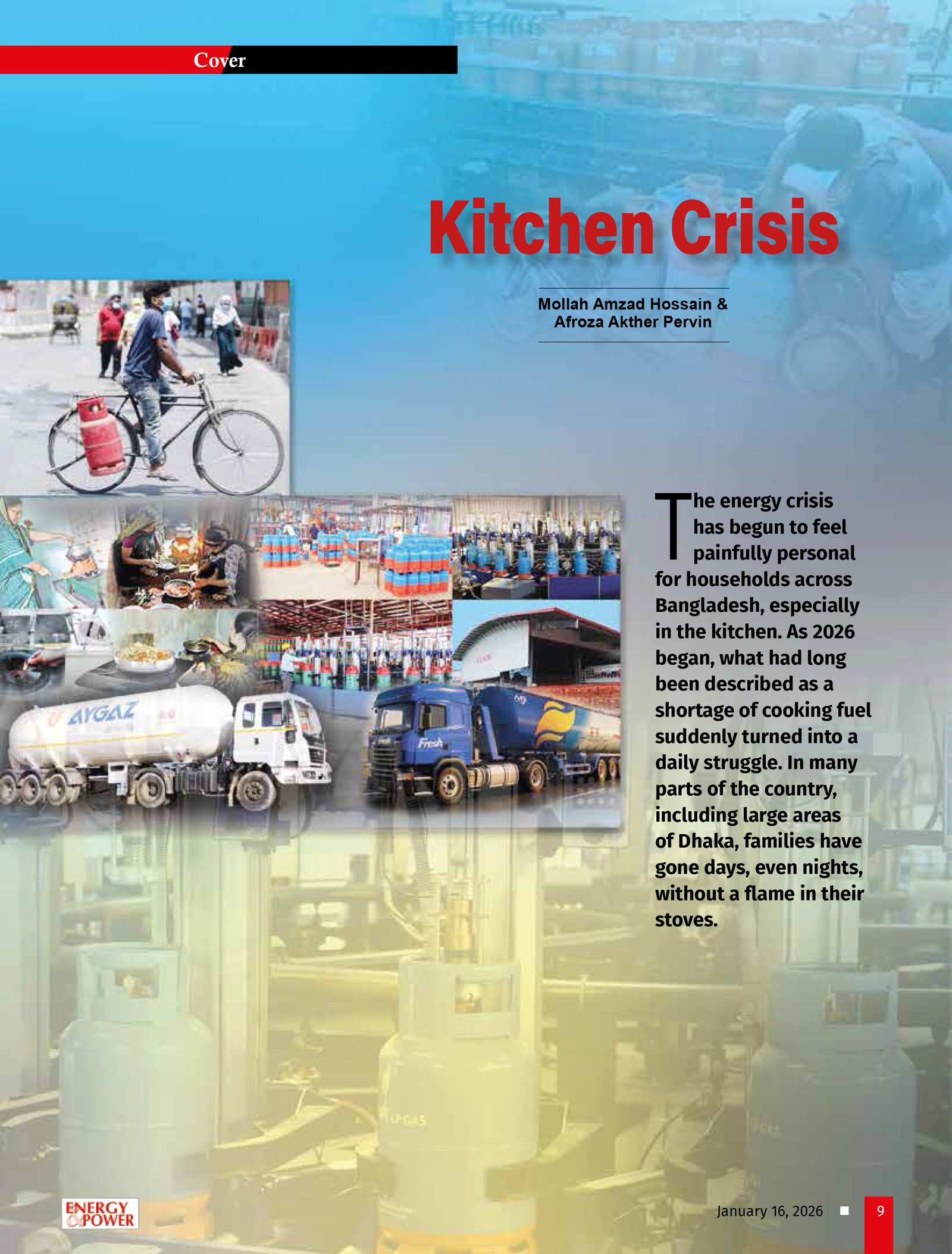

The energy crisis has begun to feel painfully personal for households across Bangladesh, especially in the kitchen. As 2026 began, what had long been described as a shortage of cooking fuel suddenly turned into a daily struggle. In many parts of the country, including large areas of Dhaka, families who depend on piped gas have gone days, even nights, without a flame in their stoves. Meals are delayed, routines are disrupted, and frustration is mounting.

For those trying to cope by switching to LPG, relief has proved elusive. Supplies have tightened sharply, and in many neighborhoods, LPG cylinders cannot be found at all—no matter the price. A 12-kg cylinder, officially priced at BDT 1,306, is unavailable in many areas even when buyers are willing to pay nearly twice that amount. The uncertainty over when normal supply will resume has only deepened public anxiety.

Some households have tried turning to electric cooking as a last resort, but that option has brought its own challenges. Induction cookers have quickly disappeared from store shelves, adding yet another layer to the crisis. Even when electricity is available, the tools needed to use it are not.

Despite the involvement of both public agencies and private suppliers, tangible relief remains out of reach. The LPG shortage continues to affect Dhaka and other regions, and recent disruptions—including a short-lived strike by LPG traders—have left lingering effects in the market. Although the strike was resolved within hours, its impact is still being felt, reinforcing a growing sense among consumers that the crisis is far from over.

Retailers report that they are unable to secure sufficient LPG cylinders even at higher prices, yet they face harassment during enforcement drives conducted in the name of consumer protection. On the other hand, LPG operators claim that the crisis has been aggravated by US sanctions imposed on several vessels involved in LPG transportation, resulting in blocked supplies. They also cite financial constraints, LC complications, and lack of timely government approval for additional imports as key reasons behind the supply shortfall. However, most operators maintain that they have continued supplying LPG to the market.

To ease the situation, the Energy Division has taken five initiatives, including a VAT reduction and approval for additional LPG imports, while BERC has also taken steps to stabilize the market. Even so, officials from LPG importing and bottling companies believe that it may take 30 to 45 days for the LPG market to return to normal in terms of supply and pricing.

Consumers using piped gas for cooking have been facing pressure-related issues for the past five to six years. However, the current crisis is the most severe in that period. In some areas of Dhaka, gas supply has been completely disrupted for up to 96 hours, while other areas experience extremely low pressure, with gas supply intermittently stopping altogether.

The recent crisis is largely attributed to pipeline leakages, although Titas Gas authorities have expressed regret over the inconvenience caused to consumers. The country is currently facing a daily gas supply shortfall of 1,200–1,300 million cubic feet (MMCFD) compared to demand. There is no immediate plan to significantly reduce this deficit; rather, the shortage is expected to worsen over the next three to four years. As a result, there is little hope that the piped gas supply for cooking will stabilize anytime soon.

Investigations show that many households are attempting to shift to electric cooking to cope with shortages of piped gas and LPG. However, this alternative is also facing constraints. A sudden surge in demand for induction cookers has led to supply shortages in the market.

LPG Cylinder Shortage Persists

Currently, 27 private-sector LPG operators (out of 49 licensed companies) and one public-sector company supply LPG in the domestic market. The private sector accounts for 99 percent of total LPG supply. Notably, LPG is the only cooking fuel in Bangladesh that receives no government subsidy; instead, the government collects VAT and taxes from the sector. Despite being promoted as a clean cooking fuel, LPG receives no direct incentives.

Although 49 companies are licensed to bottle imported LPG for domestic sale, only 27 operators are currently active. Among them, just six to seven companies supply about 85 percent of the total market demand. Each month, BERC fixes LPG prices based on the Saudi Contract Price (CP) announced at the beginning of the month.

Industry stakeholders estimate average monthly LPG demand at 35,000–40,000 tonnes, rising to 55,000–60,000 tonnes during winter. Demand began increasing from November last year. To meet anticipated winter demand, many operators imported December supplies in November. However, global supply constraints emerged at that time due to rising international winter demand.

The situation worsened after the United States imposed sanctions on 44–48 companies over alleged involvement in Iranian LPG sales and transportation. While Bangladeshi operators do not directly import Iranian LPG, many previously sourced Iranian-origin LPG through third-country channels. Additionally, sanctioned companies were also involved in sourcing LPG from non-Iranian suppliers. As their operations have now largely ceased, Bangladeshi importers are struggling to secure supplies.

Even when LPG is available, a shortage of vessels has further constrained transportation. As a result, only six to seven operators managed to import LPG in December and January—often below their required volumes. Procuring LPG at Saudi CP has become increasingly difficult, forcing some operators to purchase at higher prices.

Price Volatility and Market Disruption

According to the LPG Operators Association of Bangladesh (LOAB), most companies did not import LPG last year; instead, five companies handled the bulk of imports, while five to six others imported limited quantities. Total imports stood at approximately 1.85 million tonnes, while sales exceeded that volume.

Despite supply shortages, operators initially rationed LPG and supplied the market at BERC-fixed prices. However, from November onward, price hikes began emerging at distributor, dealer, and retailer levels, citing supply shortages. By late December, the situation escalated sharply, with BDT 1,306 cylinders selling for BDT 2,500–3,000, while in some areas LPG was unavailable even at higher prices.

The crisis intensified further when the LPG Traders Association announced a strike on January 7, demanding higher commissions and an end to harassment. Although the strike was later withdrawn, LPG cylinder availability at the consumer level has yet to return to normal.

Five Initiatives by the Energy Division to Address the LPG Crisis

In response to the ongoing LPG supply crisis, the Energy Division convened an emergency meeting with all relevant government agencies and leaders of the LPG Operators Association of Bangladesh (LOAB). Following the discussion, the Energy Division issued five directives aimed at quickly stabilizing the LPG market.

During the meeting, LOAB leaders highlighted several challenges, including the lack of approval for additional imports, difficulties in opening Letters of Credit (LCs) and accessing bank loans, and the burden of VAT and customs duties.

Importers explained that maintaining large LPG inventories is not feasible due to frequent price fluctuations in the international market. Holding excess stock carries the risk of substantial financial losses alongside potential profits. As a result, LPG imports are generally planned on a monthly demand basis. However, since November, the market has faced a shortage in meeting demand.

Five Key Measures Taken by the Energy Division

According to Energy Division sources, the following five initiatives have been undertaken to resolve the crisis:

1. Expedited Banking Support:

On January 8, the Energy Division formally requested Bangladesh Bank to fast-track loan approvals and LC opening processes for LPG operators.

2. VAT Reduction Proposal:

On the same day, the Division sent a letter to the National Board of Revenue (NBR) seeking a reduction in VAT at the import stage from 15 percent to 10 percent and the withdrawal of 7.5 percent VAT at the production level (cylinder-filling plants), considering LPG as a green energy.

3. Import Ceiling Relaxation:

The Ministry issued no-objection letters to BERC regarding applications from Omera, Meghna, Jamuna, United iGas, and Delta for increased import volumes.

4. Action against Artificial Shortages:

District and upazila administrations have been instructed, through the Cabinet Division and the Ministry of Home Affairs, to conduct regular mobile courts to prevent artificial supply manipulation.

5. Physical Verification of Stock:

Ministry officials have been ordered to inspect LPG storage facilities near Chattogram and Mongla ports and submit reports to assess the actual import and distribution situation at distributor, dealer, and retailer levels.

Industry Response

LOAB Vice President and Managing Director of G-Gas, Humayun Rashid, said that shipments imported by several operators have already arrived, with more expected soon. As a result, supply is likely to improve within one to two weeks, although a full return to normal conditions may take three to four weeks.

However, he emphasized that declaring LPG as green energy must be fully implemented in financing policies. Rising interest rates and exchange-rate depreciation have weakened many operators financially. He urged Bangladesh Bank to provide low-interest loans from the Green Fund, initially for working capital and eventually covering the entire LPG sector. LOAB plans to formally submit this request to the Governor of the Bangladesh Bank.

Market Outlook

Abdur Razzak, Managing Director of JMI LPG, noted that nearly half of the 29 active LPG operators have become financially distressed, mainly due to high interest rates and the inability to adjust selling prices in line with currency depreciation. While imports by six to seven companies may temporarily improve supply, he stressed that bringing the sector under the Green Fund framework is essential to rotate the existing 55 million cylinders nationwide.

Meanwhile, Abu Sayeed Raja, Chief Marketing Officer of Fresh LPG (Meghna Group), said the company has taken steps to increase imports, with supply expected to improve by late this month or early next month. He cautioned, however, that not all operators can import LPG due to global supply constraints and vessel shortages.

Strike Withdrawn After BERC Meeting

Following a meeting with BERC on January 8, LPG traders withdrew their strike. During the meeting, traders raised three key demands:

• An end to ongoing administrative enforcement drives

• Increased commissions for distributors and retailers

• Assurance of uninterrupted supply

BERC Chairman Jalal Ahmed assured that discussions would be held with administrative authorities regarding enforcement actions and that legal steps would be taken to address commission adjustments. Importers also confirmed that alternative shipping arrangements are being made despite vessel shortages, which could ease the supply situation within a week.

However, LPG trader Selim Khan said retailers are currently paying over BDT 1,300 per cylinder to operators, making it impossible to sell a 12-kg cylinder for less than BDT 1,500. He emphasized that lifting the strike alone would not ensure availability unless supply increases.

BERC Chairman Jalal Ahmed stated that there is no need to impose import caps at this stage, as LPG demand is growing not only in households but also in industry. Operators seeking to import additional volumes will be approved.

Piped Gas Shortage Worsens in Dhaka

The issue of low-pressure piped gas supply in Dhaka is longstanding, but the current situation is far more severe. Nearly all areas of the capital are experiencing acute shortages, with some neighborhoods facing up to 96 hours without gas. Low-pressure conditions persist throughout the city, and several districts outside Dhaka are also affected.

Titas Gas authorities acknowledged the severe pressure problem, citing damage to a distribution pipeline beneath the Turag River at Aminbazar, caused by a cargo vessel’s anchor. Although repairs have been completed, water entered the pipeline during the process. Combined with reduced overall gas supply, this has resulted in critically low-pressure conditions across Dhaka. Efforts to restore normal supply are ongoing.

Gas Supply Constraints Persist as Demand Shifts Toward Electric Cooking Appliances

According to data from Petrobangla, Bangladesh currently has around 4.3 million piped natural gas consumers. Among them, customers of Jalalabad Gas and Bakhrabad Gas companies receive comparatively better gas pressure. However, customers of Titas Gas and three other distribution companies have been facing chronic low-pressure gas supply problems for a long time.

A former Managing Director of Titas Gas Transmission and Distribution Company, speaking on condition of anonymity, said that Titas receives at best 60 percent of its total connected load. He noted that even if full demand were met at the supply level, it would still be impossible to deliver gas at adequate pressure to customers in the capital due to infrastructure constraints. In his view, ensuring proper gas pressure in Dhaka would not be feasible without replacing old and dilapidated gas pipelines.

Energy experts believe that, considering the overall gas supply situation, the supply deficit will continue to persist compared to demand, with no guarantee of improvement before 2030. In particular, without the establishment of sufficient LNG import infrastructure, meaningful improvements in supply management are unlikely. As a result, the government must now seriously consider alternatives to residential piped gas supply.

The Vice Chancellor of Independent University, Bangladesh (IUB), believes that if residential gas prices are aligned with international LNG prices, it would encourage greater use of LPG in households. In his assessment, Bangladesh will never again be able to meet full residential gas demand through piped natural gas.

Gas Crisis Triggers Surge in Demand for Electric Cookers

Amid the ongoing gas crisis, the use of electric cooking appliances has increased sharply, creating a supply shortage in the market.

Over the past two decades, the government has taken various initiatives to promote electric cooking as an alternative to gas, particularly to ensure clean cooking for all by 2030. In response to this policy direction, local manufacturers have started producing and marketing electric cookers. However, the recent shortages of both piped gas and LPG have significantly accelerated consumer interest in electric cooking.

Many urban residents now find it more economical to invest in electric cooking appliances rather than purchasing meals from hotels due to gas shortages.

There are two main types of electric cookers available in the market: induction cookers and infrared cookers, with infrared models currently in higher demand.

A visit by this correspondent to markets in Motijheel, Paltan, Dhanmondi, Mohammadpur, Ring Road, Shyamoli, Mirpur, Banani, and Gulshan revealed that stocks of electric cookers in several shops and showrooms have already been sold out. Retailers have placed fresh orders with manufacturers, while others reported significant sales volumes over a short period.

Local conglomerate PRAN Group manufactures electric cookers under the Vision and Vigo brands. Other popular brands in the market include Walton, Kiam, Gazi, Miyako, Philips, and several non-branded products. Non-branded electric cookers are also widely available in Dhaka’s markets.

Induction vs Infrared Cookers

The functional difference between induction and infrared cookers is significant.

Induction cookers do not generate heat directly. Instead, they work on the principle of electromagnetic induction, where a copper coil inside the cooker creates a changing magnetic field that induces electric currents in the cookware. Heat is generated directly in the pot, leaving the glass surface relatively cool.

In contrast, infrared cookers use powerful heating elements such as halogen or infrared heaters that generate heat directly. These elements emit infrared radiation—similar to sunlight—which heats the cookware. As a result, the glass surface of the cooker turns red and becomes hot during operation. Infrared cookers can be used with any type of cookware, whereas induction cookers require ferromagnetic cookware such as cast iron or certain stainless steel utensils.

Due to this versatility, infrared cookers are more popular among consumers.

Prices and Efficiency

Infrared cookers are generally slightly more expensive than induction models. Both types typically retail between BDT 3,500 and BDT 6,000, though higher-priced options are also available. Non-branded models are usually BDT 300–400 cheaper.

Induction cookers offer up to 90 percent thermal efficiency, which is higher than gas stoves. This allows for faster cooking and lower electricity consumption. Most induction cookers also automatically shut off when cookware is removed.

However, the sudden surge in demand has resulted in a short-term supply shortage of electric cookers in the market.

Conclusion

A steady supply of cooking fuel is not just a policy objective—it is a daily necessity for millions of families. Clean cooking is a core target under the Sustainable Development Goals (SDGs), and Bangladesh has committed to achieving it by 2030. Over the years, notable progress has been made: nearly 60 percent of households now rely on cleaner options such as piped gas and LPG. For many families, this shift has meant safer kitchens, less smoke, and better health.

Cost, however, remains a decisive factor in how people cook. Piped gas is still the most affordable option for most households, which is why it remains the preferred choice wherever it is available. LPG and electric cooking, while cleaner, are significantly more expensive for many families—placing them out of reach during times of financial stress. Yet the current crisis has exposed a hard truth: there is no longer any guarantee that piped gas will be available when people need it.

In theory, LPG should be the most practical alternative. In reality, Bangladesh is facing its most severe LPG shortage in a quarter century. For households already struggling with piped gas disruptions, the lack of LPG has removed the only viable backup option. Although the Energy Division claims it is working to stabilize the market, ensuring uninterrupted supplies of both cooking gas and electricity has become one of the sector’s most challenging tasks.

Energy experts argue that this moment calls for a fundamental rethink. Cooking fuel, they say, should be treated as “green energy” and planned with long-term security in mind—not as an afterthought. There are signs that policymakers are beginning to move in this direction. Analysts also stress the need to make piped gas, LPG, and electric cooking genuinely competitive so that households can shift between options depending on price and availability. Such flexibility, they argue, is the only way to protect families from being left without a cooking flame when the next energy shock arrives.

Download Cover As PDF/userfiles/EP_23_15_Cover.pdf

Mollah Amzad Hossain, Editor, Energy & Power and Afroza Akther Pervin, Managing Editor, Energy & Power