Against the backdrop of ongoing political debates and discussions regarding mismanagement, irregularities, and corruption in the power and energy sector, it would not be accurate to conclude that the latter is less controversial. While some other sectors may have surpassed the power and energy sector in terms of inefficiency and corruption, this remains one of the widely debated sectors. The post-COVID-19 surge in global fuel prices has significantly reshaped the energy sector landscape.

Since 2021, the widening gap between the costs of supply and prices of electricity, gas, and fuel to end-users has created a persistent deficit. The depreciation of the Bangladeshi taka against the US dollar, coupled with increasing dependence on imported fuel, has further exacerbated the crisis. Consequently, realizing the huge outstanding dues in this sector has become a significant challenge for the government. The country’s once-strong reputation for timely debt payments in the private power and energy sector is now waning. Despite sincere efforts, the current backlog still stands at around $3.5 billion.

Due to this financial strain, many international companies and nations are losing interest in supplying power and energy to Bangladesh. Foreign investment in the sector is also declining. The sector now operates at a significant loss, relying heavily on subsidies to sustain. The revised budget has further intensified the discussions through increasing power sector subsidies from BDT 40,000 crore to BDT 62,000 crore. The gas sector subsidies are also required to be increased from BDT 7,000 crore to BDT 20,000 crore.

The energy advisor of the interim government has assured that all outstanding payments in the power and energy sector will be cleared by June. However, the Ministry of Finance has stated that, in the given situation, reducing the subsidy is the key to restoring the government's financial credibility. International lenders, including the IMF, are putting pressure on the government to cut subsidies. The government is considering subsidy reductions starting in the 2025-26 fiscal year, but the key question remains: Can the sector be made self-sustaining without subsidies in the current economic climate?

Financial Health of the Power & Energy Sector

Operations of Bangladesh’s power and energy sector are entrusted upon three main state-owned enterprises: Bangladesh Power Development Board (BPDB), Petrobangla, and Bangladesh Petroleum Corporation (BPC).

Among these, BPDB is in the most precarious financial position. BPDB’s outstanding payments to energy and power suppliers exceed $3.0 billion, including BDT 2,000 crore owed to Petrobangla. In February and March 2025, BPDB cleared BDT 4,200 crore of its dues to Petrobangla. However, it still owes nearly $1.0 billion for power imports from India, including the Adani Group. Additionally, BPDB has significant debts to private power producers, state-owned power generation companies, and joint ventures.

BPDB also struggles to meet its loan repayment obligations. Although recent months have seen improvements in regular debt payments, new bills continue to accumulate. Some reports suggest that BPDB needs BDT 10,000 crore in liquidity per month to regularize payments.

However, BPC is no longer running at a loss. The corporation now adjusts fuel prices monthly as linked with international prices and has managed to cover its past losses through profits generated before and after the COVID-19 impacts. However, energy analysts argue that inefficiencies and corruption within BPC have kept fuel prices higher than international rates. Professor M. Shamsul Alam, energy advisor to the Consumer Association of Bangladesh (CAB), has suggested conducting an independent audit to assess BPC’s actual financial status. He believes that a well-planned strategy based on such an audit could lead to lower fuel prices and eliminate the need for subsidies in the sector.

Petrobangla has also significantly reduced its outstanding dues in recent months. They claim to have brought its debt down to $400 million. However, BPDB and the BCIC still owe approximately BDT 22,000 crore. Payments of gas supply by IOCs under Production Sharing Contracts (PSCs) and for LNG imports have been brought under control, with expectations that the situation will improve further in the coming months.

Power & Energy Supply Costs

The selling price of electricity and gas is lower than their supply cost. These create persistent monthly deficits. The government has been trying to offset this gap through subsidies. However, subsidies for fuel imports have been discouraged and, in some cases, discontinued, and BPC is now making a profit on fuel sales every month.

.jpg)

HFO import costs for private power producers are lower than BPC’s import costs, but the Energy Ministry claims that past fuel import operations were controlled by the monopolies. Introducing a more competitive system has reportedly reduced procurement costs.

In the gas sector, all activities—including exploration, extraction, LNG imports, transmission, and distribution—are controlled by Petrobangla through its 11 subsidiary companies. According to Petrobangla, the cost of locally extracted gas per cubic meter is: Sylhet Gas Field Company Limited BDT 1.00/CM, Bangladesh Gas Fields Company Limited BDT 1.25/CM, and BAPEX BDT 4.00/CM. Multinational Companies Chevron Bangladesh & Tullow average BDT 6.07/CM. The domestic gas production currently provides around 2,000 million cubic feet per day (MMCFD), while LNG imports add another 900 MMCFD. The average cost of gas was BDT 24.38 per cubic meter in FY 2023-24, while the average selling price was BDT 22.87 per cubic meter, leading to a loss of BDT 1.56 per cubic meter.

The spot market LNG price in FY 2023-24, BDT 65 per cubic meter, increased to BDT 71 in August 2024. Based on these increased costs, the government proposed increasing gas prices for new industrial and captive power users to BDT 75.72 per cubic meter. A public hearing has already been held on this proposal, and BERC is currently reviewing it.

However, civil society groups and industry leaders strongly opposed the proposed hike, arguing that it would make export-oriented and import-substitution industries lose competitiveness. The government’s energy advisor insisted that new gas consumers or those requesting increased allocations must pay LNG import-adjusted rates.

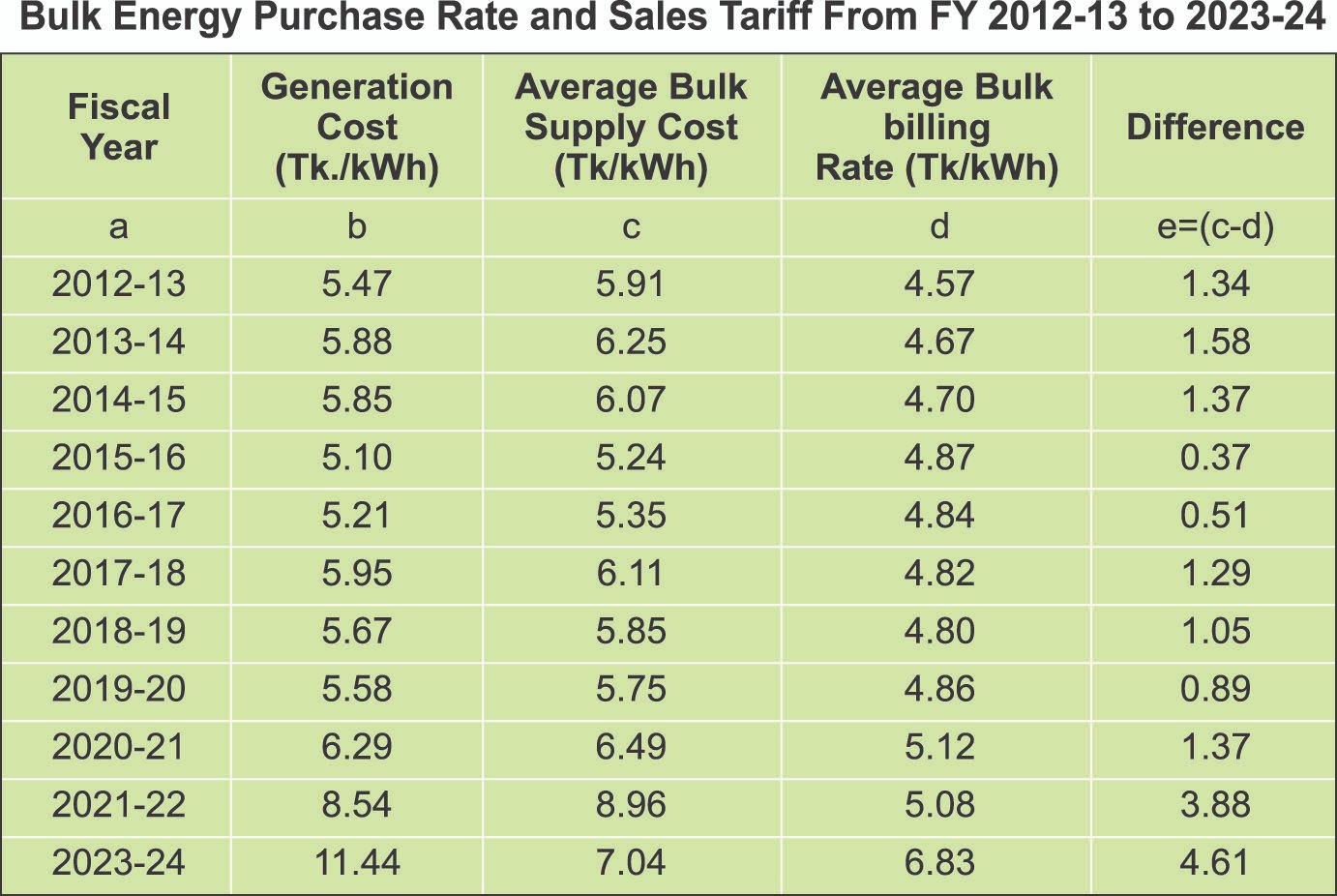

The Bangladesh Power Development Board (BPDB) is the sole buyer of the country’s electricity. BPDB generates electricity and at the same time purchases it from state-owned companies, joint venture companies, and independent power producers (IPPs) at pre-determined prices under Power Purchase Agreements (PPAs). However, analysis of financial data shows that in FY 2022-23, BPDB’s electricity supply cost per unit was BDT 12.03, whereas the bulk selling price was BDT 6.83. This resulted in a loss of BDT 5.21 per unit. While this loss decreased slightly to BDT 4.61 per unit in FY 2023-24, the deficit remains substantial. Historically, the loss was only BDT 1.34 per unit in FY 2012-13, but it gradually increased over time. During the COVID-19 pandemic in FY 2019-20 and FY 2020-21, losses temporarily dropped to BDT 0.86 and BDT 1.37 per unit, respectively, before rising again to BDT 3.88 per unit in FY 2021-22.

Experts argue that better energy mix management could reduce electricity generation costs. The country’s LNG import capacity is 1,100 million cubic feet per day (MMCFD), but actual supply over the past two years has averaged at 650-700 MMCFD, limiting BPDB’s ability to fully utilize its gas-based power plants. Currently, with gas prices at BDT 15.50 per cubic meter, the supply cost of gas-based electricity is 6.31 BDT per unit. Even if gas prices were doubled, the cost would be BDT 10.38 per unit, which is still lower than coal-based electricity and significantly cheaper than furnace oil-based electricity. Proper energy management—ensuring LNG supply and coal imports—could reduce reliance on costly furnace oil, thereby lowering overall power generation costs.

In the last fiscal year, furnace oil-based power plants operated at an average plant load factor of 21%, while coal-fired power plants operated at 54%. Experts believe that ensuring adequate funding for coal imports could have reduced furnace oil-based power usage to 10%, leading to significant cost savings.

Deficits and Subsidies: Finding a Way Out

For FY 2023-24, the gas sector subsidy allocation was BDT 7,000 crore. However, the energy adviser estimates the actual shortfall to be BDT 20,000 crore. Since the revised budget did not increase gas sector subsidies, the government plans to pass the full cost of imported LNG onto the consumers. Petrobangla is now selling gas at a loss of BDT 1.56 per cubic meter, which is expected to rise to over BDT 5.0 per cubic meter during this fiscal year. To cover this gap, authorities are considering further gas price hikes. However, experts pointed out that Bangladesh has one of the highest system losses in the gas supply chain. It has been suggested that reducing the system losses by 5% would allow Petrobangla to avoid price hikes while maintaining financial stability. Experts also reiterated their suggestion to expedite exploration and extraction of own petroleum resources to achieve long-term energy security by reducing reliance on imported energy.

BPDB’s financial crisis is much more severe than that of Petrobangla. To mitigate this, the revised budget for FY 2023-24 increased power sector subsidies by 77%, from BDT 40,000 crore to BDT 62,000 crore.

In FY 2020-21, the power sector subsidy was BDT 8,940 crore. In FY 2021-22, the subsidy increased to BDT 11,960 crore; in FY 2022-23, BDT 29,511 crore, and in 2023-24 BDT 35,000 crore. Increases of subsidy alone cannot overcome the financial deficits of BPDB. Rather it makes the SOE less efficient and financially crippled, observed experts.

According to Professor Dr. Shamsul Alam, Energy Advisor to the Consumers Association of Bangladesh (CAB), the increase in subsidies indicates continued inefficiencies, corruption, and unnecessary expenditures in the sector. He argued that the government should focus on reducing unjustified expenses in the tariff structure instead of relying on subsidies. For this to happen, the Bangladesh Energy Regulatory Commission (BERC) must be given the authority to enforce necessary reforms.

Energy experts and economists recommend a 5-7 years’ phased strategy, aimed at systematic reduction in power and energy sector deficits. The actions suggested are increasing domestic energy production and efficiency to lower electricity generation costs, gradually increasing consumer tariffs in a reasonable and transparent manner, and phasing out subsidies systematically while ensuring financial sustainability. Without these structural changes, Bangladesh’s power sector will continue to struggle with deficits, requiring unsustainable government subsidies year after year.

Expert Opinions on Addressing the Crisis

Engr. Mizanur Rahman, a former member of the Bangladesh Energy Regulatory Commission and General Secretary of the Bangladesh Energy Society, stated that BPDB is facing stress from “excess generation capacity” due to politically driven power generation expansion beyond core planning. Specifically, over 2,500 MW of furnace oil- and diesel-based power plants established in 2017–2018 have imposed an unwarranted financial burden on BPDB. He added that during the post-COVID period, when global fuel prices skyrocketed, planned load-shedding could have reduced the pressure of high-cost fuel imports, especially furnace oil. Although this recommendation was made to the government, it was not implemented, leading to increased financial pressure on BPDB. In early 2024, BPDB was unable to pay Independent Power Producers (IPPs) for six consecutive months.

Engr. Mizanur Rahman emphasized that rising fuel costs are the primary reason for the increase in power generation costs. The country’s reliance on fuel imports has been steadily increasing—from 14% in 2018 to 55% currently. Without boosting domestic gas and coal production, dependence on imports will continue to rise, further escalating power and fuel supply costs. He warned that price increase alone would not be enough to recover this cost and consequently would lead to an increasing reliance on subsidies. However, optimizing the country’s existing energy mix could help reduce generation costs. Specifically, reducing furnace oil dependency and maximizing coal-based power could lower the overall electricity generation cost.

Professor M Tamim, Vice-Chancellor of Independent University Bangladesh, pointed out that excessive generation capacity, well beyond the actual demand, has significantly contributed to the financial challenges in the power sector. He noted that investment in the private sector power generation and capacity charges under Power Purchase Agreements (PPAs) are essential. However, due to overcapacity, BPDB has paid at least BDT 40,000 crore in unnecessary capacity charges over the past 15 years.

Professor Dr. Ijaz Hossain, former Dean of BUET, argued that the standard generation cost of electricity is around 10 cents per unit. Last year, Bangladesh’s generation cost was even lower than this. However, the depreciation of the Bangladeshi Taka against the US Dollar has made the cost significantly higher in local currency terms. Over the past four years, the exchange rate of a US dollar increased from BDT 86 to BDT 122, sharply intensifying the BPDB’s financial burden. Given the growing reliance on imported fuel, he believes that reducing generation costs will be difficult.

Professor Dr. Mustafizur Rahman, a Distinguished Fellow at the Centre for Policy Dialogue (CPD), stated that abruptly reducing power and energy subsidies will not be feasible. Inflation has significantly increased the cost of living, and raising electricity and fuel prices to cover losses would further intensify economic challenges. Bangladesh already has a high cost of doing business; increasing energy costs would disincentivize new industrial investments, reduce exports due to reduced competitiveness, and shrink import-substituting industries. This would lead to lower revenue collection, job losses, and increased reliance on imports. However, he also noted that the government cannot sustain high subsidies indefinitely, given the current state of the economy. He recommended a phased 5–7-year plan or gradually lowering subsidies by reducing energy supply costs and moderately increasing consumer prices. To achieve this, the government must prioritize domestic gas exploration and extraction over fuel imports.

Conclusion

The financial crisis in Bangladesh’s power and energy sector, particularly the growing deficit, continues to worsen each year. The current approaches of increased subsidies and consumer price hikes have persisted. The Bangladesh Energy Regulatory Commission (BERC) is currently reviewing a proposal for further gas price increases.

The core issue stems from rising fuel imports since 2018, now accounting for 55% of total energy needs. Without increasing domestic energy production, this dependence will continue. The primary reason behind the gas shortage is the lack of strategic investment in oil and gas exploration over the past 25 years, despite a phenomenal increase in demand. The crisis deepened as essential LNG import infrastructure could not be developed, leading to a widening deficit and increasing supply costs.

Over the past 17 years, many power plants were built without considering a secured supply of fuel. This created excess capacity and an additional burden on BPDB, the single buyer, as it had to account for a huge capacity charge for keeping plants idle. BPDB's payment obligation led to an almost bankruptcy situation. The National White Paper Committee has also highlighted at least 10% of corruption in the power and energy sector, along with inefficiencies and mismanagement. These issues collectively contribute to rising energy costs.

BPDB sources report that the depreciation of BDT against the USD is another major factor in its growing deficit. BPDB’s annual expenses amount to BDT 110,000 crore, with 85% of these costs linked to foreign currency payments for fuel, electricity, and loan repayments. With the exchange rate rising, the financial shortfall has worsened significantly. Similarly, Petrobangla must pay for imported LNG and gas purchases in US Dollars, which has led to higher average gas prices due to currency depreciation.

BPDB sources also indicate that for every BDT 1.0 deficit per unit of electricity, the organization incurs monthly losses of BDT 6.0–6.8 billion (600–680 crore). Therefore, the gap between supply cost and bulk selling price must be narrowed.

Bangladesh’s economy cannot sustain the power and energy sector solely through subsidies. A phased reduction of subsidies is necessary, which requires lowering supply costs and implementing gradual, manageable consumer price adjustments. However, inefficiencies and corruption in the sector must not be passed on to consumers. Energy price hikes must also be managed carefully to ensure that they do not halt industrial production, which would reduce government revenue and limit job creation.

In this unpleasant situation, it is recommended to adopt a medium-term strategic plan to reduce subsidies and develop an efficient power and energy sector. Immediate comprehensive mid- and long-term actions must also be launched to confront the energy crisis and achieve sustainable energy security, which is required for achieving economic growth and development.

Download Cover As PDF/userfiles/EP_22_20_Cover.pdf