A debate over gas export triggered following signing of an MOU between India and Bangladesh for exporting Liquefied Petroleum Gas (LPG) to India from Bangladesh during the recent tour of Bangladesh Prime Minister Sheikh Hasina to India. The report published in a media of international repute has major contribution to this. The report headlined “A MOU has been signed for exporting natural gas to India from Bangladesh.” In a subsequent report published soon after, they corrected the report. The follow-up report clarified that the MOU is about exporting LPG to the northeastern (NE) states of India. Bangladesh for catering the domestic demand is importing 9.5 lakh tonnes of LPG annually. The MOU stated that about 10,000 tonnes will be exported to NE states of India from this imported LPG. Indian Oil Company (IOC) will be the importer of this LPG. They will use in the seven sister states of India after bottling. This will be sort of re-exporting the LPG. Bangladesh would add value to its imported LPG. Prior to signing this MOU, two Bangladeshi LPG operators – BEXIMCO and OMERA – exported one tanker each of (16-17 tonnes capacity) LPG on experimental basis to Tripura, India.

Even after the categorical clarification between NG and LPG, there has been no end to uninformed debate in social media. A statement of the foreign minister after clarification of Energy & Mineral Resources Division (EMRD) reignited the debate. Following the recent visit of the Bangladesh Prime Minister to India, Foreign Minister Abdul Momen at a program in Sylhet said, “Bangladesh is not exporting natural gas, rather it is exporting LNG that it imports from abroad.” His flawed statement became a laughing stock and created another round of confusion among the people.

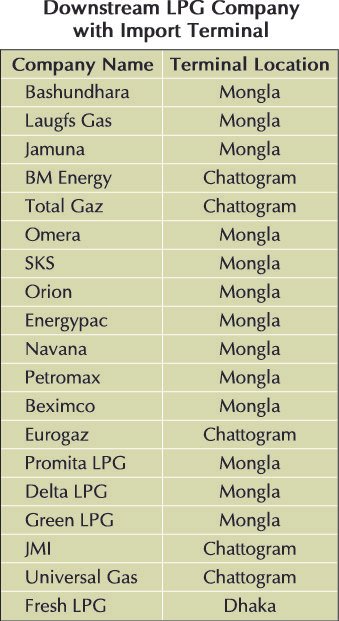

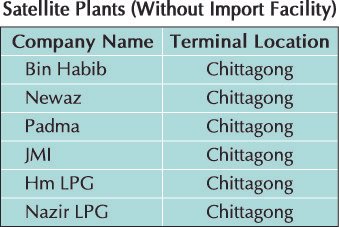

The local annual demand in 2019 grew to 9.5 lakh tonnes. Against that the total import of LPG and capacity for marketing LPG is not less than 25 lakh tonnes. The export of only a marginal quantity of LPG would not create any adverse impact on domestic market. Experts believe that this would rather act as added incentives to local entrepreneurs. LPG sector expert Saidul Islam said investment in LPG sector is much higher than requirements in domestic market. This created great risks of over investment. For a huge country like India, only three state-owned companies are responsible for the LPG market. But in a much smaller market of Bangladesh, 25 companies including 6 satellite entities for bottling LPG are active. In addition, state-owned BPC is also involved in the market with a limited capacity. The LPG production capacity from local source is not more than 22,000-25,000 tonnes. Major portion of LPG (Propane and Butane) is imported, bottled and marketed.

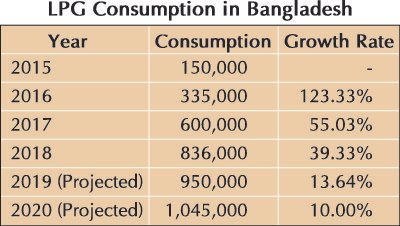

Till end 1990s, the use of LPG as fuel for cooking in Bangladesh was very limited. LPG sector started getting bigger following advent of private sector in LPG business from end 1990s. It started leap frogging from 2011 when new connection of pipeline gas for domestic use was suspended. The momentum gained has led to LPG demand growing at 123% in 2016. But in 2017, the growth dropped to 53%. The demand growth in 2018 was 39% and in 2019 it has come down to 14%. It has been estimated that in 2020 it may further drop to 10%. The phenomenal growth from 2011 has encouraged private sector operators taking license at higher rates for LPG importing, bottling and marketing. Some 53 companies got license and 25 started business in LPG value chain. Considering the inconsistent growth of LPG demand, the sector ran into business risk. Humayun Rashid, CEO of Energypac, a LPG business operator, said excessive investment in LPG sector has created such business risks. Further decline in demand growth would further worsen the situation.

On the other hand, import of liquefied natural gas has started to meet the deficit of pipeline natural gas supply. The gas crisis has created dilemma for resuming the pipeline gas supply for domestic use. A committee was formed by the Prime Minister’s Office (PMO) for reviewing whether pipeline gas supply for domestic usage can be resumed at all? The committee has already submitted the report, suggesting that imported LNG would be more affordable option than imported LPG as fuel for domestic use. But all domestic users must be brought under pre-paid metering. India is a country in the region where LPG is the highest use as domestic fuel. They are importing and using LPG for meeting the domestic demand. But recently pipeline is being constructed in some cities for expanding pipeline gas distribution networks. In Dhaka city and its suburbs, reportedly there exist over 100,000 illegal domestic gas connections. TGTDCL initiative for disconnecting the illegal connections is getting blocked by political interferences. The pressure is now mounting for new connections for domestic users. When asked, a member of BERC told the EP that LNG is comparatively more affordable than LPG for using as domestic fuel. He suggested reintroducing pipeline gas supply for new domestic users.

It is considerably expensive to supply LPG to northeastern states of India from its other parts. Zakaria Jalal, General Manager of Basundhara LPG Limited, while discussing about this with the EP said that the decision of the government is a timely and positive one. But the monthly demand of LPG in northeastern (NE) states of India is not over 1,000 tonnes a monthnow. This makes annual demand as 12,000 tonnes. Primarily BEXIMCO and OMERA have been authorized for exporting LPG to India. But any company having road tankers those meet Indian standard would ultimately qualify for supplying bulk LPG to India. He mentioned that Indian states would start importing LPG at competitive price from Bangladeshi exporters soon. Tanzim Chowdhury, General Manager (Corporate Affairs) of Omera Group, said the decision for exporting LPG would create new opportunities for the local LPG operators. Bulk LPG can be exported from Bangladesh after adding value to the imported LPG. Humayun Rashid of Energypac claimed that LPG export opportunities should be opened for all the operators instead of restricting it for few ones only.

Like the entrepreneurs, the government also thinks that the export decision of LPG has nothing wrong in it. It will rather expand avenues of trade between Bangladesh and India. But a member of BNP standing committee and former Minister of Energy Dr Khondkar Mosharaff Hossain considered the LPG export to India as anti-state decision. He demanded for immediate cancellation of the decision. But energy sector experts and analysts observed that this decision would create opportunity for supplying LPG at more competitive price than ever before in the NE states of India. Bangladesh companies would gain further benefits as this may create expansion in LPG market in those states. This would also infuse new life to LPG sector of Bangladesh as business growth has considerably slowed down for market saturation.

In conclusion, the debate over gas export to India is age old. The debate was initiated in 2001 when talks gained momentum over a proposal for pipeline gas export to India from Bibiyana Gas Field. But that did not materialize as domestic gas demand witnessed phenomenal growth. Now talks are maturing about importing RLNG from India to Bangladesh through pipeline. The works for importing diesel from Indian Refinery at Numaligarh is progressing through constructing a pipeline from Numaligarh India to Parbatripur, Bangladesh. Tender for constructing the pipeline has already been invited. Some 1,160 MW of electricity is currently being imported from India through two grid connectivity with Indian power grid at Bheramara and Cumilla. An MOU has been concluded between India and Bangladesh for constructing a power transmission line from Assam to Bihar across Bangladesh. Bhutan and Nepal would be connected with this. This would make the BBIN power trading dream a reality in the foreseeable future. Against the backdrop of such a scenario of regional power and energy trading, there is no opportunity for creating any confusion and political debate over LPG export to India. Rather this may be considered as one positive step for advancing the regional energy trade.