Bangladesh is suffering from severe gas supply crisis over the past several years. Chronic gas deficit has affected fertilizer production, power generation and even operation of industries, including export-oriented industries. Many investors invested their fortune in setting up new industries are in serious anxieties about getting gas supply for commencing production. The government has initiated the process of importing expensive LNG for meeting the gas deficit. We are aware that setting up of FSRU, land-based terminals and importing LNG from the volatile global market alone require time and huge investment and consequently would create great vulnerability in the long term energy security. A country like Bangladesh having very limited opportunity for setting up enabling infrastructure for imported fuel should not rely almost exclusively on imported fuel. Bangladesh is a least explored riverine delta. One cannot completely rule out the possibility of finding new petroleum resources in onshore and offshore areas. Bangladesh needs to have right mix of own and imported fuel for ensuring long term energy security. We have to explore and exploit our own petroleum resources to the fullest extent. But unfortunately the present exploration campaign is well below the required level. For the last 17 years very little exploration has been done. Proven recoverable gas reserve is fast depleting, raising concerns of getting completely depleted by 2030. Expediting the exploration campaign, the reserve must be replenished by further strengthening BAPEX technically and financially, and engaging IOCs in onshore tight structures, deep drilling, western region and offshore. Well planned and carefully executed exploration campaign can only change the scenario in 5-7 years. In the present state, offshore exploration campaign is on a destination unknown.

Successful resolution of long standing maritime dispute of Bay of Bengal with Myanmar and India came as a blessing. We could start getting the benefits from our offshore resources by now if we could plan exploration program properly and implement professionally. Our next door neighbors, Myanmar and India, have advanced to a great extent in offshore explorations in the Bay of Bengal over the past five years. Bangladesh was the first country entering the Bay of Bengal for offshore exploration immediately after liberation. It was indeed a milestone achievement for the present government in its past term. It is also equally frustrating that Bangladesh in five years failed to even engage a contractor for conducting multi-client survey for acquisition of data and information of deepwater prospects. Bangladesh needs a database of information in its PSC package for attracting IOCs in considering risk-investment in deep offshore. Bangladesh also needs further updating of the draft model PSC to make this as attractive as the PSC documents of India and Myanmar. Needless to mention that IOCs have lost incentive in offshore exploration due to low pricing trend of crude oil in the global market. In the backdrop of chronic gas crisis prevailing in Bangladesh, it is very urgent that Bangladesh do everything possible to expedite exploration campaign in deep water alongside shallow water and onshore frontier areas.

The only success of offshore drilling was discovery and development of Shangu offshore gas field by a joint venture of Shell–Cairn and Holland Sea Research in late 1990s. First Cairn and then Australian company Santos operated the field for some years. Shangu came as a blessing for the gas-starved Chittagong region after major depletion of Bakhrabad and disputes with NIKO suspending works at Feni field. But depletion of Shangu also created curse for gas franchise in greater Chittagong. Bangladesh has so far failed to carry out very urgent offshore exploration in the offshore. Snatos with KrisEnergy JV partner is waiting for carrying out exploration in a shallow water block. Indian company ONGC is also working in two blocks -- one of which is further development of Kutubdia gas field discovered by UNOCAL in 1970s. Daewoo Posco has signed PSC for two offshore blocks where ConocoPhilips worked for some years and later relinquished after failing to successfully renegotiate gas price. Apart from these, Australian company Woodside Petroleum has submitted proposal for carrying out exploration in five deep water blocks.

It may be mentioned here that after independence of Bangladesh, Bangabandhu-led government was the first in the region to enter the Bay of Bengal for offshore exploration. After formation of Oil & Gas Corporation (Now Petrobangla), Bangladesh in the shortest possible time could engage six IOCs in eight offshore blocks through formulating model PSC and inviting the first bidding round. But after unfortunate assassination of Bangabandhu along with most of the members of his family in August 1975, the IOCs left Bangladesh one by one. Petrobangla and Bangladesh failed to resume offshore exploration with the same intensity ever since. With vast offshore area, almost the size of Bangladesh, open for exploration, EMRD and Petrobangla have so far failed to engage contractor for conducting multi-client surveys for acquiring data and information of offshore petroleum resources. Bangladesh desperately needs preparing a database of information, without which IOCs may not show interest for making risk investments.

Chronological Development of Petroleum Exploration

One of the major initiatives of Petrobangla since its formation was organizing petroleum block bidding, evaluating offers, negotiating Production Sharing Contracts (PSCs), supervising and administering PSCs with International Oil Companies (IOCs). From 1974 to 2017, four bidding rounds were conducted.

In the first round of block bidding in 1974, six IOCs -- Ashland, ARCO, BODC (Japan), Union Oil Company, Canadian Superior Oil and Ina Naftaplin -- were awarded eight offshore blocks under PSCs. The companies conducted 31,069 km of marine seismic surveys and drilled seven wells. Kutubdia gas field was discovered by Union Oil Company in 1977. Before and after these exploration activities, maritime boundary disputes surfaced between Bangladesh and Myanmar, Bangladesh and India. IOCs started leaving Bangladesh and by 1978 all left abandoning the PSCs. Moreover, the essence of these PSCs was exploring oil. Finding no oil was a disincentive for the IOCs.

The first bidding round was followed by an interim period when Shell Oil Company (Shell) signed contract with Petrobangla for exploration blocks in Chittagong Hill Tracts (Block number 22). They were also awarded block 23 in the northern region. Seismic surveys were carried out and two exploration wells were drilled at Sitapahar and Salbanhat. An unfortunate insurgency act in CHT leading to abduction of Shell officials caused the company to leave Bangladesh. Scimitar Exploration Company was awarded a PSC for exploration in Surma Basin (later block 13). Jalalabad Gas field was discovered.

The next bidding round, named as second bidding round, was held in 1993. Four IOCs Occidental (blocks 12, 13 & 14), Cairn Energy (blocks 15 & 16), Okland-Rexwood (blocks 17 & 18) and United Meridian Corporation (Block 22) were awarded 8 blocks. The third formal PSC block bidding was conducted in 1997. Tullow-Chevron-Texaco-Bapex was awarded block 9. Shell-Cairn-Bapex was awarded blocks 5 & 10 and Unocal- Bapex was awarded block 7. During this bidding round, a mandatory provision of 10 percent carried interest for BAPEX was introduced and implemented for all blocks.

The fourth bidding round 2008 in the offshore attracted some IOCs, but maritime boundary disputes in most of the blocks acted as major impediment. However, the government could manage concluding PSC with ConocoPhilips for deep water blocks DS-10 & DS-11 on June 16, 2011. Conoco conducted 2,680 line kilometer 2D seismic survey in February–March 2012. They conducted additional 3,180 line kilometer 2D survey in the blocks in March–April 2013 for getting better knowledge of the blocks. It made a presentation on Comprehensive Technical Evaluation of the Petroleum Potential of Blocks DS -10 and DS -11 on 26 October, 2014. Considering further investment for exploration uneconomic, ConocoPhilips terminated PSC for blocks DS -10 and DS -11 and relinquished the blocks. From 15 June 2014, these blocks became free again.

Immediately after resolution of maritime boundary dispute between Myanmar and Bangladesh in March 12 by ITLOS, Petrobangla reorganized the blocks taking into account the new boundary. The PSC bidding round was announced in December 2012. Three shallow water PSCs have been signed with ONGC Videsh, Oil India & BAPEX Joint Venture -- two PSCs for blocks SS-04 and SS-09. Santos, KrisEnergy and BAPEX JV have been awarded SS-11. PSC has also been concluded with DAEWOO–POSCO for DS-12, DS-16 & DS-21.

Present Status of Offshore Exploration

Great opportunity has been created for major finding of petroleum resources in the vast offshore areas following resolution of maritime boundary disputes with Myanmar and India. Decision for carrying out multi-client seismic survey was taken for acquiring knowledge and preparing database of information about geological structure and assessing potentials for petroleum resources in the extensive maritime area. Once prepared, these can be packaged for selling to intending bidders willing to invest in exploration in offshore areas.

The initial tender failed to take any decision for engaging contractor. Bids were received on 31 January 2016 following retendering done on 15 December 2015. Five companies TGS-SCHULMBERGER JV, DMNG Joint Stock Company (DMNG JSC), SPEC PARTNERS–SINOPEC–GEOTRACE JV, BGP INC, China National Petroleum Corporation–Ion Geophysical Corporation–Spectrum Geo Pty Ltd, Marine Arctic Geological Expedition Joint Stock Company (MAGE JSC) participated in the bidding. EMRD has approved Petrobangla committee recommendation for awarding the works to the evaluated bidder. This was placed to a cabinet committee for approval. In the meeting of the cabinet committee held on 03 August 2016, a five member committee was formed with the Minister of Law and Parliamentary Affairs as Chairman for assessing the recommendation of EMRD and Petrobangla. The first and the second meeting of the committee were held on 01 September 2016 and 04 December 2016.

The prolonged delay in engaging contractor has already put Bangladesh way behind Myanmar and India in offshore exploration. Some allegations were seen in media that one particular contractor not in winning position of the work always create impediment utilizing the access to policymakers. Hope the evaluated bidder can be engaged soon.

Status of Offshore Exploration

Santos (Block-16)

Santos operated Sangu gas field completely depleted. The assets of the field and production facilities were handed over to Petrobangla. Santos earlier conducted seismic surveys in April 2010 in Magnama and South Sangu of block-16. After evaluation of survey reports, Santos drilled three exploration wells (South Sangu-4, North–East Sangu and Sangu 11). Of these, a marginal reserve was found at Sangu 11. Wellhead compressor was set in the field and well intervention done to prolong production life and maximize recovery. For some years, the field produced 25 MMCFD, but gradually depleted to 4 MMCFD. The production was finally abandoned on 1 October 2013. Offshore platform, pipeline and all production facilities onshore were handed over to Petrobangla. There are thoughts of using the offshore platform as anchorage for small scale LNG import.

Santos – Kris Energy Ltd – Bapex (Block SS-11)

PSC was signed between Petrobangla and Santos Sangu Field Ltd & KrisEnergy Ltd for exploration in SS-11 under the offshore bidding round2012. Against the mandatory PSC provisions of carrying out 1,893 line kilometer 2D seismic survey and 1 exploration well, they has conducted 3,220 line kilometer 2D seismic survey during December 2014 and January 2015. The data interpretation has shown some prospects in the block. EOI has been invited for 3D seismic survey. The survey is expected to be conducted in March 2018.

ONGC Videsh Ltd – Oil India Ltd – Bapex (Block SS-04 & SS-09)

Petrobangla signed Two PSCs with ONGC Videsh Limited (OVL) and OIL on 17 February, 2014 for exploration in offshore blocks SS-04 and SS-09. The operators are contractually obligated for carrying out 2,700 line kilometer 2D seismic survey and drill one exploratory well in SS-04. They are under obligation for conducting 2,850 line kilometer 2D seismic survey and drilling 2 exploration wells in SS-09. They have conducted 2,016 line kilometer 2D seismic survey in SS-04 and 3,010 line kilometer 2D Seismic survey in SS-09 in March 2016. Later they carried out another 2,542 line kilometer 2D seismic survey. One drilling location in SS-04 has been identified. Construction of drilling pad and approach road are underway. It is expected that drilling may commencesoon.

Recent Initiatives for Offshore Exploration

DS-12, DS-16 & DS-21

For reasons ranging from lowering trend of oil price in global market and in the excuse of lack of appropriate fiscal incentives in Bangladesh Model PSC, IOCs appeared reluctant in responding to PSC bidding rounds. In this situation, Bangladesh government under “Power and Energy Speedy Supply (Special Regulation) act 2010” invited EOI from International Oil Companies for petroleum exploration in the deep water blocks DS12, DS16 and DS21. On evaluation of offers KrisEnergy (Asia) Limited, POSCO Daweoo Corporation and Statoil were advised to submit Request For Proposal (RFP) for block DS12, DS16 and DS21 respectively. Unfortunately, only Daewoo Corporation submitted RFP. Subsequently, following due approval process, PSC was signed with Daewoo on 14 March 2017. Daewoo conducted 3,560 line kilometer 2D seismic survey in the allotted block. The findings of 2D survey are under interpretation. EOI has been invited for 3D seismic survey in the block. It is expected that 3D seismic survey may be conducted in the block in April 2018.

DS -10, DS -11 and SS-10

KrisEnergy (Asia) Limited, POSCO Daewoo Corporation and Statoil submitted EOI for the above blocks by 28 September 2016. RFP was sent to all after finding their EOIs in order. But none submitted RFP in time.

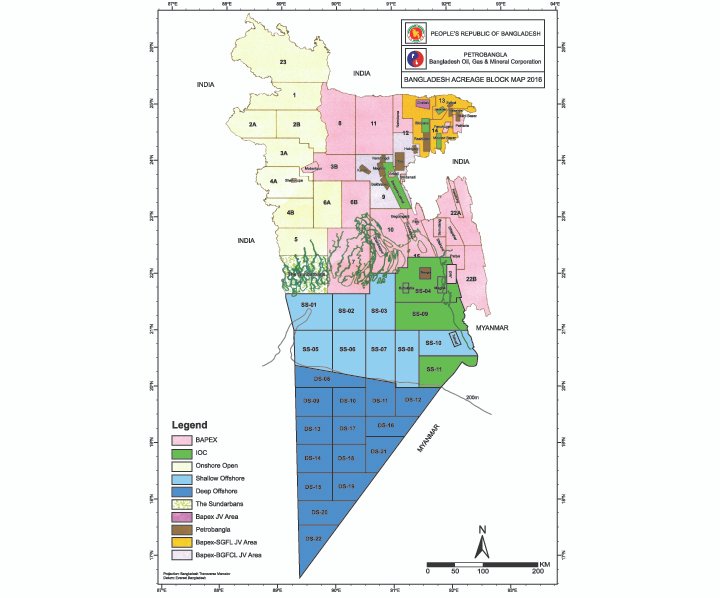

Draft Onshore and Offshore Model PSC 2017

Draft model PSC 2012 was applicable for both offshore and onshore. For onshore exploration, only a draft model PSC 2016 was prepared. It was sent to all relevant ministries/enterprises/directorates seeking their opinion. A meeting was held with stakeholders on 13 September 2017 on onshore and offshore model PSC. The meeting decided to prepare two separate model PSCs for onshore and offshore. The documents named as Model PSC 2017 have been sent to EMRD for approval. New offshore block map has been prepared. There are 11 shallow water and 15 deep water blocks. Ring-fenced areas in the onshore reserved for BAPEX has been identified.

Suggestions

Bangladesh is among the first few countries adopting PSC for petroleum exploration. But since retirement or dissociation of some senior experienced professionals, Petrobangla and Bangladesh have possibly lost much of capacity of negotiating PSC with IOCs or monitoring their activities. It was ridiculous that EMRD requires assistance of consultants for updating PSC while some former Petrobangla officials assisted few countries in formulating PSC and negotiating contracts.

Bangladesh Model PSC for deep water must have similar or better fiscal and financial incentives than Myanmar, India, Vietnam and Thailand. Especially for deep water exploration, gas price must not be fixed below US$ 8. Using a well practiced model, we tried to analyze various combinations of gas price and incentives in a training program of Petrobangla senior officials in Australia.

Conclusion

On the backdrop of rapid depletion of proven gas reserve and widening deficit in national gas grid, too little has been done by Bangladesh for exploration of new gas reserve. If action could be taken appropriately on time, some positive results could be achieved by now in shallow and deep water. But lack of professionalism of Petrobangla and EMRD led Bangladesh groping in the dark with deep water exploration. Very recently, Woodside Petroleum submitted a proposal to Petrobangla showing their interest for investment in five deep water blocks. Their proposals also include LNG supply to Bangladesh. Woodside is the leading Australian Petroleum company. They are working in Myanmar also. Petrobangla and EMRD should try and negotiate PSC with them as block bidding in the recent past did not receive positive responses from leading IOCs. Same approach should be there if any other IOC with proven track records approaches Bangladesh for deep water exploration.

Capacity hamstrung Bapex did some works in the onshore leading to discovery of some marginal gas fields. Most of these have however depleted or nearing depletion. It is sad that Petrobangla and EMRD were not allowed to award contract to its evaluated and recommended bidder over the past three to four years. Bangladesh is lagging at least three years behind India and Myanmar in deep water exploration. Neither Petrobangla nor EMRD showed any sense of urgency. Perhaps depleted capacity of bureaucracy-dominated Petrobangla and unwarranted interference of EMRD in technical intensive matters can be accounted for that. Bangladesh now has no option but to go for expensive imported LNG option to manage the huge present and emerging gas deficit. Exclusive reliance on imported LNG would definitely create vulnerability in long term energy security. The present offshore exploration campaign especially in the deep water may not bring any positive dividend in less than 7-9 years. Petrobangla is well and truly unprofessional now for handling its own affairs.

Petrobangla and EMRD must have clear and transparent strategy and time bound action plan for offshore exploration. Its own officials must have technical and managerial capability for updating PSC, negotiating contracts and managing operations of IOCs more efficiently. Petrobangla companies will also be required expertise for managing offshore infrastructure, submerged pipelines in the event of a large discovery in deep offshore.

Saleque Sufi;

Contributing Editor, EP