Experts at a virtual discussion suggested conducting a realistic and proactive review of the Power System Master Plan (PSMP) 2016 against the backdrop of the COVID-19 pandemic and the changing the world order. They stressed on the need for realistic projection of demand, appropriate mix of primary fuel, harnessing and optimally utilizing domestic primary fuel resources, considering all options of fuel diversification, expediting, updating and modernization of power transmission grid, ensuring energy efficiency and better coordination between the power and energy sector with the ultimate objective of achieving sustainable energy security.

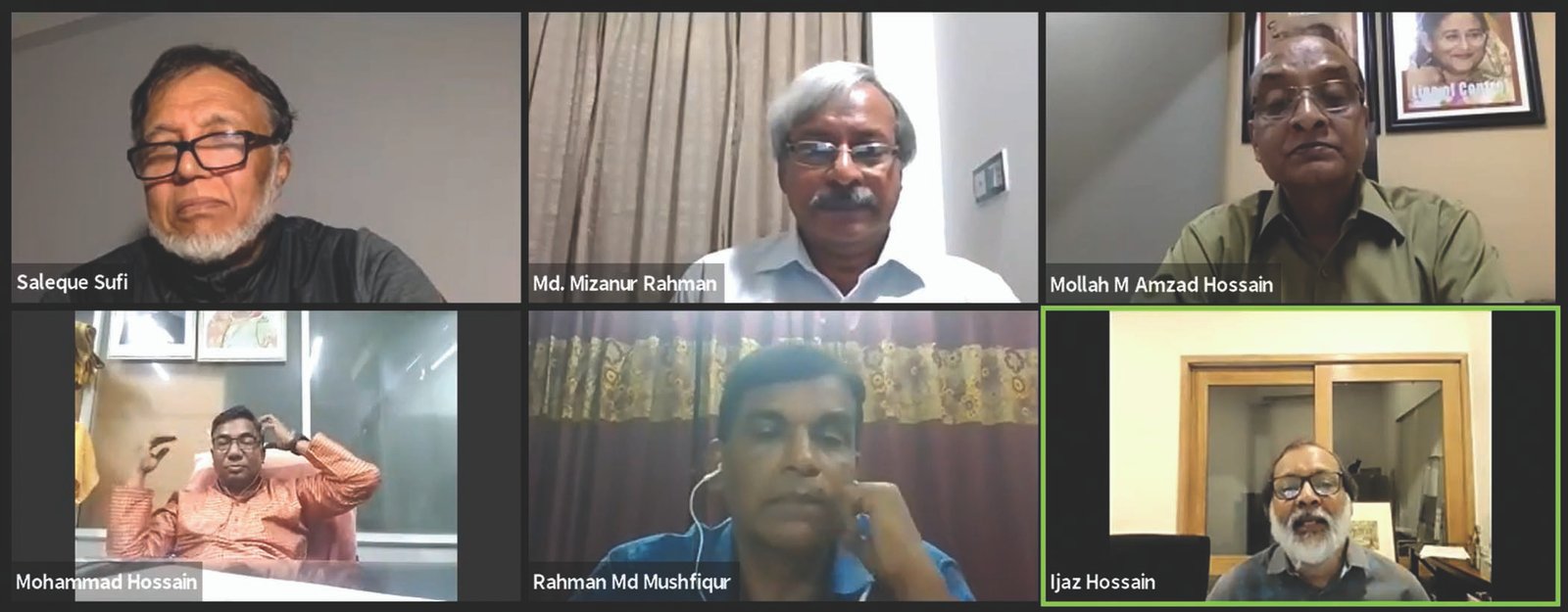

Energy and power sector professionals and academics put forward the recommendations at the EP virtual debate on “Is It Necessary to Review the PSMP 2016?” Energy & Power magazine in collaboration with M2K Technology & Trading Co., Bangladesh recently organized the debate, moderated by EP Editor Mollah Amzad Hossain.

Engr. Mohammad Hossain

Director General, Power Cell

The PSMP is a dynamic document and already reached the stage of reviewing as we are approaching 2021. Over the last few terms, the PSMP is being reviewed every 5 years. It was estimated that the power demand in 2020 would be 15,000 MW. The COVID-19 pandemic is affecting the normal way of life as well as demand growth.

In the past, the PSMPs were done separately, but this time an integrated power and energy system master plan titled “Power and Energy Master Plan” is being formulated. Greater importance is being given on primary fuel and power grid reliability. We have taken consultancy services in the past and would take similar services this time too while the stakeholders concerned would be deeply involved. Global situation will be taken in view in preparing the plan. This time preparing the master plan will be extremely challenging.

In the past, power transmitted from the east to the west. But the situation has reversed by now. Some plants need relocation. Responding to allegations that the PSMP was not followed in the past, he argued that it should not be a reason for not making new master plan. I agree that we must better implement the plan. There is challenge in everything.

Prof Dr. Ijaz Hossain

BUET

“Why we are so much away from the reality? Why we departed so much from the plan? I am not blaming anyone. Is there any requirement of making plan unless it is meticulously followed? There is of course a necessity for reviewing the plan but we are miles away from reality. Was it in the plan that Payra will be a power hub? Over achievement of power generation has created challenges for us. Now there are talks about over capacity.

Power grid reliability is a major problem now. No one dares operating any industry now without having captive power generation. We are yet to earn confidence of the consumers about reliable power supply. We must plan for at least 50% reliability in the future. We decided about coal import but have no control over it. There must be integrated planning. Why people are talking about going to LNG leaving coal? We have to have back up. Oil based plants should be restricted as peaking plants only. Over capacity created pressure on cost of generation and eventually on power tariff. I will salute all if the planned capacity after completion of all power projects in the pipeline is used. However, I find no possibility. Industries want their captive generation. Where the power would be supplied? Domestic demand growth would not support huge growth of generation capacity unless grid power is reliably supplied to industries. Forecast of demand is not correct in my opinion.

Engr. Mizanur Rahman

Former member,

Bangladesh Energy Regulatory Commission (BERC)

Reviewing the PSMP 2016 is essential now. Over the past terms, it has become a tradition to review the long-term plan after every 5 years. It does not mean revisiting, but it needs reviewing and developing the new PSMP in the context of global scenario of the New Normal World.

Every plan discusses about base condition, high and low growth scenarios. When required, a plan based on high growth scenario is pursued. The first PSMP was formulated in 1985, the second in 1995 and the third in 2006. From 2010, it is formulated after every 5 years. The PSMP 2016 was due for review in 2020.

Own natural gas exclusively dominated the fuel mix of the first three PSMP. In 2010 when gas product stumbled, Bangladesh moved towards coal. Many termed the PSMP 2010 is a coal-based one. Recognizing the various challenges of mining the coal resource of Bangladesh, it is possible to carry out open pit mining in two mines and carry out underground mining in two others. In PSMP 2016, the own coal was almost completely taken out of the context. The government directives were moving increasingly towards imported primary fuel. For the concept of 20 years into the future, the PSMP 2016 projected the likely scenario of 2041 consistent with the government vision of achieving developed economy.

Pricing, environmental, technology and economic issues are considered in long-term planning. The key determinations are demand projection, primary fuel supply and technology choice. We now have to consider the evolution of nuclear power technology.

BPDB is purchasing coal at US$130 from Barapukuria Coal Mining Company Limited (BCML). It is far cheaper importing coal from abroad. Using the 1.0 billion tonnes of extractable Barapukuria-Phulbari coal, it is possible to generate 6,000-7,000 MW power. Power generation unit cost using domestic coal would be Tk2.50-3.00/Kwh. If LNG price remains at US$7-8/MMBTU, the power generation cost would be Tk 8.00/Kwh. Generation cost using imported coal would be Tk 6.00/Kwh and cost of nuclear power would be about Tk5.00/Kwh whereas the unit cost of HSFO-based power is Tk 12.00/Kwh and that of diesel is Tk 18.00/Kwh. Unfortunately, we could not get rid of liquid fuel-based generation so far. The cost of renewable power is far less. In 2019, the government had to account for Tk 1,700 crore of capacity charge.

In 2019, the highest power demand observed was 12,000 MW. In 2020 before COVID-19, it grew almost to 13,000 MW. I find no option but relying on coal and nuclear for serving base load.

There is no reason for objecting engagement of KEPCO as consultant for JICA-assisted PSMP formulation. Greater involvement of local stakeholders in future PSMP review and formulation should be ensured. Padma, Meghna rivers bifurcation of Bangladesh acts as barrier for transmission of power. Power was transmitted from east to west along Bangabandhu Jamuna Multipurpose Bridge. At that time Rooppur Nuclear Power Plant was not in view. In future additional power would come from the west. About 1,600 MW imported power from Adani Coal Power project would come in 2022. How that power would come to major load center around Dhaka? We must pay attention now. LNG based power plant must not be constructed at Payra.

Khondkar Abdus Saleque Sufi

Consultant Editor, Energy & Power

International Energy Expert

Revisiting the projected power demand, generation target and particularly fuel mix prescribed in PSMP 2016 must be urgently done due to the changed situation of the New Normal World. The fuel mix prescribed in PSMP 2010 could not be achieved for lack of political commitment. In PSMP 2016, the fuel mix was almost completely reversed. Our culture is forecasting power demand relying on projected GDP growth rate. The situation demands reviewing and formulating new PSMP or in other words as suggested by DG Power cell integrated Energy and Power Master Plan. Advise of foreign experts should be taken as Bangladesh can no longer avoid going big on imported primary fuel.

Petrobangla failed in its mission for exploiting coal reserve and exploring petroleum from onshore and offshore. BAPEX alone policy in onshore exploration did not work. In a very optimistic scenario, up to 2000 MMCFD LNG import may be possible through setting up land-based LNG terminal at Matarbari. Bangladesh could not take advantage of very low LNG price at spot market due to PPR.

Hence Bangladesh must continue relying on coal. We must not let our coal at mineable depth remaining buried, and exploit it as much as possible applying proven technology for impact management. Bangladesh must keep all options open. Given the huge demand, renewables can never make more than 10-15% contributions. We must set up regional power grid and see how much import is practical. The regional grid must have provision for both import and export. We must focus on strengthening power transmission. It is sad that the entire power from Payra cannot be evacuated for non-completion of 400 KV power transmission line from Gopalganj to Aminbazar. Similar situation may happen with evacuation of power from Rooppur nuclear power plant.

Dr Mushfiqur Rahman

Mining Engineer and Environment Expert

We forecasted power demand considering 7% GDP growth. It is not possible now. Hence we must review PSMP 2016. We now have to decide whether a completely new plan would be formulated or PSMP 2016 would be updated. Primary fuel import was given the highest priority in PSMP 2016. Here absence of deep sea port is the stumbling block. Very little achievement has been made so far in setting up enabling infrastructure for fuel import. We must not let a foreign consultant developing master plan for Bangladesh. They have no ownership.

For different reasons policymakers are playing domestic coal matter on the back foot. Barapukuria, Phulbari are the most feasible and viable coal basin. It is the right candidate for open pit mining. But for flawed planning, mining from Barpukruria pursuing the present underground mining technology would be over soon. I do not find great prospect of Dighipara. Not much works have been done at Khalaspir. We are way behind in mining own coal. Land acquisition is a huge problem for mining. It remains a huge question whether the government would take political risk. Some champion has to own it. If not, we have to forget about own coal.

In high vision neither power import nor renewable can contribute more than 10% of the projected demand. The present capacity of BAPEX and Petrobangla cannot encourage anyone for remaining optimistic about own gas in the foreseeable future. The projected contribution of imported coal is also highly unlikely achieving for transportation challenges. Our shallow coastal area only allows Matarbari window for primary fuel import. That will have its own limitations. Nuclear power contribution has been targeted as 10%. Let us consider that we would achieve 5%. I do not think, apart from 2,400 MW Rooppur power plant, other projects would be feasible by 2030. Hence reviewing PSMP 2016 is the need of the hour.

My experience of working with Rooppur nuclear project allows me observing that major works is essential for Bangladesh power transmission grid for evacuating power from Rooppur. The grid frequency must be upgraded from 49.5 to 51 MegaHZ. I did not observe much happening yet. Power evacuation may be an issue when the power plant gets ready for commercial operation.

Mollah Amazd Hossain

Editor, Energy & Power

We observed completely reversed plans – PSMP 2010 and PSMP 2016. In 2010, the emphasis was given on utilizing own coal and in 2016, the stress was on primary fuel import. Both failed. Now talks are around to grow big in LNG. Local think tank CPD talked about renewables.

We have to seriously consider getting out of captive power dependency. Despite of reasonable surplus in generation capacity, industry still remains reliant on captive power and permissions for new captive generation are still being issued. The entire sector would collapse if the power grid cannot be made reliable for encouraging industries switching to grid power. Power sector would have to arrange the sustainable supply of own fuel if Petrobangla does not get smarter soon.

Recommendations

The EP digital conference had meeting of minds on the following:

· Situation and circumstances necessitate reviewing the PSMP 2016 in its entirety. Experts suggested for an integrated Energy and Power Planning and for a much more coordinated approach between power and energy sector by ensuring smooth supply of primary fuel for avoiding generation capacity remaining idle.

· The demand projection must be more realistic taking into account the issues regarding foreign direct investment affecting investment for industrialization.

· Ensuring greater involvement of local experts and stakeholders, and seeking assistance from foreign consultants as minimum as possible.

· Ensuring a balanced fuel mix of domestic and imported primary fuel taking into consideration the challenges of exploiting discovered coal resources, lack of capacity of BAPEX for exploration of petroleum in onshore, COVID -19 pandemic creating challenges for attracting investment in offshore exploration.

· Reviewing the almost exclusive dependence on imported fuel (coal and LNG) in consideration of challenges to development of coal port and LNG terminals. Taking into account the impact of COVID-like situation, geopolitics, disrupting supply chain.

· Keeping all options (coal local and imported, own gas and LNG, nuclear, renewables) open. Power import may be capped to 10% of the demand by 2041.

· Considering mining of coal from Barapukuria and Phulbari on priority basis and setting up mine mouth power plants.

· Letting out PSC bidding in onshore frontier areas outside BPAEX assigned blocks, deeper prospects of discovered fields.

· Expediting power transmission projects upgrading ensuring timely evacuation of power and also modernizing power distribution networks making it more reliable for industries relying exclusively on grid power.

Considering energy efficiency as the sixth fuel and incorporate modern technology and innovation in systems operation of power and energy infrastructures.