Technology is evolving at breakneck speed to address climate change and assist industries in transition. Bangladesh, one of the most vulnerable nations to climate change, has an incredible opportunity to invest in climate adaptive infrastructure and technology. Standard Chartered with a history of firsts in global sustainable finance, is prepared to partner in net-zero opportunities in Bangladesh. The duality of Bangladesh’s position is profound—it is a minor contributor to global greenhouse gas emissions, yet it has one of the highest needs for sustainable financing. Here is an encouraging perspective: the challenge of climate change also brings significant opportunities. Bangladesh is in a unique position to install climate smart infrastructure through greenfield projects and shape consumer behavior as a large consumer population gains disposable income. This is quite unlike other economies, which first need to decommission existing infrastructure—a costly process—or alter well-established consumer patterns that harm the environment.

The Emerging Market Transition Finance Gap

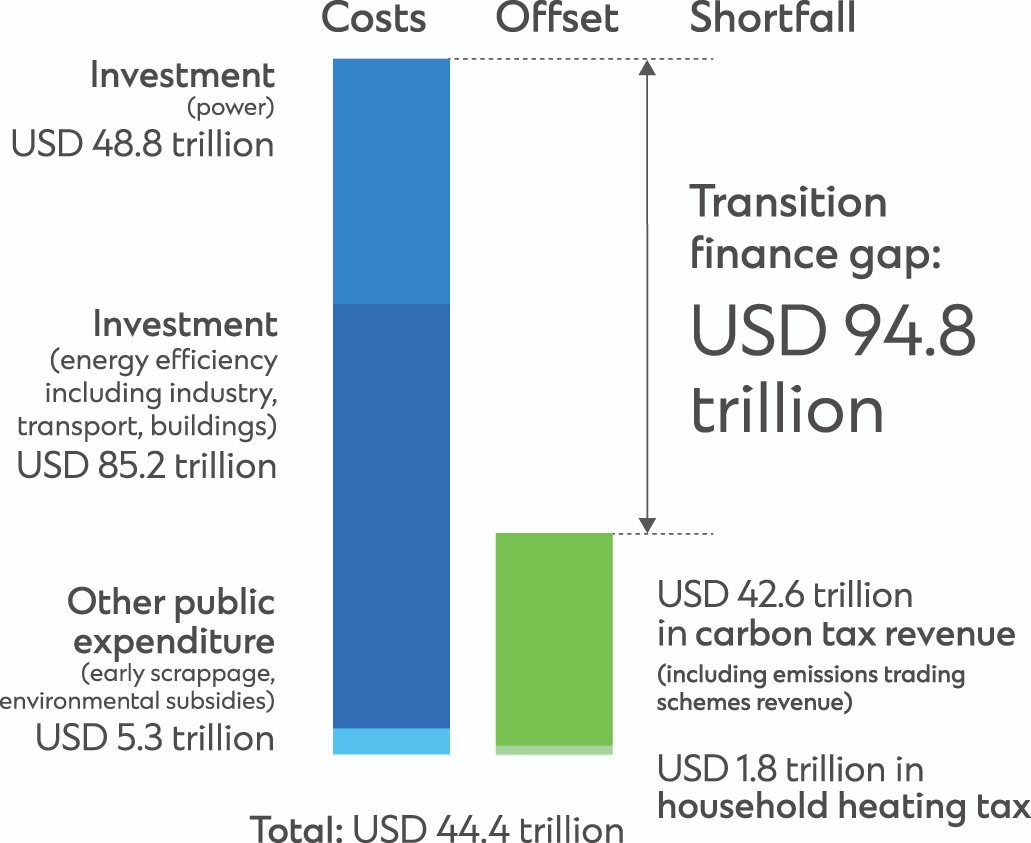

Emerging markets need to find an additional USD 94.8 trillion of transition finance – a sum higher than annual global GDP (projected at around USD 93.9 trillion in nominal terms for 2021) to transition to net-zero by 2060. The USD 94.8 trillion required is in addition to the capital already committed in each market for the power sector, improving energy efficiency in industry, transport, and buildings, as well as other public expenditure, including early scrappage schemes and environmental subsides.

Specifically for Bangladesh, Standard Charterer’s Opportunity 2030 report has quantified the short-term private sector opportunity in the power sector. A staggering USD 74 billion of private investments is required by 2030 to ensure access to affordable and sustainable energy for all Bangladeshis. The total private and public sector investment required amounts is USD 164 billion. Achieving Bangladesh's shared net-zero ambition will demand collaboration among entrepreneurs, the financial services sector, consumers, and policymakers. On this net-zero journey, Standard Chartered has been a close partner.

First in Solar, first in Bangladesh

Getting the energy mix right to power the nation forward while ensuring long-term sustainability is a key part of the challenge. In 2018, Standard Chartered helped the nation take its first step toward achieving this balance by supporting the development of the first utility-scale solar power plantfeeding Bangladesh's national electric grid. This was a pioneering deal, creating a new template for private sector renewable energy operators in Bangladesh. Standard Chartered (Bangladesh and United Kingdom) arranged the project’s foreign currency financing, along with a component of local currency financing. A key challenge was structuring a deal with a 15-year maturity—well beyond the comfort zone of most commercial banks. The answer was a unique guarantee-backed structure and repayment mechanism that aligned the financing needs with the risk appetites of all stakeholders. Risk coverage through a guarantee provides comfort to lenders to support infrastructure projects in low-income countries, promoting domestic infrastructure financing, and capital market development. This transaction speaks to Standard Chartered’s unique network connecting local clients to international partners, its innovation in product design, and its values in prioritizing client, climate and the country.

A New Era: The Story Behind Bangladesh’s First Green Bond

Bangladesh’s maiden sustainability-linked bond issuance in 2021 was a rallying call for corporates and investors in the debt and capital equity markets, especially with regard to sustainability-linked products. The green bond was issued amid challenging market conditions and structured to incentivize both issuers and investors. This exemplifies the potential of such initiatives to unlock much-needed capital in the market.

To support their climate goals, clients can choose to raise capital through the bond market, leveraging Bangladesh’s growing investor pool. There can be several obstacles to overcome as a corporate entity seeks to raise debt. Currently, Bangladesh’s bond market is dominated by government bonds, with corporate debt remaining relatively underdeveloped. The private bond market is primarily limited to commercial banks issuing subordinated debt to meet capital adequacy requirements.

The first green bond’s ground-breaking structure incentivizes both the issuer andinvestors – a move that encouraged the clientto seek a debt-raising alternatives beyondtraditional bank financing while addressingthe appeal of the green bond segment. Thegreen bond’s metrics link funding costs to theclient’s impact on the climate and othersustainable development goal (SDG) targets.Since its issuance, the bond has positivelyinfluenced environmental initiatives, includingimprovements in resource efficiency, wastemanagement, and renewable energyadoption.

Global Best Practices for Net-zero: Battery Storage in Melbourne, Australia

Few countries can claim the potential to power the world—and even fewer can do so using low-carbon sources. But according to one estimate, Australia could potentially generate enough renewable electricity to power the globe eight times over, mostly through wind and solar energy. However, the intermittency of renewable energy generation sources, and the limitations in current power infrastructure, mean that businesses and households cannot yet rely exclusively on them for their energy needs. When the Australian government-owned renewable energy company chose to build the ambitious Melbourne Renewable Energy Hub (MREH), the nation entered a new chapter in its pursuit of net-zero journeys. Standard Chartered, was there to partner with them. MREH is one of the world’s biggest Battery Energy Storage System (BESS) projects and the largest in Asia-Pacific region. When fully built in 2025, MREH will be able to provide 1.6 gigawatt-hours (GWh) of energy storage. This is enough to power up to 200,000 homes during peak periods. However, prior to MREH's success, many battery storage and renewable energy projects in Australia were unable to reach financial close. Most of those that received the green light were fully equity funded. As such, project owners seeking alternative forms of capital faced a tough challenge. Global Best Practices for Net-zero: Battery Storage in Melbourne, Australia

Accelerating in Bangladesh

Standard Chartered had a long-standing relationship with the project’ s developer, Equis, not only in Australia but across the client’s footprint in the Asia-Pacific region. This relationship allowed the Bank to offer competitive pricing, and Standard Chartered acted as the lead arranger for the project finance loan extended to MREH, supported by other lenders. The landmark transaction is the first financial close of a four-hour battery storage system in Australia’s National Energy Market. In addition, Standard Chartered provided further support for the project through adjacent services, including taking on an allocation of the hedging portion that another lending group was not able to take. The climate impetus is felt deeply by the private sector, financial services industry, and the public sector. This culminated in the first utility scale solar plant, which paved the way for many more of its kind, and the first green bond sparked the conversation on blue and sustainable-linked bonds as alternative sources of financing. While Standard Chartered takes pride in these historic transactions, the Bank is also aware that it’s only the beginning – there is much more to this opportunity.

To accelerate the net-zero commitment, policymakers and private partners need to focus on establishing solar parks in Bangladesh. Solar parks provide suitable developed land with all necessary clearances, transmission systems, water access, road connectivity, communication networks, and more. This approach would address the persistent challenges of affordable land availability near catchment areas, the dichotomy of land use for agriculture versus renewable energy, and the limited availability of power infrastructure, such as evacuation lines and substations. A solar park may also require an innovative public-private partnership or joint venture backed by foreign direct investment (FDI) with the government, which can be easily replicated and scaled across Bangladesh's renewable energy landscape.

The private sector and the government need to agree on the appropriate rate structures which give the underlying contracts longevity, while multilateral partners need engagement from all stakeholders to share risk coverage for these long-tenured transactions. And Standard Chartered, with its record of first-of-its-kind transactions in Bangladesh and beyond, is prepared to innovate new products, connect partners, and drive the net-zero aspiration.

Download COP29 Special As PDF/userfiles/EP_22_10_COP29 Naser Ezaz Bijoy.pdf

Naser Ezaz Bijoy, CEO, Standard Chartered Bangladesh