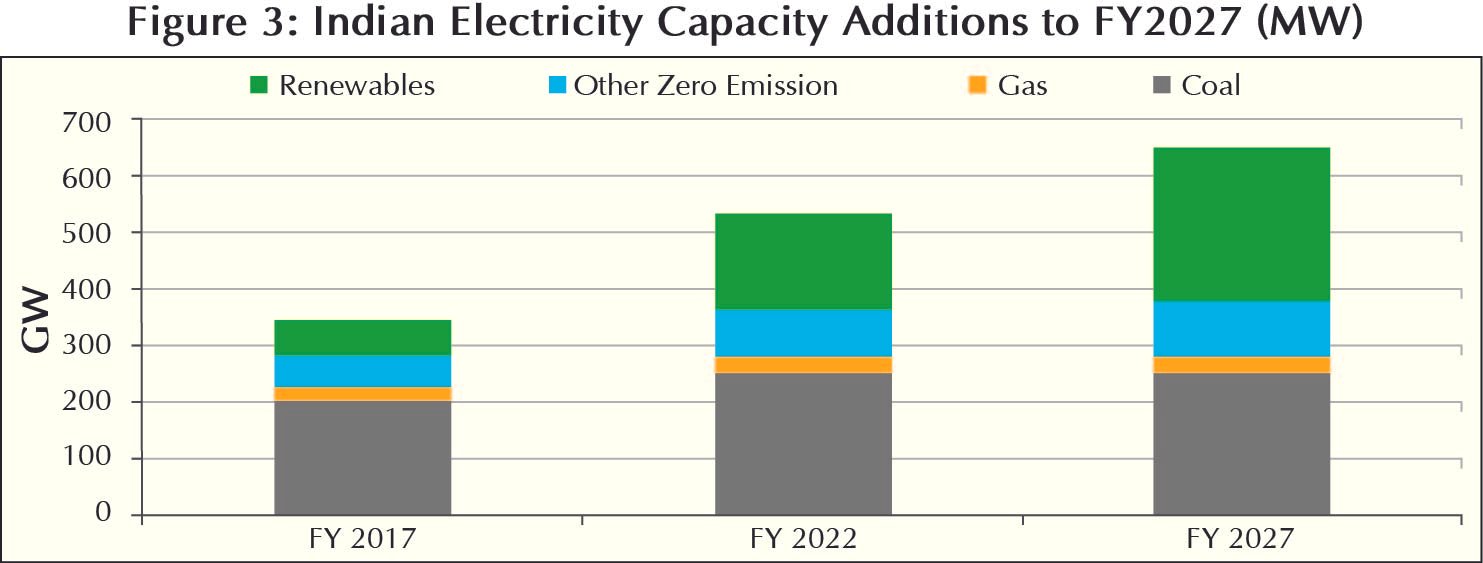

India's generation portfolio is poised for a dramatic change. The renewable energy source particularly solar and wind will share the bulk of energy requirement in next decade. India’s leading financial news paper published a news item on October 7 stating a record low tariff of Rs 2.64 offered by private players (Renew Power & Orange Sironnj) in the second windenergy auction conducted by Solar Energy Corporation of India. Only in February 17, for the first wind power auction winning bid was Rs 3.46. In solar power front, in January 2016 NTPC's solar park in Bhadla the energy cost was Rs 4.34, subsequently buoyant by lower capital expenditure and soft loan the tariff fell to 2.97 in February 17 for Rewa solar park and recently in May 2017 L1 bidder quoted 2.44/Kwh for Bhadla stage III.

The average coal based power tariff today hovers around Rs 3.20/Kwh, the lowest generation cost in some of the NTPC's (India's central sector power utility) older units are around Rs 1.80/Kwh (due to low capital expenditure). In the backdrop of spiraling fall of wind and solar tariff in current situation and tariff crossing the barrier of generation cost of coal, the future of Coal based power station (currently has a market share of 79%) appears to be doomed.

In this backdrop India's Third Draft National Electricity Plan (NEP3) from 2017 to 2027, unambiguously concludes that beyond the half build plants under construction, India does not require any new coal fired power stations. At the same time India has identified 5.5Gigawatt (GW) of inefficient and old (more than 25 years) power stations as the country looks to cut emission of CO2.

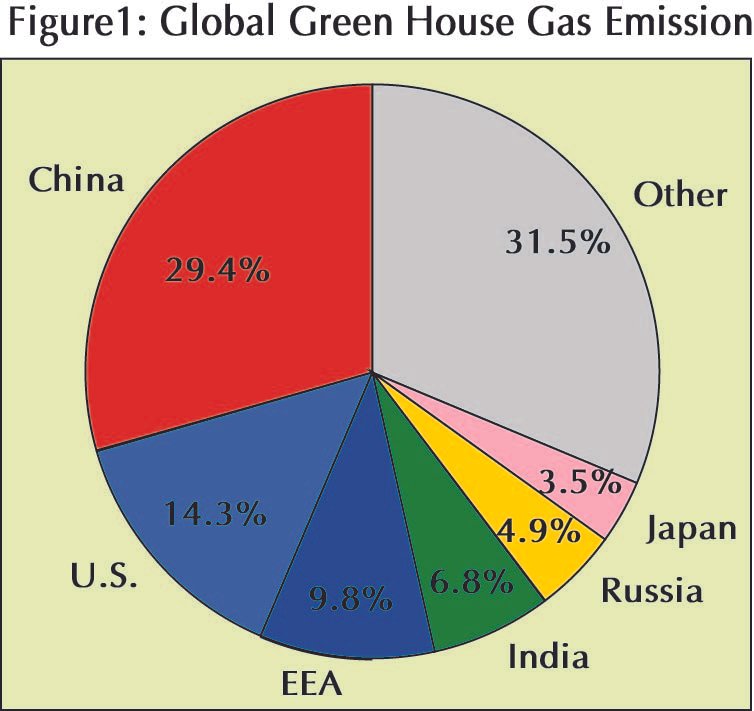

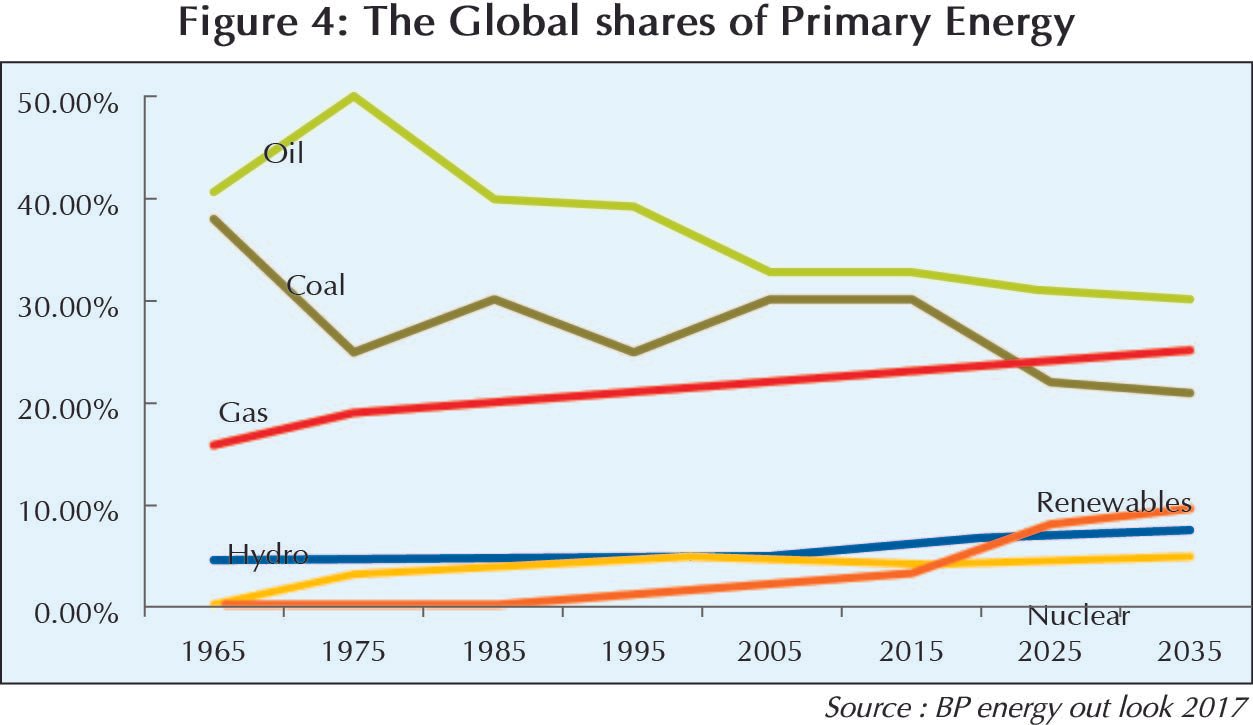

India has signed the Paris Climate Agreement which essentially aims to cut down greenhouse gases to pursue to limit the global average temperature increase to 1.5degree C above pre industrial level. The major share of global CO2 emission is shown below. This translates into develop 40% of energy basket through non fossil fuel and also to increase its forest cover by 5 million hectors before 2030.

The future of Coal based Power station in India

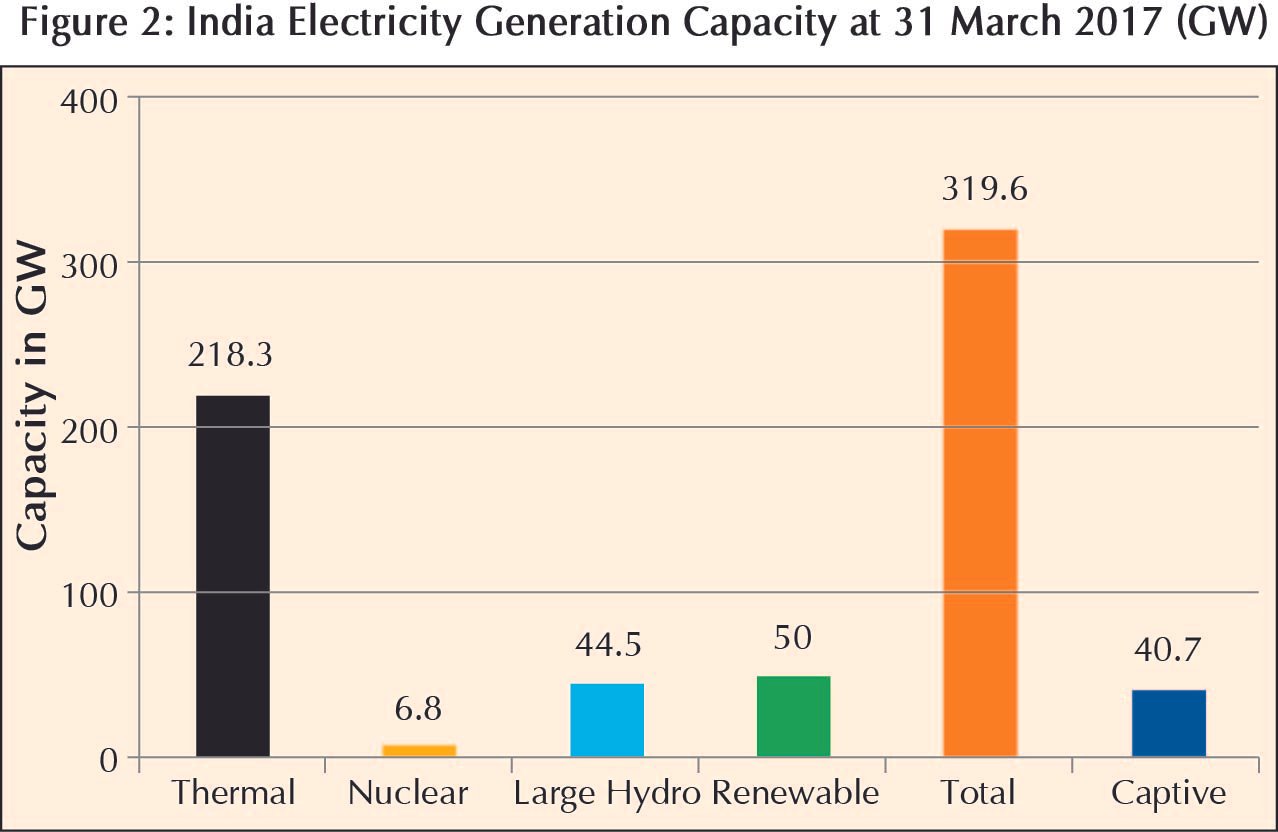

From the above generation figure, out of India's 320GW installed capacity, 68% is thermal (coal and gas) and thermal share of electricity generated is 79% of actual production. As per Power Ministry's recent statement India poised to have 175 GW of power from non -fossil fuel by end of 2022 out of which 100GW will be solar and 60GW will be wind.

The worldwide concern for global warming and India's commitment in Paris accord is shunning India to produce power through "dirty Fuel" like coal and gas. India is the 5th largest producer of coal which traditionally and till recent time the mainstay of power production. After opening of power generation to private players in 2003, lots of capacity addition in thermal power station took place and current installed capacity of 320GW is adequate to meet electricity demand at present. But it is to keep in mind that for 1.3 billion population, till today 300million population is out of reach of electricity. With 6-7% GDP growth and commitment of "Power to all" by Honorable prime minister the annual electricity growth forecast is 5% increase/year.

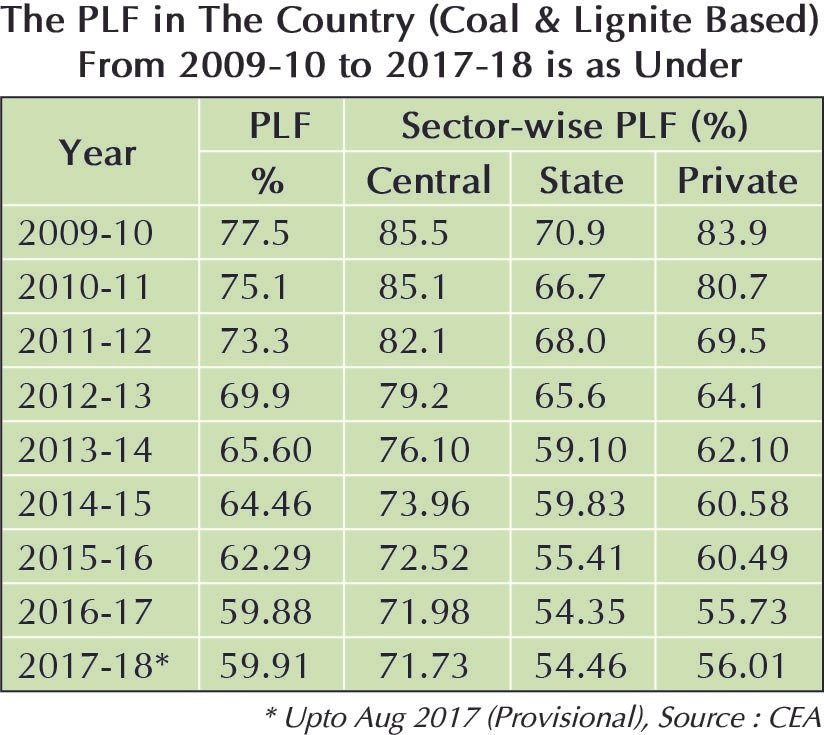

At present around 50,000 MW coal based power station are in various phase of construction which shall come into operation by 2022. Significantly all the under construction power plants are using super critical technology thereby increasing efficiency of 2-3% which results in less consumption of coal. Off late the newly installed coal power stations (barring the ultra mega projects) tariff hovering around Rs 5 to Rs 5-50 mainly due to high Fixed cost charges. In the scenario of falling renewable electricity charges and by adopting practice of "merit order generation" (lower tariff power station will get generation preference), the new plants will not get generation schedule. Traditionally in India before 2010 (in the period when demand exceeds supply), all coal based power stations used to run with PLF more than 80% thereby justifying the term "base load power station". The peak load demand in evening used to meet by hydropower. In 2010 demand exceeds supply by 10% and currently demand supply is matched (there is no shortfall in generation) thanks to large participation of private companies in building power stations.

However from the statistics shown above in last seven/ eight years the PLF has fallen to 56% from 83%. The primary factors are high generation cost and less demand. Earlier in the regime of high demand condition before building a coal power station, PPA get used to be signed identifying the beneficiary states. This method used to give the much needed comfort to generating station that all generated electricity will be sold in a cost plus mechanism (tariff used to get fixed considering capital charges and energy charges plus rate of return). But now merchant power concept has come in vogue and utilities are concentrating more on cost economics rather than "plant availability". The progressive steep fall in PLF is likely to be continue further as share of renewable energy will increase further. The experts say if the PLF falls below 50%, then coal power stations may require to be ON/OFF periodically as per demand or shall run at partial load. The first will definitely reduce thermal power station life due to metal fatigue or commercially unviable due to lower efficiency if run at partial load. With more stringent environment norms, now the old coal power plants are required to retrofit FGD (Flue Gas Desulphurization) to reduce SOX emission. This will definitely add up to capital cost and make the old generating units tariff higher which otherwise could have compete with lower solar tariff. Also there is space constraint in old stations to install FGD.

In recent couple of years back the coal production in country (the sole responsibility of coal mining lies with central sector utility Coal India Ltd) could not match with rapid increase in generation capacity. As a result, coal was getting imported from Indonesia/Australia. All power stations were having acute shortage of coal and some of them (where transportation from port is viable) used to blend foreign coal (which progressively increased peak at 2014-15) with indigenously produced coal. It shall be kept in mind that boilers designed to use Indian coal (having lower calorific value with high ash content of 35-40%) can not use high grade foreign coal. Only blended coal (partially mixing foreign coal with indigenous coal) can be used for boilers designed with Indian coal. India has only few power projects which are designed to use high grade coal. Off late the scenario of dependency in imported coal has completely reversed due to price hike in foreign coal. There is a classic case of Tata Mundra plant (4GW) and Adani Mundra plant (4.6GW) in west coast, where after an adverse supreme court ruling disallowing any tariff revision to compensate for higher cost of imported coal both Adani and Tata plant generation got stopped or run partially. Recently Tata power has written to Central Government to sell 51% equity asset at a cost of mere 1 rupee for its ailing asset underpinning the fact that plant has become a non performing asset. Also according to energy minister statement India is likely to discontinue its dependence of foreign coal totally. The coal projects now in progress are a visible mark of earlier economic and political conditions when coal power was inexpensive relative to renewable and government policy encouraging a swift ramp-up in power capacity. A record 21GW of new coal capacity added in 2015 although this dropped to less than 18GW in 2016. More over the new plants under construction are taking more gestation period because of myriad factors ranging from delay in getting land, delay in statutory clearances, delay in coal and water linkages.

Last year International Energy Agency said it makes "no real economic sense" to build more coal plants. India is now in the cross road of transition of shifting major portion of energy basket from coal to renewable. However, coal based energy will definitely continue for next 20-30 years. But it is really difficult to predict the share of coal energy in future due to volatile market of primary fuel and solar PV module cost.

Debadatta Ray;

Thermal Power specialist,

India