Bangladesh’s power sector continues to experience financial troubles amid high expenditure compared to revenue. From fiscal year 2019-20 to fiscal year 2023-24, the Bangladesh Power Development Board’s (BPDB) cost increased by 2.6 times while its revenue increased by 1.8 times. This is the gap the Bangladesh government fills with subsidies. A recent study titled “Fixing Bangladesh’s Power Sector” conducted by the Institute for Energy Economics and Financial Analysis (IEEFA) showed that the Bangladesh government provided a subsidy of Tk 1,267 billion during the past 5 fiscal years. However, the BPDB still made a total loss of Tk 236.42 billion.

The study highlights several factors responsible for BPDB's financial challenges and provides an actionable roadmap that is expected to help address them.

Overcapacity

The country's power sector has long been criticized due to its excess capacity. IEEFA’s recent study also points to the overcapacity issue. The calculated reserve margin of the country’s power sector stood at 61.3% in October 2024. Such a high margin resulted in capacity charges even when many private plants do not generate electricity.

The study also compared the system capacities of India and Vietnam under two scenarios. In one scenario, it considered the total installed power capacity of these countries with Bangladesh. In another scenario, it excluded variable renewable energy (VRE) capacities of these countries from the total system capacities.

The comparison shows that when variable renewable energy is excluded, India and Vietnam’s reserve margins are just over 25%. However, Bangladesh’s reserve margin is 57.4% when variable renewable energy is excluded. This shows that Bangladesh’s power sector has a significant overcapacity that must be reduced.

Captive power use in industries due to unreliable grid power

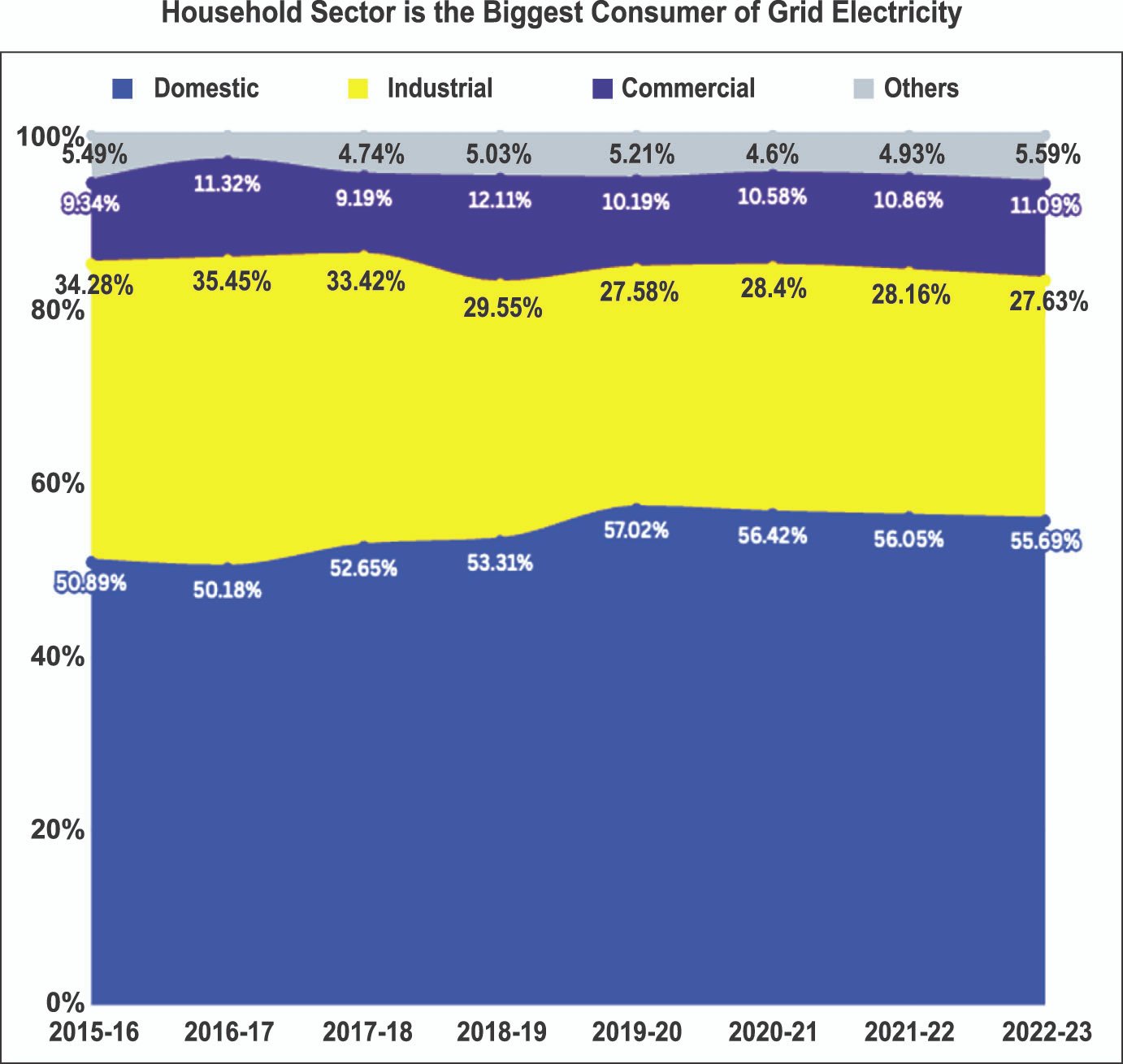

Bangladesh’s grid power consumption is mostly dominated by the residential sector. During 2022-23, the residential sector consumed 55.69% of the grid power whereas the industry sector consumed 27.63%. This is a testament to the industry sector’s apathy towards using grid electricity. As the grid electricity is not reliable, the industry sector largely depends on gas-fired captive generators.

IEEFA’s analysis shows that industries that have gas-fired captive generators with 35-45% efficiency can save Tk 1.30-3.53/kWh compared with grid power. Both economics and reliability issues encourage industries to rely on gas-fired captive generators.

As gas-fired captive generators with more than 3,000MW capacity operate in the country, the power sector’s overcapacity problem worsens, affecting BPDB’s financials.

High cost of fuels

As Bangladesh’s power system does not have enough renewable energy, it uses expensive oil during peak hours. IEEFA’s calculation shows that from July 2023 to May 2024 Bangladesh used oil-fired plants to produce 10.9% of the total power, resulting in a 32% of the total fuel cost of the power sector.

Such high fuel costs increase the average power generation cost, increasing BPDB’s losses.

On the other hand, renewable energy during the day peak can reduce the cost.

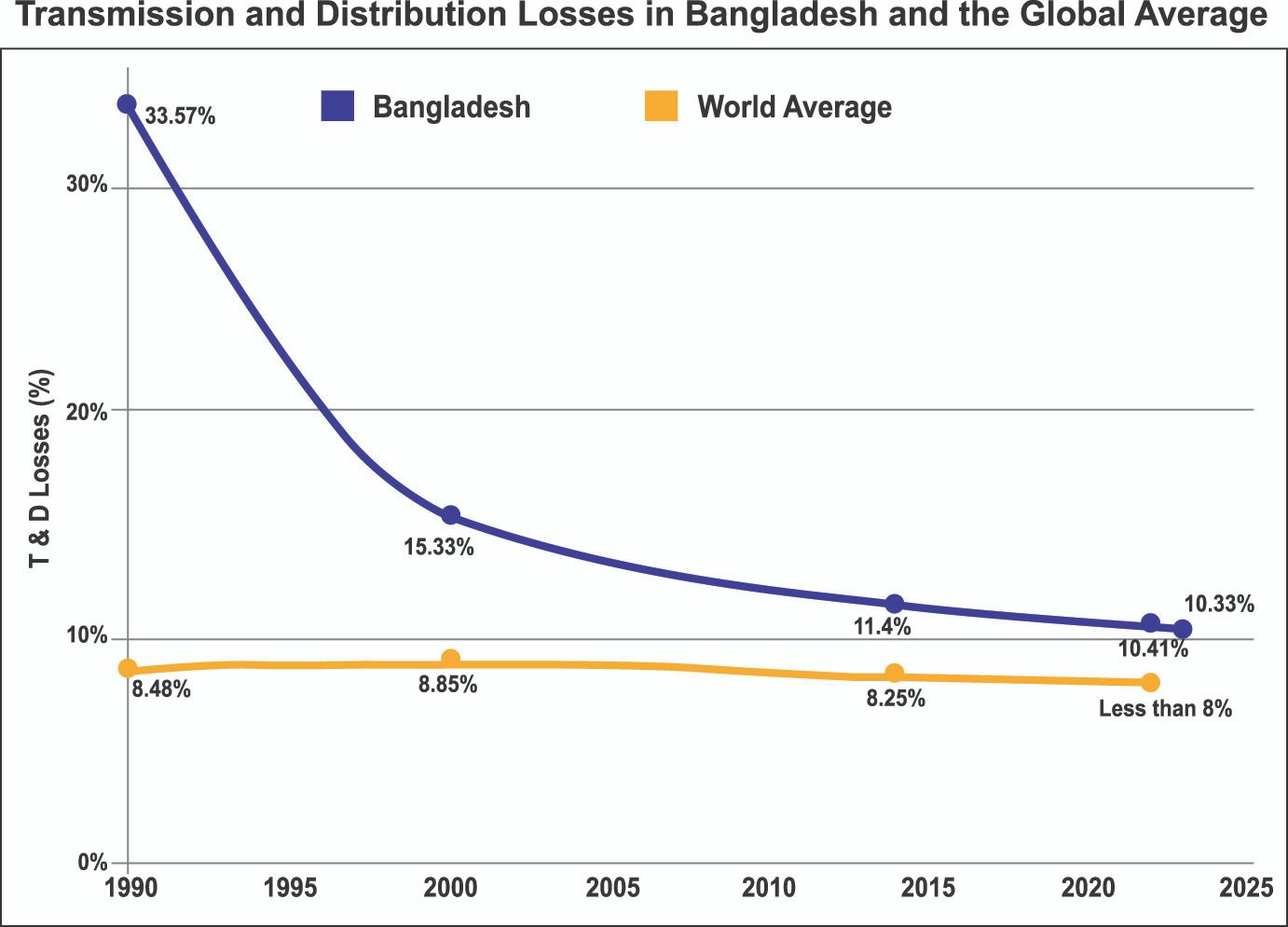

Transmission and distribution losses are still high

The power sector’s transmission and distribution losses have significantly come down in the last three decades. However, IEEFA’s comparison with the global average transmission and distribution losses shows that Bangladesh can further reduce these losses from more than 10% to 8%, reducing BPDB’s growing expenditure.

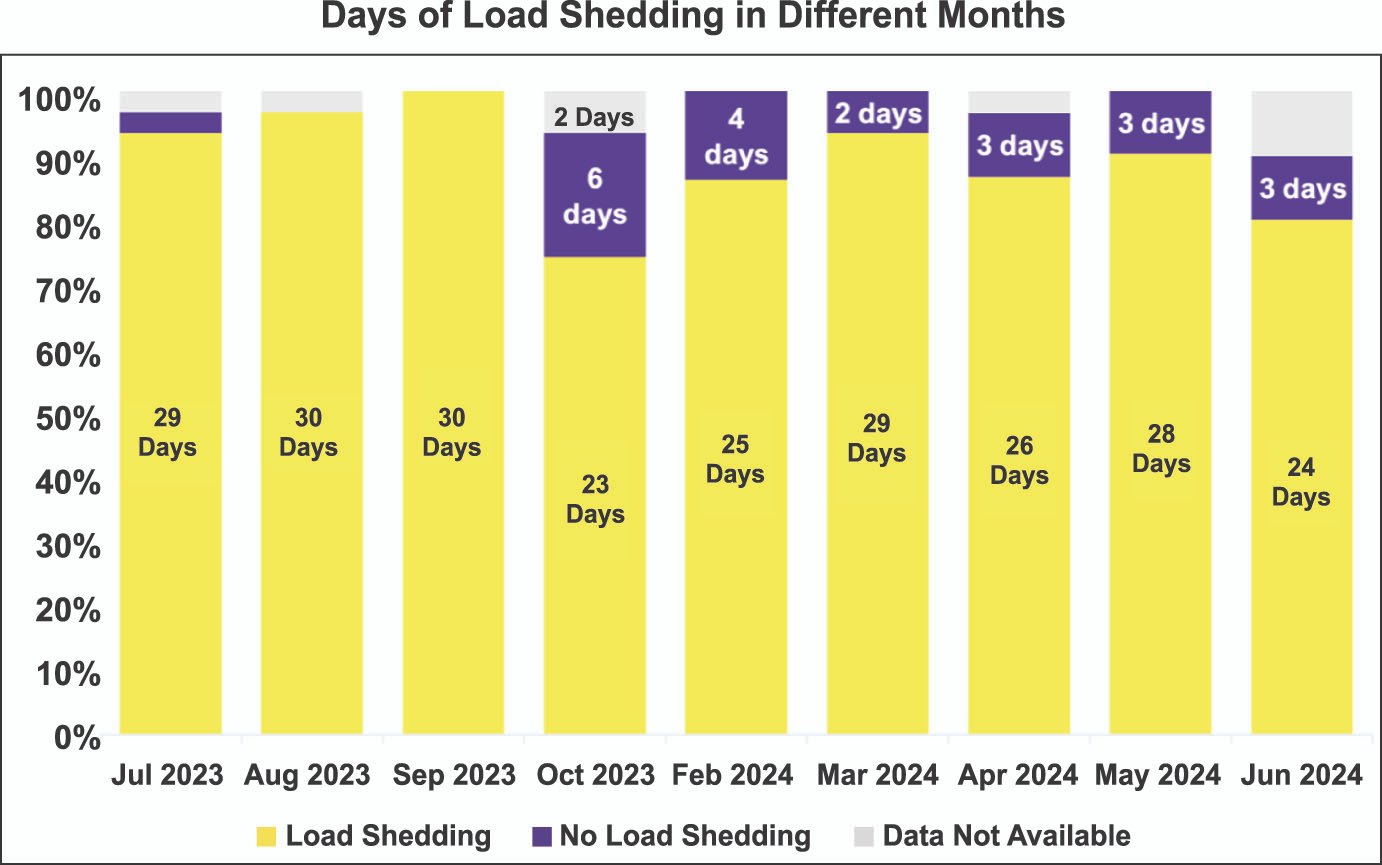

Load-shedding

Despite the surplus power generation capacity, Bangladesh experienced severe load shedding during 2023-24. There was load shedding on at least 23 days in 9 months of the fiscal year 2023-24. The dollar crisis forced BPDB to reduce the generation of power and purchase of power from the private plants which resulted in significant load shedding during the past fiscal year. During the load-shedding periods, the BPDB needs to pay capacity charges to the private power plants. This makes BPDB worse off as its expenses mount amid the concern over revenue.

How to fix the power sector

IEEFA’s study recommends estimating the country’s power demand more precisely, reducing reserve margin, minimizing transmission and distribution losses, and limiting costs.

Estimating power demand

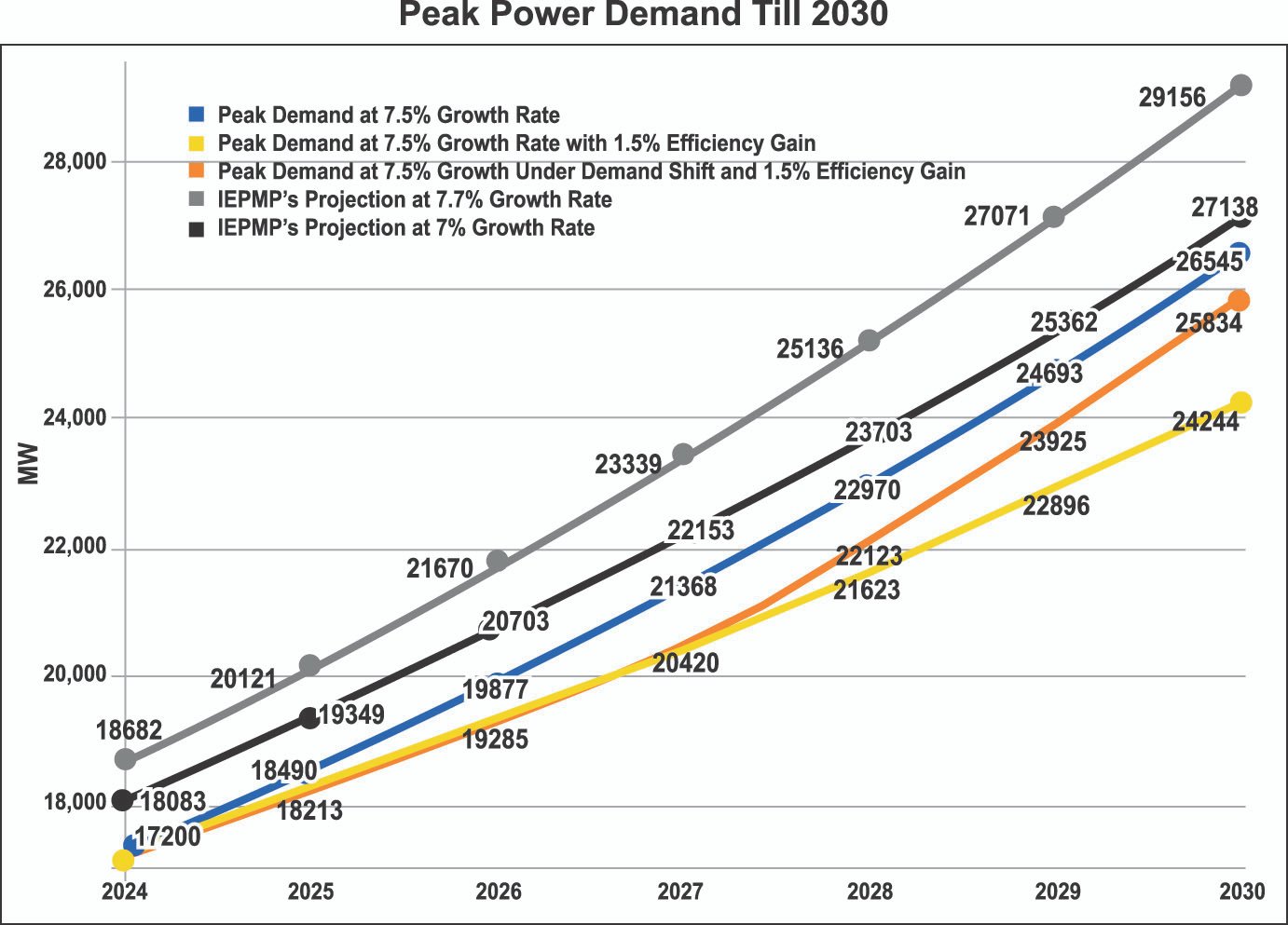

The power demand estimates based on GDP growth have resulted in overcapacity. IEEFA, however, includes energy efficiency and demand shift measures to estimate Bangladesh’s peak power demand till 2030. It assumes a 1.5% energy efficiency improvement on the demand side per annum and considers half of the industrial demand met by gas-fired captive generators will shift to the grid between 2028 and 2030 subject to the grid modernization to ensure reliable electricity supply.

Under different scenarios, the study concludes that Bangladesh’s peak power demand will likely reach 25,834 MW in 2030 which is less than the projections made in the Integrated Energy and Power Master Plan 2023.

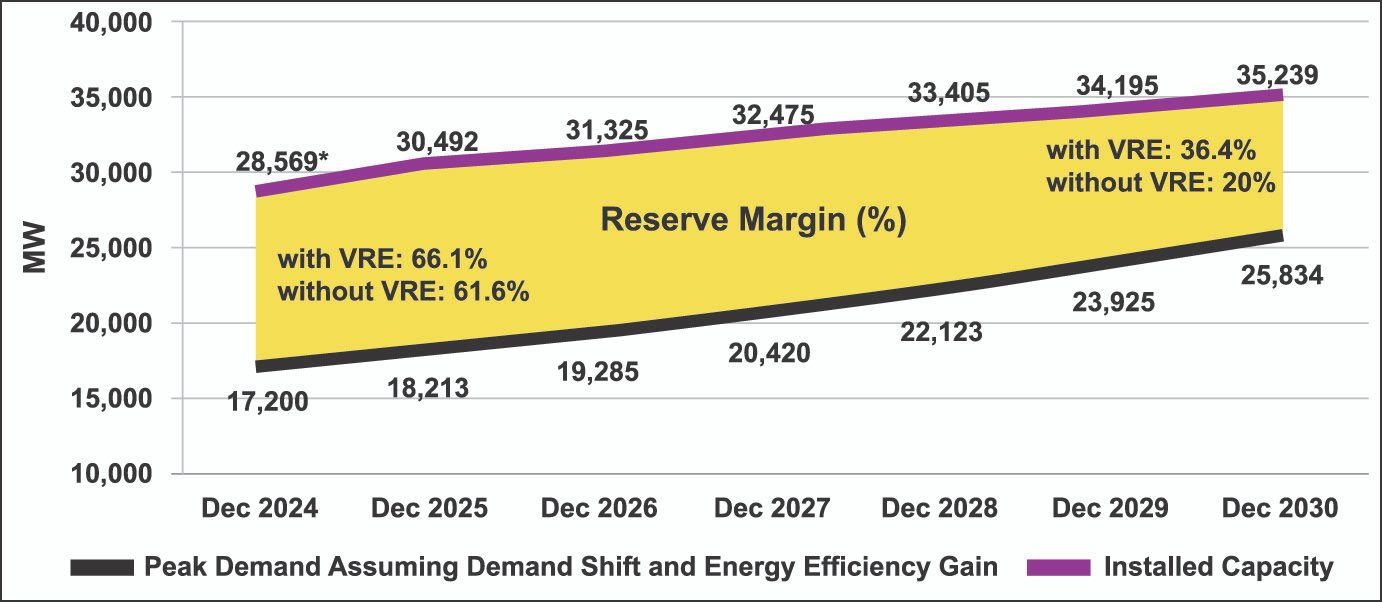

System capacity with a reduced reserve margin

IEEFA’s study concludes that the installed power generation capacity of 35,239 MW in 2030 will be able to meet the estimated peak power demand of 25,834 MW. The installed capacity includes grid-connected renewable energy capacity of 4,500 MW of which approximately 1,000 MW capacity is currently in operation. Moreover, a renewable energy capacity of 560 MW is at different stages of construction. IEEFA recommends including at least 2,900 MW of new renewable energy capacity beyond the existing and under-construction capacity which will lead to a total renewable energy capacity of 4,500 MW including battery storage of 500MW capacity. This means a total renewable energy capacity of 3,500 MW should be added by 2030. On the other hand, oil-fired plants and gas-fired plants of 4,500 MW should be phased out by 2030 (mostly oil-fired plants).

Renewable energy will help meet the peak power demand. On the other hand, oil-fired plants of just over 3,000 MW, battery storage of 500 MW, and gas-fired peaking plants of more than 1,000 MW will help meet the evening peak demand.

The reserve margin will come down to 36.4% including variable renewable energy in 2030. However, if variable renewable energy is excluded, the reserve margin will be around 20%. Such reserve margins will be comparable to India and Vietnam. Moreover, the capacity charges will also come down.

Limiting expensive fossil fuels

By increasing renewable energy capacity, Bangladesh can reduce the use of expensive oil-fired plants during the day peak. The country should fix a goal of reducing the use of oil-fired plants to 5%. This will significantly reduce BPDB’s power generation cost and subsidy burden.

Improving transmission and distribution losses

Bangladesh should set the goal of reducing the transmission and distribution losses to 8%. Such an effort will help the country reduce energy wastage of 2,222 GWh based on the power generation in the fiscal year 2023-24.

Reducing load-shedding

Load-shedding is financially burdensome for the BPDB which pays heavy capacity charges for the idle private power plants. The government should work on ensuring sufficient dollars to reduce load-shedding to 5% of the last fiscal year. This will allow BPDB to sell additional electricity and earn revenue.

Financial savings of the reform

The study proposes several reform measures that will help BPDB reduce its subsidy burden. These measures are:

i. Shifting industrial power demand met by gas-fired captive generators to the national grid

ii. Enhancing renewable energy capacity

iii. Limiting T&D losses

iv. Bringing down the country’s load-shedding

By implementing these measures, BPDB can save Tk138 billion a year.

However, to further reduce the BPDB’s subsidy burden of Tk382.89 billion recorded in the last fiscal year, Bangladesh should gradually transition to electric systems from gas-driven appliances, like boilers, to increase the demand for grid electricity. Alongside this, industries should fully rely on the grid, keeping gas-fired captive generators as backups in the future. These will help increase BPDB’s revenue from selling additional energy while reducing capacity payments to idle plants.

While making Bangladesh’s power sector sustainable seems a challenging proposition, it is still possible if properly planned reform measures are undertaken.

However, Bangladesh should work on making policies more conducive to promoting renewable energy and modernizing the grid to encourage industries to gradually shift to grid power.

Arunima Hossain, North America Correspondent

Download Special Report As PDF/userfiles/EP_22_13_Special_Report.pdf