The prospect of exploring oil and gas reserve in the seabed has been underplayed in South Asia while concentration on import dependence or development of expensive LNG infrastructure have been overplayed. Uninterrupted availability of mineral resources (oil and natural gas for South Asia) is a prerequisite to the healthy growth of power & energy sector; however, in both counts the region significantly falls short of its true potentials. The region is yet to unearth its true prospects of natural gas and crude oil. As the existing onshore energy is depleting, and renewables are still in infancy, it is high time we concentrated on the true potential of deep-sea oil and gas reserves in the Indian Ocean Region.

Need for Deep-Sea O&G Exploration in SA

With 8 countries and 1.7 billion people, South Asia is already one of the most energy-starved regions in the world. The need for massive energy consumption becomes even more critical as the region recently emerged as the fastest growing economic region if the world at 7.06% GDP growth. However, the lack of central energy hub and well-coordinated energy trading and cooperation has led to weak trade trajectory in the region (only 5% intra-regional trade) and one of the least economically integrated regions in the world (Kulkarni, 2017).

While demand of energy is growing at 4.6%+, the region has only 707kWh (2014) of per capita electricity consumption, as opposed to the world average of 3,128kWh. Total energy consumption in 2013 was 928.4mtoe against the domestic production of only 641.7mtoe, leading to a massive 286.7mtoe of energy gap in the region. This gap is filled in by importing LNG bases and transporting it via tedious routes across half of the world. But a concerted effort to make the full realization of power trading within the neighboring countries and exploring the indigenous O&G mother lodes in the IOR and Bay of Bengal still remain unrealized (World Bank, 2014).

Opportunities in the Indian Ocean

Importing around 75% of its hydrocarbons requirement, India is the 4th largest consumer and 5th largest importer of O&G in the world. Other than renewables and alternative energy source, hydrocarbons meet around 40% of energy requirement in India. The country houses 20% of the world population, but only 3.3% of its energy (Goldman Sachs, 2014). As a result, more than 85% of O&G domestic demand is met through imports. This massive demand-supply gap is resulting as domestic production and exploration activities are not marching with the growing demand for energy.

India has 26 sedimentary basins equivalent to the land area of 3.14MMkm2 which offers vast potential of hydrocarbon resource. Among this, 0.40MMkm2 lies in offshore shallow water, while 1.35MMkm2 is in 3 deep-wells at the east coast in Bay of Bengal, south-east in Andaman Sea, and west coast in Arabian Sea and (Sharma, 2012). Although, there is no separate estimate for O&G reserve in the IOR deep-water, prognosticated estimate suggests that the region may have 32 billion tons (recoverable - 12 billion tons) of mineral resources. The deep-water hydrocarbon potential covering about 1.4 million km2 of the Indian offshore is estimated to be between 5-9 billion tons of oil and gas (Ministry of Mines, Government of India, 2013).

Gastropods at the Bay of Bengal

Bangladesh is currently dependent on onshore fields for gas output, with production hovering around 2,700MMCFD against a demand for over 3,300MMCFD (S&P Global Platts, 2015). To meet the growing energy demand and depleting onshore energy reserve, the country lately but recently has concentrated on exploring O&G reserve in the Bay of Bengal.

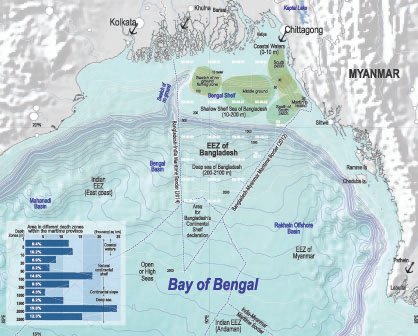

TheBay of Bengalis the least explored area for O&G potential. The western part (India) and the eastern part (Myanmar) of the Bay have discovered significant natural gas reserves in the past decade. Geological studies and interpretations suggest that Bangladesh can have significant gas resources in the onshore and offshore belts which are yet to be discovered. The seabed of Bay of Bengal is home to a rich core of solidified natural gas known as: ‘diamond’ or ‘gas hydrates’ (Imam, 2017). However, Bangladesh has not matured its technology to extract the petroleum at such depth or run the feasibility study.

At the Bay, Bangladeshhas 11 blocks for O&G exploration at the India and Myanmar border. Among these, 6 prospective blocks are at Myanmar border. However, out of these 6 blocks, only one (DS Gas Block 12) was assigned to South Korean Posco Daewoo International Corporation, an IOC also involved at the Shwe gas field in Rakhine state, Myanmar. The Shwe project first came into operation at the Mya field in July 2013 and the gastropod offered 500mmscfd by the end of 2014 (Siddique, 2017).

Under its assignment, Daewoo would be investing $60-120 million from 2017-2021 to conduct 2D and 3D seismic surveys in the block 12.(Thiha, 2017). In the continuation, the government intended to award the next offshore block and its multi-client seismic survey in 2018. But much to the citizen’s dismay, the Energy Division recently cancelled the decision to conduct the non-exclusive 2D multi-client survey (Agencyes, 2017; Siddique, 2017).

The exclusivity of the gastropods in the bay is unique enough for the Government of Bangladesh (GoB) to start immediate exploration and operation in the Bay of Bengal. Myanmar hit the Shwe gas field in 2004 and started exploring since 2014, which is adjacent to the recently cancelled DS block 12 (Hossain, 2015). Especially the Rakhine offshore basin at the south eastern bay of Bangladesh has had mining successes in the recent years. As the offshore Rakhine Basin of Myanmar and south eastern bay of Bangladesh are members of a single geological line, there should be bright prospects of securing a natural gas mother lode in the Bangladesh part.

Even Deeper…

There will always remain challenges to new initiatives, but it is the first baby steps that initiate the desired changes. Despite the presumed roadblocks, South Asia can reap the benefit of intra-regional connectivity through proper exploration of the energy reserves in the IOR. To start with, the concern governments need to adopt integrated policy frameworks that will encourage and invite the private sector to the drilling activities both for offshore and onshore fields. Country like Bangladesh that is about to enter into the game, should split its deep-water territory into a number of smaller O&G blocks to accommodate an increased number of IOCs in offshore hydrocarbon mining.

The member states should also setup research taskforces on various climate change and environment risks that is mandatory for exploration of offshore energy. In this regard, TVET programs should be initiated and institutional capabilities should be expanded. At the same time, the region needs to develop expertise and adequate skilled manpower for carrying out the challenging operations in both the fields to develop self-sufficiency in the energy sector.

New innovations of deep or ultra-deep O&G mining technology, and new geologic findings of potential gas and oil reserve at great depths would be just wishful ideas and images on paper if there is no delivery mechanism for the market. For South Asia, the depleting energy reserves will challenge the economic development unless therecent discovery of huge gas reserves at the Bay fails to be an eye-opener for the authorities to go all-out for deep-sea exploration.

(This paper is written solely in Riasat’s personal capacity and the views/opinions expressed are strictly of his personal and do not in any manner what so ever reflect the views and opinions of anyperson/organization.

The original article titled: “Hunt for Deep-Sea Hydrocarbon: The South Asian Case” was published at Connectivity and Trading in Power & Energy: A Regional and International Dimensionin October 2017.)

Riasat Noor;

He is a research-savvy professional with experience in wide spare of power & energy verticals and expertise in quantitative and qualitative analysis. He leads national and international power & energy projects, with work in energy value chain, sustainability reporting and investment in the energy sector of South Asia. A seasoned copy editor, Riasat has authored several publications on energy connectivity and digitization, and appeared in flagship platforms such as UNIDO, GSCASS, ESI - NUS, and II Eurasian Forum (YES-Forum). He also speaks widely on CCS & carbon pricing, CBET, and marine geopolitics, as well as advocates for energy security.

He can be reached at riasat.noor@hotmail.com, or +880 1737464676.