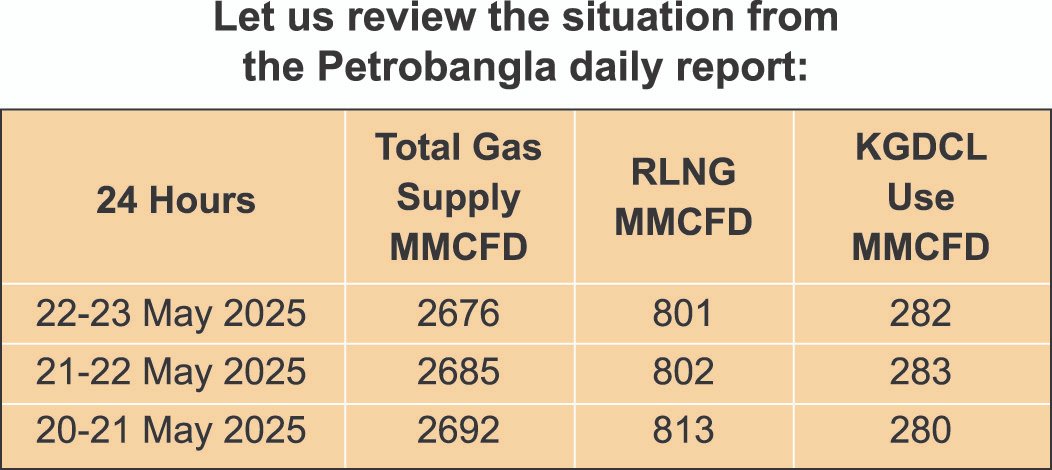

Irrespective of whatever contingency actions for smart transition are taken to increase the contribution of clean energy, Bangladesh will remain heavily dependent on fossil fuels - gas, LNG, and coal – at least until 2040. Natural gas will dominate the fuel mix. Against the backdrop of the major depleting scenario of the country’s proven gas reserves and not encouraging prospects of major discovery, imported LNG will play a major role as a fuel resource. Bangladesh's gas demand is now 4,200 MMCFD. In 24 hours on May 22-23, 2025, Petrobangla supplied 2,676 MMCFD, including 801 MMCFD RLNG. Two FSRUs have a stated capacity of 1,100 MMCFD. The question arises: Why is the gas supply chain not getting at least 1,000 MMCFD RLNG supply at the time of high system demand? The Energy Adviser has assured gas-hungry industries of an increase of at least 250 MMCFD gas supply. An additional 200 MMCFD RLNG supply could facilitate gas supply to end users. Industries, especially in the TGTDCL franchise of Gazipur, Tongi, Ashulia, Savar, and Narayanganj areas, have been suffering from an acute gas crisis.

It is unfortunate that, due to the absence of appropriate transmission planning during the high summer of peak electricity and gas demand, the gas supply chain suffers from constraints in the gas transmission grid for consistent withdrawal of RLNG from two FSRUs in operation at Moheshkhali, Cox’s Bazar. There is a capacity to transport even 1,050-1,100 MMCFD gas by using two transmission pipelines from Moheshkhali to Anowara. But for the capacity constraints of the Anowara-Faujdarhat 42-inch OD transmission segment, it is not possible to transport more than 650 MMCFD downstream. KGDCL system from Chattogram Ring Main and KAFCO, and other bulk consumers, together now use 300 MMCFD or less. Hence, even if two FSRUs are ready to deliver 1,000 MMCFD plus gas, it is unlikely to be possible to deliver more than 815-820 MMCFD. For system constraints, about 200 MMCFD RLNG cannot be transported now to meet the increased demand of power and industries. In such a situation, even if Petrobangla ensures the import of additional LNG by letting two FSRUs operate at full capacity, it is unlikely that this will bring tangible benefits till the transmission constraint is addressed.

Let us review the situation from the Petrobangla daily report:

LNG supply is contingent upon regular import of the required number of cargoes to meet the design capacity of two FSRUs. It is learnt that Petrobangla has managed to import additional cargoes. From the end of May 2025, the gas system will be ready to supply 1,050 MMCFD consistently. The constraints will be in the transmission system and integrated transmission planning.

The Northeastern and central regions of Bangladesh are the major sources of supply from the domestic gas fields. The lone gas field in the Southern region at Bhola is not connected to the grid. Imported LNG comes from Moheshkhali through two GTCL-owned gas transmission pipelines to Anowara. From Anowara CGS, gas is delivered directly to the Chattogram City Ring Main comprising 24“, 20“, and 16” OD segments. The design capacity of the Chattogram Ring Main is 420 MMCFD. All the consumers of KGDCL in Chattogram can be supplied gas from the Ring Main through HP DRSs, IP DRSs, and CRS. GTCL has also constructed dedicated pipelines from Anowara CGS for KAFCO and CUFL. GTCL also constructed a 42” OD Anowara-Faujdarhat transmission pipeline for transporting RLNG. The capacity of the pipeline is 600 MMCFD. Unless the KGDCL distribution system in Chattogram uses 400 MMCFD, it is not possible to withdraw 1,000 MMCFD or more RLNG. At present, KGDCL's total gas use is below 300 MMCFD. Hence, the total RLNG supply is hovering around 800-820 MMCFD. CUFL and Sikalbaha power plants are not taking gas. To overcome the present situation, KGDCL should arrange to consume at least 80-100 MMCFD in its franchise that would facilitate withdrawal of 1,000-1,050 MMCFD RLNG consistently in the system. For the future, GTCL must plan to set up a new Compressor Station at Feni or a suitable location in the system, as a significant volume of gas will be consumed in the Bangladesh Special Economic Zone. GTCL will also need to expedite planning of the third pipeline from Matarbari to its transmission hub at Faujdarhat for evacuating additional RLNG expected to come from the Third FSRU and land-based terminal.

FSRUs in the turbulent Bay of Bengal always face the risks of interruption. The gas system must also be ready to manage gas blackouts in the KGDCL area in the event of the operation disruptions of FSRUs due to cyclones and tidal surges.

Download Follow Up As PDF/userfiles/EP_22_24_Follow Up.pdf