LPG (Liquefied Petroleum Gas) is the most preferred alternative fuel in Bangladesh in household demand for cooking and heating purpose and, in the past few years, there is a significant change to the demand picture with a further rise in consumption. Till now in rural and semi-urban parts of Bangladesh, most of the families depend on traditional fuels like wood, animal and crop waste, and charcoal for cooking and heating. These traditional fuels not only affect human productivity but also very much harmful for the atmosphere. However, Bangladesh government already connected 6% of total population through pipeline of Natural Gas (NG) for household use which consumes about 12% of the total consumption. Nowadays the primary energy shortage is the most discussed issue in Bangladesh and the government already declared that no more NG connection for households. At present, people are getting more aware about using LPG instead of the other conventional fuels as LPG is considered as “Clean Fuel”.

Meanwhile, due to dwindling reserve of natural gas, local industries are gradually shifting towards LPG for uninterrupted supply. LPG also enables expansion of industries in the areas where there is no access or poor access to natural gas. It has transformed from being a choice into a need for Bangladesh and, considering the current and upcoming demand, the existing refilling infrastructure is not sufficient enough.

Global LPG Scenario

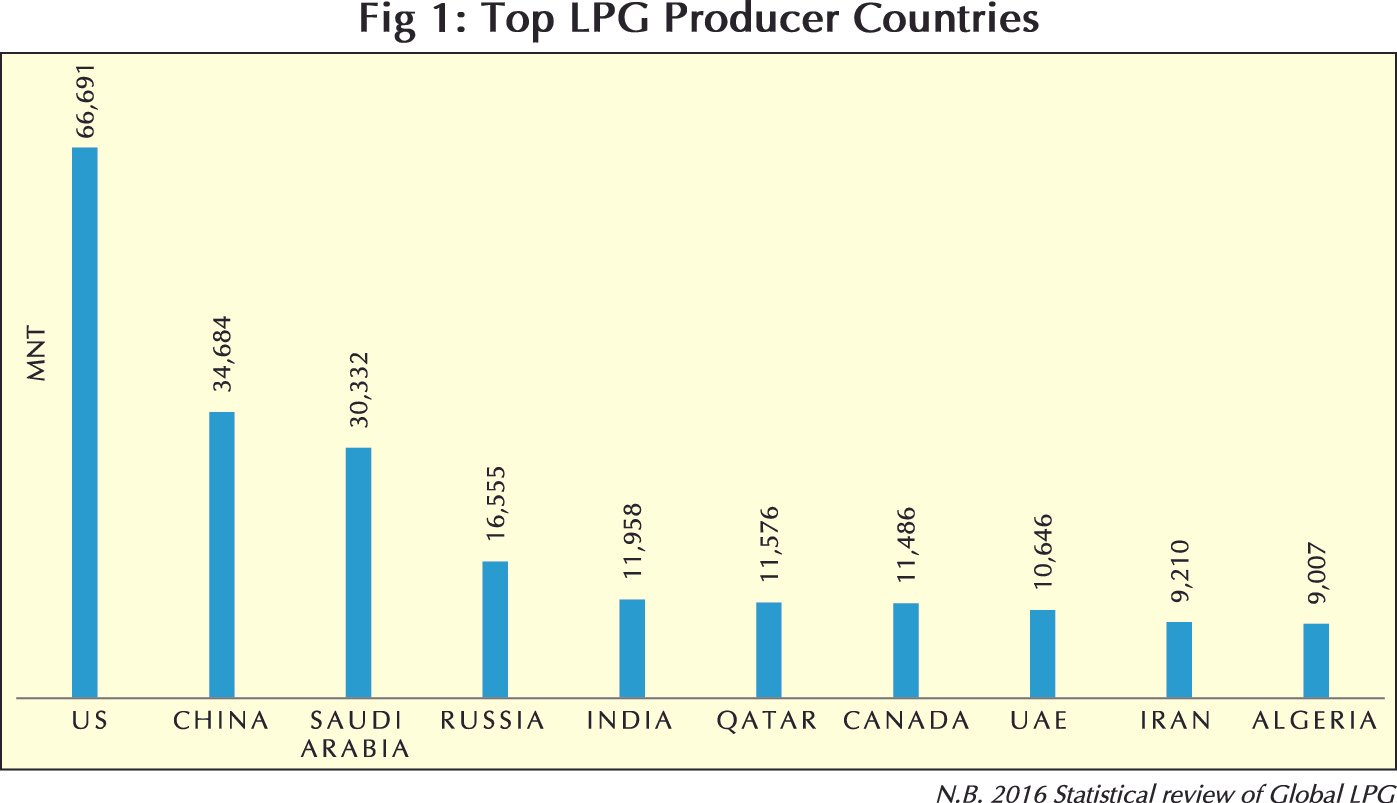

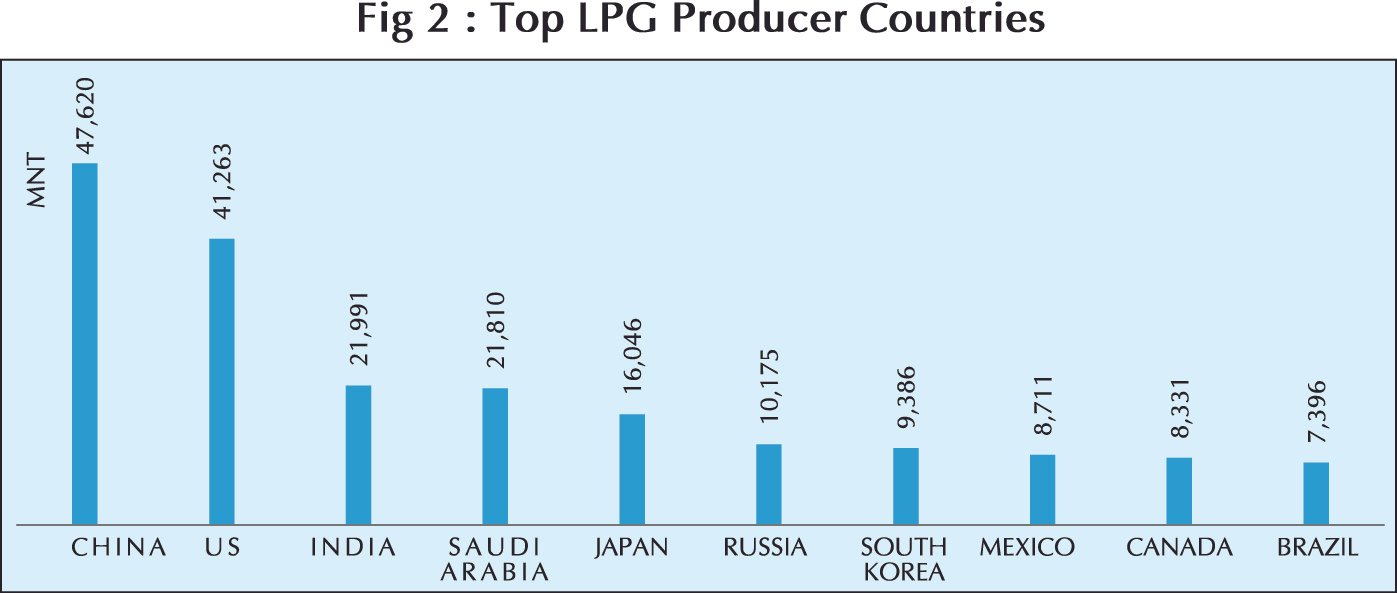

The strong growth of LPG production and consumption since 2015 shows that it is not an industry in crisis and it is still needed as alternative fuel in the present day world. In last three years, the US has taken the title and now it looks like other producing countries are showing same strong growth as well. But the rate of LPG production growth of US is only 3.3% compared with 2015 whereas china’s LPG production climbed by more than 20%.

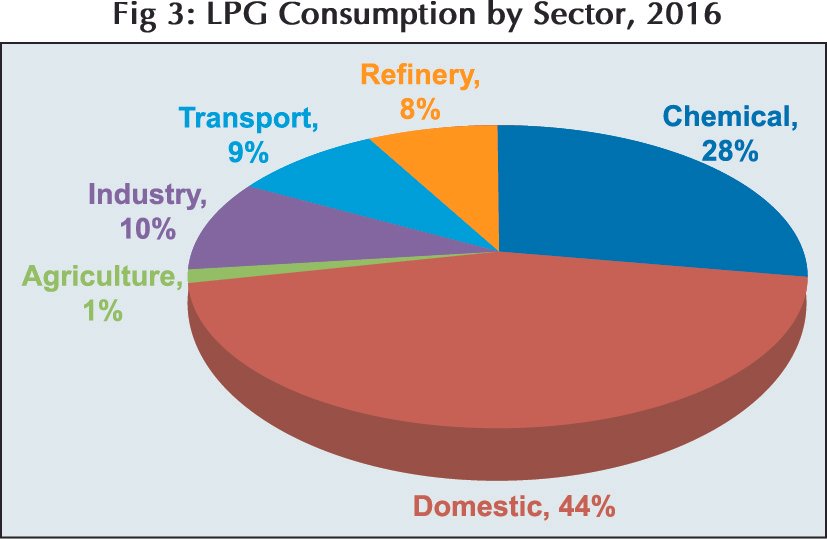

Looking at the picture of global LPG consumption, the utmost share of LPG consumption goes to the domestic purposes and the second biggest proportion is on the chemical industries. In addition, currently automobile and refinery industries are increasing their interest on LPG as an alternative fuel.

LPG Pricing

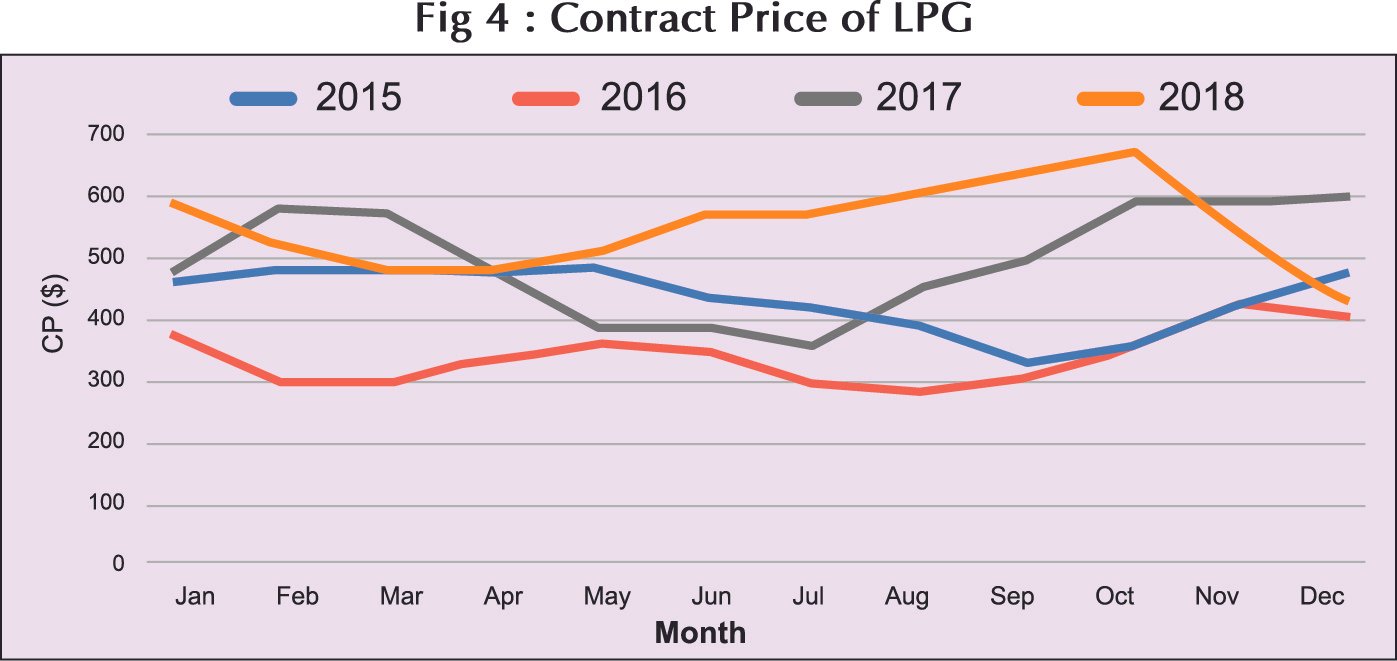

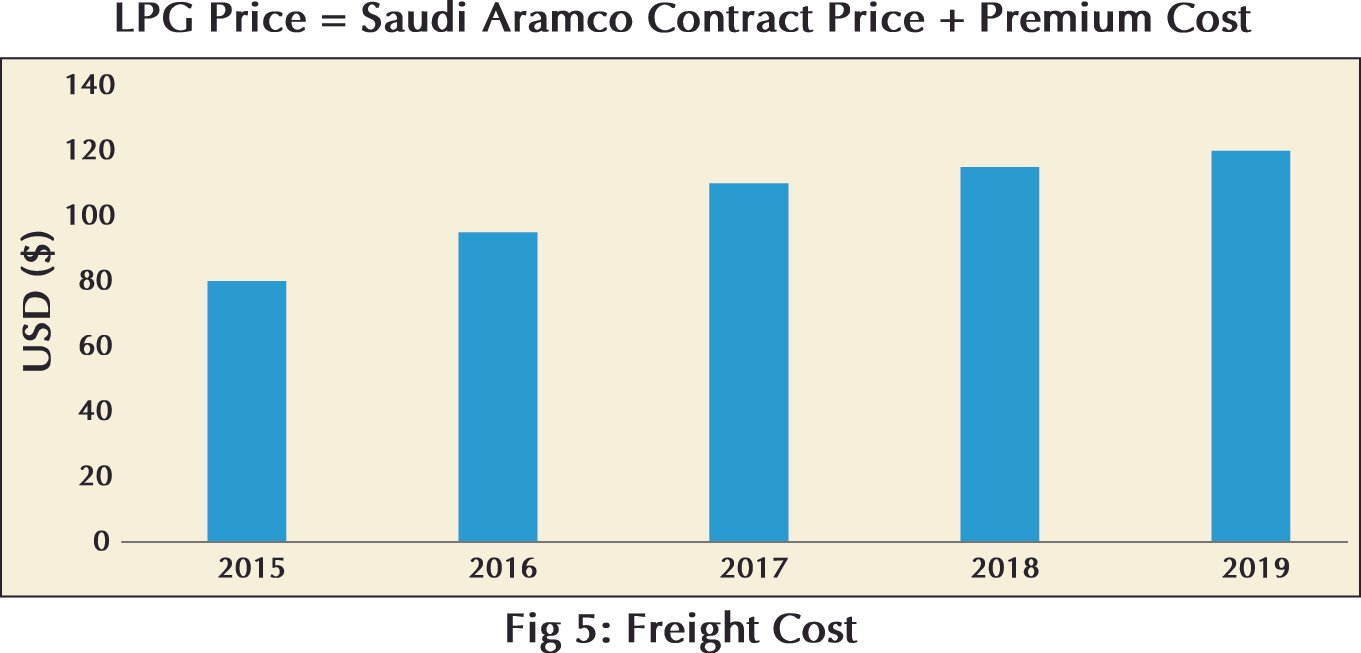

The Saudi Aramco Contract Price is the most important factor that determines LPG price in the global market. It is also known as “CP Price”. The operators purchase LPG from the International market either in spot or term contract. The formula is generally based on CP plus freight and premium. There are several factors that decide the freight and premium, but the CP always remains constant for a month. Saudi Aramco is responsible to declare monthly CP for the International market. Let us have a look on the International LPG contract price (CP).

The importers have to play for freight, premium and necessary duty & taxes to release the gas from ship. After including all sorts of overheads, the expanses, the gas is sold in the market in different pack sizes.

There are several factors that decide the premium cost, but Saudi Aramco Contract Price remains constant for a month.

Bangladesh LPG History

Bangladesh is one of the fastest growing economies in the world right now having impressive economic growth in the last decade. GDP, per capita income, foreign reserve, industrialization and name any index, Bangladesh achieved laudable successes in recent times. All such successes were not magic, but it all came out of a successful plan. All such development key indices were the result of seamless plan of Energy portfolio behind. Without proper energy sourcing, the development as such would have been dream so far. In 1980, the state-owned BPC (Bangladesh Petroleum Corporation) started the LPG business in Bangladesh and failed to grab the market. It was a hard move to fight against lots of odds, lower income of the people, higher price of LPG, weak distribution channel; considering all aspects, private players have created the LPG market from desert land and educated people about the LPG uses and convinced the customers for it. With this vision twenty years back in 1999, some private sector invested on LPG. Since then, the private sector never looked back. In 2013-14, this business started riding on exponential growth line and lots of investors hit the market. Currently, 24 players are in this field who already invested more than Tk 2,000 crore since the beginning along with reinvestment by the big players.

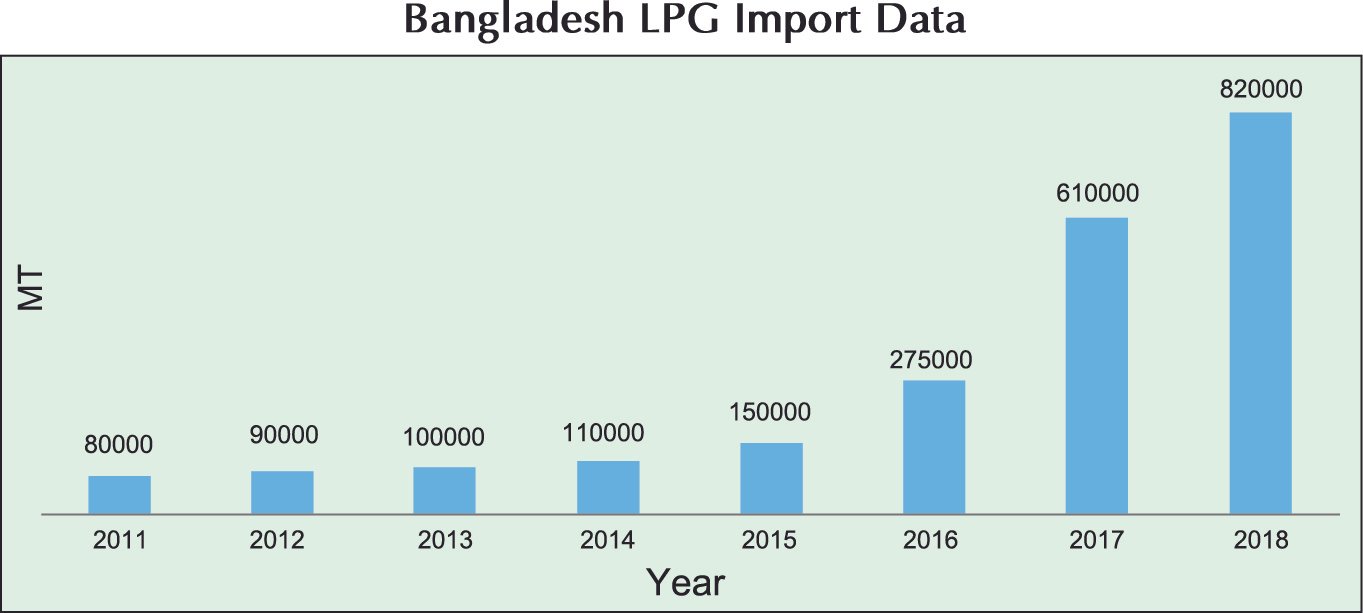

Bangladesh LPG market now stands approximately at 820,000 MT per year which is forecast to be 2.0 million MT by 2025 and 3.0 million MT by 2030. People’s per capita income going high, life style changing, and awareness about clean cooking fuel will push up the number that we have targeted so far. It is a huge support to the government plan to provide clean cooking fuel access to all within the shortest possible time and conveniently as well. Apart from this, use of LPG as Autogas is another great aspect of LPG usage variation in Bangladesh.

Challenges of LPG Business

LPG business is not like as FMCG business or any food and beverages like one-time business, this business is all about close relationship with the customers, distributors, retailers and importers. This full links managed by cylinders which carry the LPG from importers to customers, without which no one can think of doing business. Managing cylinder supply chain which is quite a bit heavy in weight and price as well is the key to strengthen the company to do the business smoothly. Another significant aspect of LPG business success is the logistics capacity, which also requires investment. These all put the entrepreneurs in a real challenging position to shape up the venture with reinvestment. Else the market share will be deterred continuously which is alarming for any company. Again another biggest challenge remains in distribution channel, which is lack of awareness of developing good faith. Lack of adopting safety measures by the distributors and retailers is also an obstacle to the growth of the business in a sustainable manner. Malpractices by ill-minded businessman, traditional bureaucratic delays by different government bodies and even involvement of different government bodies in controlling the business are throwing this industry to a tough position. One of the utmost issues that still remained unresolved for the LPG industry is not looking after by the government. As we all know, a substantial number of investors have built up their capacity in Mongla where they cannot bring big vessels, hence two big problem arise – the price of LPG will always remain high as the number small pressurized vessels around the world is limited causing higher time chartering cost and the volume that we are targeting for next 7-8 years will be difficult to manage with only 2-3K MT vessels. The government should emphasize on dredging the channel continuously as a part of accumulated demand of the investors. This is coming as greatest concern for the industry as we can foresee.

Future Aspects of LPG Industry

Let us draw what could be the total demand of Bangladesh market. Considering that 20 percent people will be remaining under certain level of income capacity and they will not be able to afford the LPG, the LNG and new exploration of NG will increase the supply to the industrial segment and until or unless the domestic price of natural gas goes substantially beyond the LPG price, and considering the user friendliness of NG, the demand for LPG can reach at best 2.5 million MT per year by 2025 in Bangladesh. That means, by next seven years, the current demand will increase by three times. Let us now, draw the supply curve of LPG for the upcoming years with existing 24 importers. The investment by the new operators and reinvestment by old ones would be capable to supply more than that of the demand as estimated for the next 7-8 years. With the effort of the private entrepreneurs and good wish from the government policymakers, the industry is now going to fit fully to serve the demand. In some cases, we are afraid of next years, when there would be persisting game to start for the new investors. There is one certain reason for that – sustainability game. The demand will not go up as fast as witnessed in the past five years while the few stakeholders who are trying to penetrate into the market in the next years would experience immense competition. But if they could continue with their survival effort for three to four years, certainly it would take them in a position to withstand their position.

With that courageous decision from the government and on-time investment by the private entrepreneurs, it is to be noted around the world that Bangladesh became the fastest growing LPG market in the world in recent times. When around the world, LPG is the most favorable fuel for cooking purpose, we were lagging behind and only using precious natural gas. With that great decision back in 2010-11, the LPG business saw a big jump in import growth. Most available fuel in the word saw continuous growth in Bangladesh for last six years and continuing with potentials.

Apart from the development of the industry so far, we have to be cautious about the sustainability of the growth of this business. Still, this industry lacks safety awareness of the users and the channel partners need to enforce safety feature of the cylinder handling and others. The industry still needs support from government to bring big LPG vessels to the Mongla port which can lower the import cost and can directly impact at the user end. Apart from the legislative support, ensuring safety is the key to expand the business in a sustainable manner.

Engr. Md. Jakaria Jalal;

General Manager (Sales)

Bashundhara LP Gas Ltd.

jakaria.jalal@bg.com.bd