Bangladesh is on the way to having its first nuclear power plant, designed and built by Russia at a cost of over 12.65 billion dollars. Rooppur NPP, the Generation III+ Russian two units of VVER-1200 reactors of total 2,400MW capacity fully comply with all the international safety requirements.

The nuclear energy future is the marker of development, progress, and energy security. At the present stage nuclear programs and policies are designed to lead it by a consciously directed and accelerated movement from old technology into the modern era of advanced safe Gen III+ nuclear power technology now on the threshold of the atomic age. The idea of a nuclear plant is a modern technological solution to energy shortages in the country, with officials thinking of possessing a nuclear plant as a marker of national achievement and success and a proof of state power.

Now, we are on the verge of entering the elite club of countries having nuclear power plants. Bangladesh ground, supporting and encouraging the elite dreams of nuclear nationhood in Bangladesh, is the International Atomic Energy Agency (IAEA). The agency seeks to accelerate and enlarge the contribution of atomic energy to peace, health, and prosperity in the world. The IAEA carried out a planning study in 1974-75 and projected between 1,200 and 3,000MW of nuclear capacity in Bangladesh, with nuclear power constituting a projected 47 percent of the country’s electricity capacity.

In 2005, Bangladesh signed a nuclear cooperation agreement with China. In 2008, China offered funding for the project at a much lower cost. Instead, the Bangladesh government started discussion with the Russian government a year later. In the end, it was Russia that edged out other countries that could have sold Bangladesh a reactor at a much cheaper cost.

It was only in May 2016 that negotiations finally concluded over what had become a US$12.65 billion nuclear project at Rooppur. Russia making available US$11.385 billion as credit. Russia would provide 90 percent of the funds on credit at an interest rate of LIBOR plus 1.75 percent. Bangladesh will have to repay the loan in 28 years with a 10-year grace period.

Current schedules suggest that commercial operation for Unit 1 is expected in 2023 and Unit 2 in 2024 and two additional reactors are expected by 2030. The expected operational lifetime of the nuclear plant in Rooppur is sixty years. The sixty years is the least, and possibly another 20 years longer. How much will the Rooppur reactors cost? There is a long history of underestimating the time and cost it would take to complete a nuclear power plant. Thus, the final cost of Rooppur may be much higher than the stated figure of $12.65 billion. Nuclear plants have not come cheaply. The economic cost of the Rooppur Nuclear Power Plant (RNPP) is twice as much as similar projects elsewhere in the world.

A study published in the Environmental Science and Pollution Research journal found that Bangladesh has had to bear a hefty setup cost for various nuclear facilities.

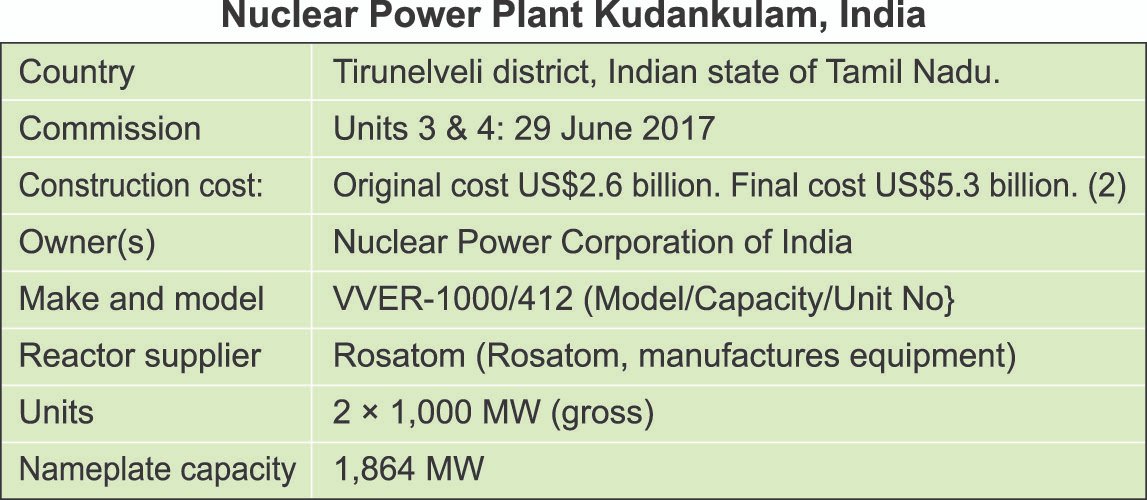

The economic cost of setting up a nuclear power plant at Rooppur in Bangladesh compared to the cost of Rooppur Units 1 and 2 to India’s Kudankulam Units 3 and 4, as both projects are being built by ROSATOM, in Russia is more than double. According to the study, the economic cost amounted to 9.36 cents/kWh for the capacity of 2,400MW as opposed to Kundakulam where the corresponding cost is 5.36 cents/kWh for 2,000MW. The Rooppur nuclear plant is intended to operate for sixty years, electricity will contribute to higher electricity bills for decades due to double the construction cost.

(1) Friday, December 25, 2015, 08:52 PM, Engr Md Monirul Islam, chairman of Bangladesh Atomic Energy Commission, and Savushkin of Russian state nuclear power company Rosatom, witnessed by Science and Technology Minister Yefesh Osman, signed the biggest ever contract worth $12.65 billion with a Russia’s state-run company to build the Rooppur nuclear power plant that would generate 2,400 megawatts of electricity.

(2) Reported by “FRONT LINE” India news on 9 August 2013: The original cost of the two units (units 1 & 2) latest revised cost (US$2.6 billion). 17 February 2016: Due to technology changes, inflation, and insistence of the supplier and operator for additional liability insurance the construction cost of units 3 & 4 amounted to twice the cost of units 1 & 2 and was revised to US$5.38 billion.

Economics of setting up a nuclear power plant at Rooppur compared to a similar model nuclear plant in India

My study Estimating the Economic Cost of Setting Up a Nuclear Power Plant at Rooppur in Bangladesh compared the costs of Rooppur Units 1 and 2 to India’s Kudankulam Units 3 and 4, both of which are being built by Rosatom, Russia’s largest electricity producer.

The original cost of the two units for the Kudankulam Nuclear Power Plant in INDIA was US$2.6 billion. The Kudankulam Nuclear Power Plant Units 3 and 4, which are being built by Rosatom, cost approximately $5.3 billion for 2 units. If we consider that each unit might cost around $3.25 billion, this gives us a baseline of roughly $3 billion per unit. If similar plants cost around $3.25 billion per unit in India, this baseline is an important reference for cost expectations in Bangladesh.

Given that Bangladesh is building its first nuclear power plant, initial costs might be higher due to factors like the lack of existing infrastructure and supply chains. For a fair comparison, assuming a reasonable increase for the first-time cost (e.g., 50% to 100% higher due to the initial setup), a more realistic estimate for a new plant in Bangladesh might be around $3.5 billion per unit, compared to India (original price US$ 2.6 billion).

So, if a comparable nuclear power plant in India finally costs $5.3 billion for two units, the expected cost for the Rooppur Nuclear Power Plant in Bangladesh should ideally be around US$ 7.0 billion, factoring in the additional costs associated with setting up a first-time project.

Actual Final Cost: The higher reported costs of US$12.65 for Rooppur, the actual final costs should be in the range of $6.5 billion for the entire 2,400MW project, considering it involves multiple units and additional factors such as regulatory and logistical challenges.

The reported cost of $12.65 billion suggests that the RNPP is significantly more expensive than similar projects, raising questions about potential misappropriation. Exactly who and where that money was utilized is yet to be investigated by the appropriate authorities. The Bangladesh government agencies need external independent audits to ensure transparency and accountability.

The study found that the economic cost of the Rooppur project is over double that of Kudankulam Units 3 and 4, which are India’s 25th and 26th nuclear power reactors.

According to the study, the economic cost was 9.36 cents per kWh for a capacity of 2,400MW, compared to Kudankulam, where the corresponding cost is 5.36 cents per kWh for 2,000MW. The fifth and sixth units of Kudankulam in Tamil Nadu, which were not covered in the study, will also have a financial cost of about $6.5 billion to build.

Furthermore, the cost in Bangladesh is triple that in Belarus, which is also setting up its first nuclear plants using Russian VVER technology, indicating that a cost overrun of over $5 billion is by artificially inflating the cost of the Rooppur Nuclear Power Plant (RNPP) which people of Bangladesh must pay back by paying higher electricity bill.

This significant cost difference will result in higher electricity bills for decades, as the Rooppur nuclear plant is intended to operate for sixty years. The increased cost of construction will be passed on to consumers, making electricity more expensive for generations to come.

According to experts, the cost of construction, as per expert analysts, suggests that the price tag is inflated far beyond any rational pricing, leading to charges of corruption and collusion on the part of the Bangladeshi officials responsible for the deal.

To ensure transparency and accountability, the Bangladesh government agency responsible for the project should consider:

* External independent audits to scrutinize the project`s finance.

* Ensuring transparency in the allocation of fund.

* Holding individuals accountable for any mismanagement or misappropriation of fund.

* Recovering any misused or misallocated funds to ensure value for money.

By taking these steps, the government can guarantee that the RNPP project is completed efficiently and effectively, with minimal waste of resources.

Zainul Abedin P. Eng (Alberta), Canada, Engineering Consultant Energy & Power

Download Opinion As PDF/userfiles/EP_22_7_Opinion.pdf