The dependence on liquid fuel – furnace oil and diesel – has started increasing due to the acute gas supply crisis. The price of coal has also skyrocketed. Consequently, the cost of power generation is getting higher. According to a projection of Bangladesh Power Development Board (BPDB), the cost of power generation in 2021-22 would stand at BDT 8.34/kWh at current price of natural gas. That would be BDT 2.00/kWh higher than the previous financial year. On the other hand, Petrobangla has informed that the net cost of LNG import was BDT 31.56/cubic meter in last financial year. This may grow to BDT 50.39/cubic meter in 2021-22. The weighted average price of gas would then increase to BDT 20.36/cubic meter from BDT 12.60/cubic meter in 2019. This would leave no other option but to increase the price of gas for all categories of end users. Meanwhile, the use of liquid fuel in power generation increased to 26% in December 2021 and January 2022 from 21% earlier. It is now being said that the dependence on furnace oil and diesel would further increase in meeting the higher demand for power over the ensuing summer peak unless gas supply is increased by 750 MMCFD from the present level. In that case, the contribution of liquid fuel to power generation may grow to 30% and the cost of power generation may increase further during the current fiscal year.

.jpg)

For failure in construction of power evacuation infrastructure on time, the 1,320MW imported coal-based power generation capacity of the Payra power plant could not be utilized at its optimum level and the plant’s generation remained limited to 660MW. The full capacity of one of the two units cannot be utilized. The price of coal has also skyrocketed. The cost of generation of power from Payra plant has consequently increased by 36%. The cost increased to BDT 8.60/kWh from BDT 6.30/kWh. Bangladesh Power Development Board (BPDB) had projected the price of coal in the international market would remain around US$150.00/tonne in the current fiscal year while it would be around US$200/tonne for the Rampal plant. But the current price of superior quality coal in the global market ranges between US$240 and US$262/tonne. It is still uncertain how long the price would remain at this level.

.jpg)

The installed generation capacity of 66 gas-based power plants is 11,268MW. For utilizing full capacity, these require 2253 MMCFD gas. For a technical glitch of one of the two FSRUs, the RLNG supply has been reduced to 400 MMCFD. At present, Petrobangla allocates only 750 MMCFD for power generation. Consequently, the cost of power generation has already increased for operating the dual fuel power plants using diesel. The demand, which was at its low in December 2021, has started increasing from February 2022. This trend would continue till September 2022. Nasrul Hamid, State Minister for Power, Energy and Mineral Resources, has informed the media that during the ensuing summer, the demand for grid-connected power would be 15,000MW. BPDB mentioned that they would be compelled to further increase reliance on liquid fuel-based expensive generation if 90% of the gas-based generation cannot be utilized during this time. For this, at least 1150 MMCFD gas supply would be essential. Petrobangla sources confirmed that even if the Summit-operated FSRU gets back into its capacity delivery, it would not be possible to supply more than 3,000-3,100 MMCFD gas. It would not be possible to supply gas per demand for power generation unless, as a contingency measure, gas supply to fertilizer plants and CNG is suspended temporarily.

.jpg)

BPDB sources informed the EP that 21% power generation depends on liquid fuel over the last financial year. In January 2022, it had already increased to 26%. They apprehended that the reliance may grow beyond 30% in the ensuing summer if gas per demand cannot be supplied. All the liquid fuel-based power plants may need to be used if the demand for grid power grows to 14,000-15,000MW. The total capacity of grid-connected power is now 22,066MW. The furnace oil-based plants' capacity is 6,059MW and that of diesel is 1,290MW.

The Power Cell information evidences another 6,468MW capacity additional LNG-based power plants are in the pipeline. These may come into operation by 2024. During this time, an estimated total of 19,651MW nuclear and coal power plants may come into operation. There is a plan to abandon 3,990MW capacity gas and liquid fuel-based power plants by then. The new LNG-based power plants would require about 1,000-1,100 MMCFD gas supply. But Petrobangla has no plan now to increase gas supply to cater this. A maximum of 500 MMCFD RLNG supply may be possible during this time from the third FSRU now at negotiation stage. The agreement has not been signed yet. It would take at least 18 months for coming into commercial operation from the effective date of the contract. Experts observed that unless coal market volatility eases and the first of the two units of Rooppur Nuclear Power Plant comes into operation by 2024, reliance on liquid fuel-based plants would continue. A source in the Power Division informed the EP that import of hydro-electricity from Nepal may start by 2025.

BPDB informed that considering the actual cost of July–December 2021 and projected estimates of January–June 2022, the cost of power generation would be Tk 8.34/unit. This estimate took into account the present price of gas and liquid fuel. On this basis, BPDB has submitted a proposal to BERC for considering 64% price increase of bulk electricity. But BERC refused to consider the BPDB’s proposal now. Consequently, BPDB would require submitting the proposal again after reviewing the impacts of BERC-determined price adjustment of gas following a public hearing in March 2022. The price of gas for power generation is now BDT 4.45/cubic meter. Petrobangla has proposed to BERC to increase it to BDT 9.66/cubic meter.

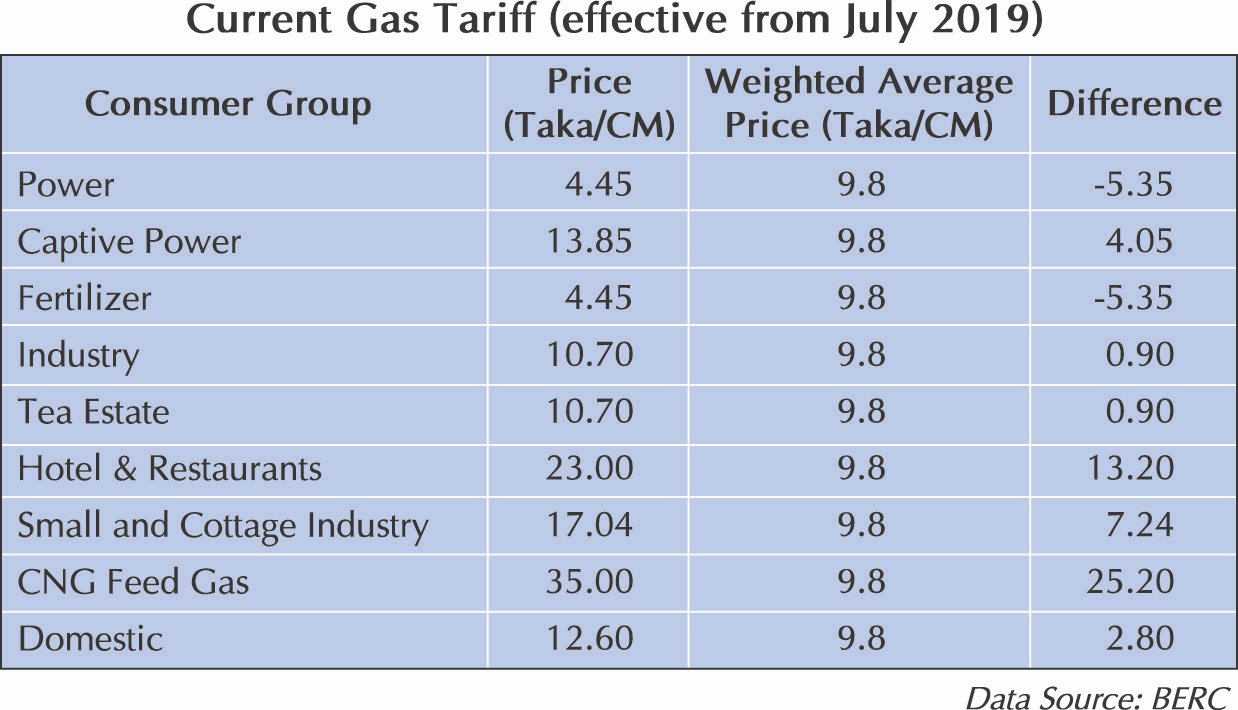

During the gas price adjustment in July 2019, Petrobangla fixed the weighted average of gas price at BDT 12.60 considering 850 MMCFD RLNG supply in the mix. But BERC determined the end-user price at BDT 9.80, including subsidy. Taking into consideration the spot market volatility, Petrobangla now claims that the weighted average cost of mixed gas is BDT 20.36. In a recent CPD seminar, there is a recommendation for not going for any new LNG-based power plants. It has been informed that the LNG price at end-user level in 2018-19 per meter cube was BDT 43.35, in 2019-20 it was BDT 35.20 and in 2020-21 it was BDT 31.53. According to the CPD estimate, the price of LNG has reduced by 10.64% over the last three years. It may increase up to BDT 50.39 in 2021-22.

A senior executive of BPDB informed the EP that the price of gas for power generation now is US$1.15/MMBTU. New Petrobangla proposal, if approved, would make it US$2.28/MMBTU. If the entire LNG price is passed through to BPDB and that is over US$20.00/MMBTU, the cost of per unit generation would exceed that of the furnace oil.

Information from the Energy & Mineral Resources Division (EMRD) indicates that LNG from the spot market was purchased at US$36.95/MMBTU in October 2021. The price of LNG received on 13/14 February 2022 was US$29.77/MMBTU and 27/28 February would be US$27.97/MMBTU. Initiative for purchasing LNG from the spot market for March has been launched. This would be finalized by 20 February 2022.

Bangladesh has long-term contracts with QatarGas and Oman Trading Limited for supplying LNG at US$6.23/MMBTU and US$6.29/MMBTU. Till June 2021, the average price of LNG procured from the spot market was US$7.98/MMBTU. The government has failed in concluding contracts with other probable LNG suppliers under long-term contracts apart from the two mentioned above. LNG price at spot market has dropped at least by US$10/MMBTU from the sky-high level of October 2021. RPGCL expects that this would go down further over the next few months.

The reports published in the global media quoting market analysts evidence that coal price may not ease till Indonesia lifts embargo on coal export. Use of coal for power generation has increased in Europe following the surge of gas and LNG prices in the global market. Peaceful resolution of Russia–Ukraine standoff and emerging cheaper North American LNG export to Europe may inject positive impacts on coal and LNG prices in Asia.

But the question remains whether Bangladesh with its present level of expertise can effectively manage the advantages of the global fuel market in procuring fuel at competitive price? Production from own gas fields continues depleting alarmingly. Some new reserves (marginal fields) added through efforts of BAPEX are only trickles in the ocean. Demand for LNG would increase significantly by 2025. But the land-based LNG terminal at Matarbari can be completed by that time. It is being told that this may come into operation by 2027. Only possibility is the 3rd FSRU starting operation by the end 2023.

Besides, some other LNG import proposals are under review and negotiation stages. A new proposal for LNG import by a private sector initiative has been submitted to the EMRD. But none of these proposals, even approved, can ensure supply by 2025. BPDB has now no option but to continue reliance on liquid fuel-based generation.

Energy researchers and experts observed that the cost of power generation would continue to increase. For managing excessive stress on Petrobangla created from spot market LNG price, the gas prices for end-users would require adjusting in phases. The cost of liquid fuel-based power would continue to remain high. Price hike of crude oil and petroleum products in the global market may not ease soon. The amount of subsidy in 2020-21 increased to BDT 11,780 crore. That was BDT 7,440 crore in the previous year. This would necessitate power price adjustment as well.

However, they pointed out that the sorry state of the energy supply situation has been created due to overlooking the need for exploration and exploitation of the country's own primary energy resources. The situation would not have been created had the policymakers given adequate attention to the domestic resources. From that perspective, they think, it’s not a proper excuse that the end-users will have to bear the burden of increased energy prices due to global price volatility.

In conclusion, keeping energy and power prices within the affordable limits may not be possible unless the contribution of our own energy is increased and energy efficiency at all levels of fuel and power value change is ensured. The highly-acclaimed success of power generation would die wondering if sustainable supply of primary fuel at affordable price cannot be ensured. Experts believe that without a smart fuel mix, the phenomenal increase of cost of power generation cannot be kept under control.