A multifaceted approach to fixing the power sector’s core problems and consistent actions from now through to 2030 can help cut the government’s subsidy burden to nearly zero

Key takeaways:

· While the Bangladesh Power Development Board’s (BPDB's) installed power system capacity soared by 125% between June 2016 and October 2024, its financial troubles brewed due to tepid power demand growth, use of expensive fuels, limited success with renewable energy, and unfavourable economic conditions.

· During the fiscal year (FY)2019-20 to FY2023-24, the BPDB’s total annual expenditure increased 2.6-fold against revenue growth of 1.8 times, prompting the government to allocate a combined subsidy of Bangladeshi Taka (Tk)1,267 billion (US$10.64 billion) over the years.

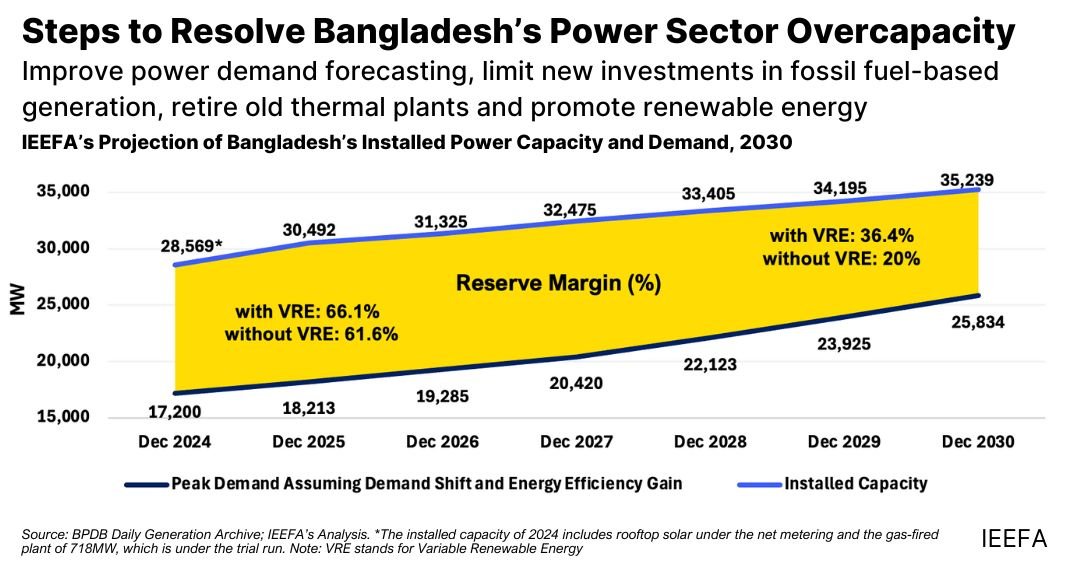

· The power sector's reserve margin will likely reach 66.1% by December 2024, which is much higher for a country with limited renewable energy. With IEEFA's assessment showing that Bangladesh's demand may rise to 25,834 megawatts (MW) in 2030, a system capacity of 35,239MW will be sufficient, leading to a reserve margin to 36.4% in 2030.

IEEFA South Asia, December 4, 2024 - The Bangladesh Power Development Board (BPDB) can save Bangladesh Taka (Tk) 138 billion (US$1.2 billion) of annual loses, funded by government subsidies, through electricity sector reforms targeted at addressing core problems, according to a new new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

The report highlights Bangladesh can achieve the savings by shifting half of the industrial demand, met by captive generators, to the grid, adding 3,000 megawatts (MW) of renewables, reducing load shedding to 5% from the fiscal (FY) 2023-24 level and limiting transmission and distribution losses to 8%.

“With the reserve margin hovering around 61.3%, Bangladesh’s power sector has an overcapacity problem which contributes to the BPDB’s persisting subsidy burden. Despite a series of power tariff adjustments, the hefty revenue shortfall and subsidy allocation will likely persist in the foreseeable future. IEEFA’s proposed roadmap for reform suggests improving power demand forecasting methods by factoring in the role of energy efficiency to reduce overcapacity,” says the report’s author, Shafiqul Alam, Lead Analyst – Bangladesh Energy, IEEFA.

“Our roadmap recommends limiting new investments in fossil fuels-based generation while promoting renewable energy deployment. Further, it suggests modernization of Bangladesh’s electricity grid to encourage industries to shift to grid power rather than operate gas-based captive plants and minimize load shedding. We find that taking such consistent actions can help reduce the sector’s subsidy burden,” he adds.

The report finds that during the fiscal year (FY)2019-20 to FY2023-24, the BPDB’s total annual expenditure increased 2.6-fold against revenue growth of 1.8 times, prompting the government to allocate a combined subsidy of Bangladeshi Taka (Tk)1,267 billion (US$10.64 billion) to ensure power supply to keep the economy afloat. Yet, the BPDB recorded a cumulative loss of Tk236.42 billion (US$1.99 billion).

In FY2023-24 alone, the government gave a Tk382.89 billion (US$3.22 billion) subsidy to the BPDB.

In order to bring the subsidy burden down to nearly zero, Alam recommends ensuring industries fully rely on the national electricity grid. “Additionally, the country should gradually transition to electric systems from gas-driven appliances, like boilers. This will help increase the BPDB’s revenue from selling additional energy while reducing capacity payments to idle plants,” said Alam.

“The window to make Bangladesh’s power sector sustainable is rapidly narrowing, but there is still time to get the sector back on track by following a suitable roadmap,” he adds.

As the first step of the reform, the report calls on the government to forecast power demand from 2025 by factoring in energy efficiency gains and demand shift measures. IEEFA’s projection by factoring in such variables shows that the country’s peak power demand in 2030 is likely to be 25,834MW as against the Integrated Energy and Power Master Plan’s (IEPMP) forecast, made in July 2023, of between 27,138MW and 29,156MW.

Simultaneously, the IEEFA roadmap also suggests halting investment in fossil fuel-based power and limiting the use of oil-fired plants to 5% of total power generation. If these steps are taken along with the anticipated 4,500MW of fossil-fuel-based power plant retirements, the report expects Bangladesh will have a system capacity of 35,239MW.

“A system capacity of 35,239MW will help Bangladesh meet the peak demand of 25,834MW by 2030. It will bring the reserve margins down 66.1% in December 2024 to 36.4% (including variable renewable energy) and 20% (excluding variable renewable energy) in 2030. A reserve margin of 20%, excluding variable renewable energy, is comparable to countries like India and Vietnam,” Alam says.

Finally, the country can consider a conservative goal of installing a total combined grid-connected renewable energy capacity of up to 4,500MW by 2030 to help reduce mostly expensive oil-fired power generation during the day. The use of battery storage of 500MW with a backup for three hours will help reduce the operation of oil-fired plants in the evening, too. If batteries become more economical in the future, Bangladesh may consider their increasing use during the evening peak.

“However, the success of Bangladesh’s efforts to fix the power sector’s problems will hinge on how it makes policies more conducive, whether it shifts focus from GDP-centric demand projection to other factors, like energy efficiency gain, modernizes the gird, adjusts gas tariffs to attract industries to use grid power and addresses the challenges of renewable energy expansion,” Alam adds.